The yield on the benchmark 2-year Treasury note slumped to its lowest level in more than two years on Thursday as a weaker-than-expected report on the strength of the U.S. services sector fueled Wall Street’s concerns of a slowdown in the domestic economy.

The Institute for Supply Management’s Thursday report showed the services sector continued its expansion in September but at a much slower pace than expected.

The yield on the 2-year note fell under 1.38%, its lowest reading since Sept. 2017, while the yield on the benchmark 10-year Treasury note sank to 1.519%. The yield on the 30-year Treasury bond dropped to 2.022%.

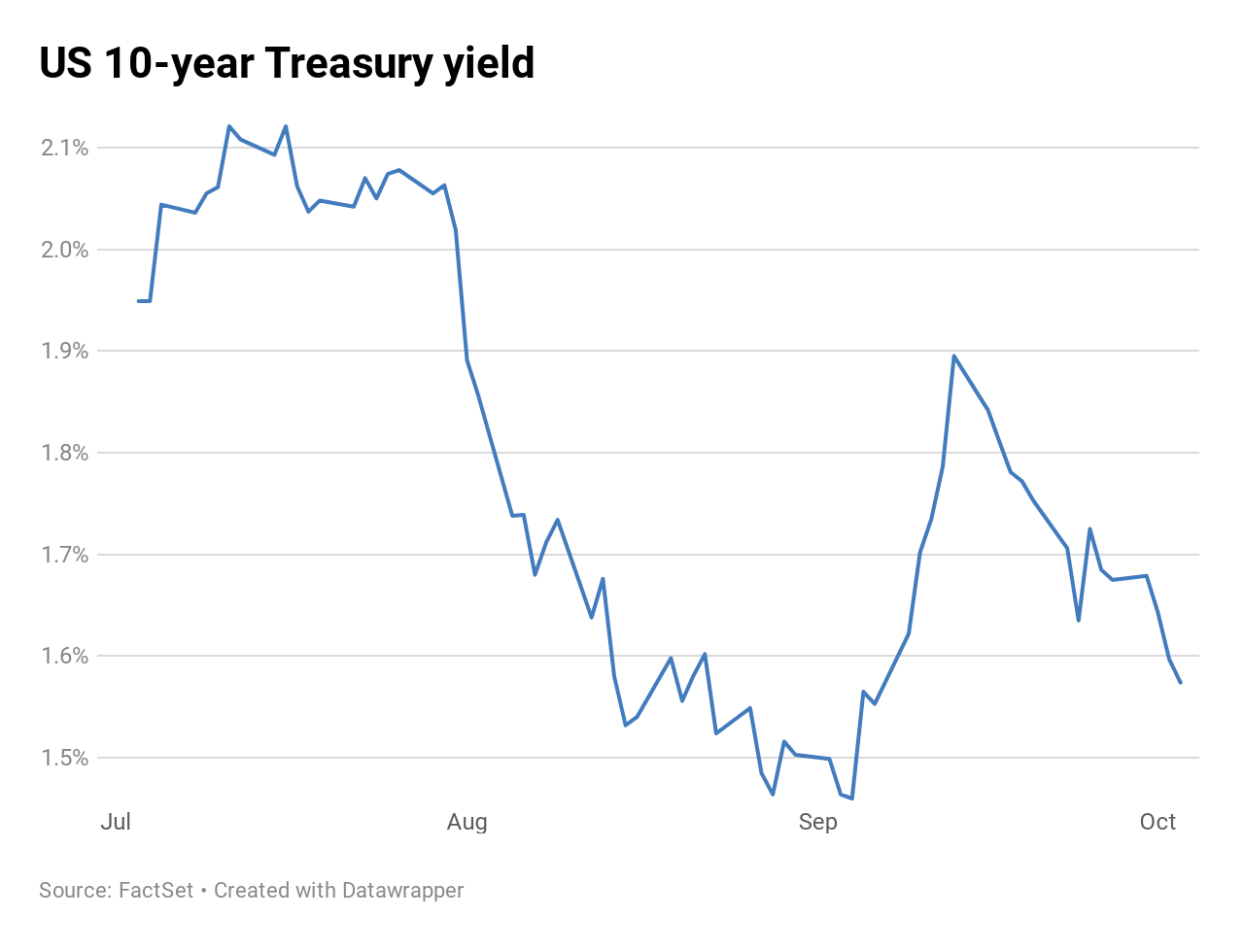

Treasury yields of varying maturity have fallen in tandem since mid-September — largely tracking the mounting recessionary angst — with the 10-year rate down over 30 basis points since Sept. 15.

The scrutinized services metric into the main component of the American economy came in at 52.6, compared to an expected reading of 55.3 from economists surveyed by Dow Jones. It was the weakest reading since August 2016. Anything above 50 represents growth in the survey, which gauges the percentage of companies expecting to expand their businesses.

“We expect that the current slowdown will not end the decade-long economic expansion, but note that risks are elevated and position accordingly,” wrote Mark Haefele, UBS’s global chief investment officer.

Members of the ISM said fears over tariffs, stretched labor resources and concerns over the general direction of the economy contributed to the disappointing services print. The institute’s manufacturing report earlier this week showed that sector contracting for the second straight month in September.

Haefele continued that the weak manufacturing data “added to concerns that the contraction in US and global manufacturing could be starting to undermine the strength of employment markets and consumer spending.”

Renewed trade tensions between the U.S. and the European Union further aggravated fears of a GDP slump in the U.S. on Thursday. The Office of the United States Trade Representative on Wednesday released a list of products it plans to target, starting on Oct. 18.

The duties include 10% tariffs on aircraft from France, Germany, Spain or the United Kingdom; 25% duties on single-malt Irish and Scotch whiskies, various garments and blankets from the U.K.; as well as 25% tariffs on coffee and certain tools and machinery from Germany.

The latest round of import taxes from the Trump administration came after the World Trade Organization on Wednesday backed a U.S. request to impose tariffs on $7.5 billion of European goods for what they believe are illegal subsidies grants to planemaker Airbus.

EU News Digest Latest News & Updates

EU News Digest Latest News & Updates