Tom Steyer, a businessman and 2020 presidential candidate, greets an attendee during the Iowa State Fair in Des Moines, Aug. 11, 2019.

Al Drago | Bloomberg | Getty Images

Billionaire Democratic presidential candidate Tom Steyer remains an investor in assets tied to the hedge fund he founded.

Steyer has made millions through funds linked to his former firm, Farallon Capital Management, since he left in 2012. He founded the firm in 1986, turned it into one of the world’s biggest funds, and eventually turned over power to former Goldman Sachs investment banker Andrew Spokes.

The funds are advised and managed by Farallon, according to people with direct knowledge of the matter. They insisted that Steyer is not involved with running Farallon Capital.

Alberto Lammers, press secretary for Steyer’s campaign, confirmed to CNBC that Steyer is a passive investor in Farallon investment funds.

“Tom is a passive limited partner investor in Farallon investment funds,” Lammers said. “Tom has not had any participation in management or control of Farallon, or any right to compensation from Farallon — other than the amount due in respect of the sale — since he left Farallon at the end of 2012.”

The spokesman also noted that Steyer, in 2012, “sold his stake in the management company to the firm’s existing partners for a fixed amount of money which is paid out over time.”

Representatives for Farallon declined to comment.

The insight into this corner of Steyer’s wealth – courtesy of clues in his tax returns, which were released Thursday – comes as his campaign fails to gain traction. He did not qualify for September’s Democratic primary debate, and he has posted anemic poll numbers despite big spending on ads. Steyer has campaigned against inequality and has tried to dispel the notion that he’s more than a rich executive running for the White House.

Yet his wealth and business entanglements are largely unique among recent presidential candidates. The clearest comparison would be President Donald Trump. The president did not divest his related assets in the Trump Organization after he won in November 2016, although he handed control of the company over to his two eldest sons.

Steyer built his political brand on funding a campaign to coax lawmakers into impeaching Trump. He has accused Trump of “using the Presidency to make money for himself,” among other things.

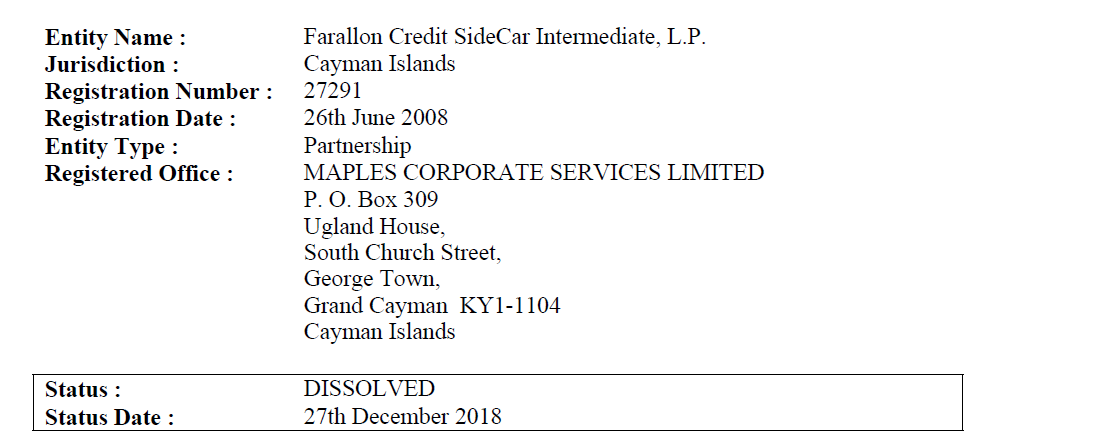

Buried in Steyer’s 2017 tax form, under a document labeled “sale and other dispositions of capital assets,” Steyer lists Farallon Credit SideCar Intermediate L.P. as one of his long term investments. The filing shows that a sale from this limited partnership brought in at least $1.7 million for him and his wife, Kat Taylor.

This particular fund was registered in the Cayman Islands, whose government does not levy income, corporate or estate taxes. A company profile from the online database Dato Capital shows that the fund dissolved in December 2018.

In 2014, two years after he stepped down from running his firm, Steyer and Taylor made up to $6 million from selling its investment in the Farallon Capital Partners fund.

Tax returns show that the family invested in the fund in January 2009 and shed the assets in December 2014. A filing from the SEC lists this fund’s address as the same as Farallon Capital Management, with Spokes and other members of his firm listed as related persons.

Steyer and his wife also list Farallon Asia Special Situations Master on their 2014 filing as an outside fund that led to a $2 million loss. An SEC filing says it too has jurisdiction in the Cayman Islands.

EU News Digest Latest News & Updates

EU News Digest Latest News & Updates