A Goldman Sachs sign is seen on at the company’s post on the floor of the New York Stock Exchange.

Brendan McDermid | Reuters

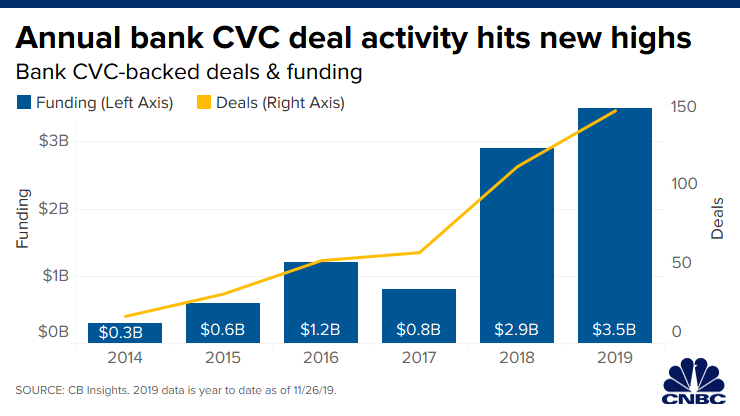

Corporate venture capital funding is at an all-time high and banks are leading the charge.

Investments by financial services firms into start-ups hit a record 329 deals worth a total $8 billion in 2019, according to a report by CB Insights published Tuesday. Nearly half of that deal activity this year came from banks.The third quarter saw the highest deal activity on record by financial services venture capital.

A handful of established companies — from Google to Airbus to American Express — have their own venture capital arm to make early stage investments. They can form strategic partnerships with the start-ups to learn from their technology, and have an early look at companies as potential acquisition targets. And much like traditional venture capital does, they eventually profit if these investments do well. The equity investments are often a way to “future proof,” according to CB Insights.

Banks are “rapidly accelerating” deal activity, with annual deal activity increasing by 8 times between 2014 and 2018, according to the report.

Investing in start-ups is becoming increasingly important for Wall Street banks as they look to diversify as their key profit engines get squeezed by falling interest rates. There’s also pressure from new fintech options like Square, PayPal, Wealthfront and Robinhood which have debuted many of the same services with zero fees.

Financial services corporate venture deals surged 500% from 2014 through the third quarter of 2019. Nearly half of the total financial services deals are in California.

Citi Ventures is the most active when it comes to deal flow with 66 venture deals, compared to 64 by Goldman Sachs’ VC arm.

Goldman has backed the most so-called unicorns with five companies valued at more than $1 billion. Its bets include Plaid, Circle and Marqeta.

Six other financial services groups have invested in three or more unicorns. American Express Ventures came in at number three with 55 deals since 2014.

Payment corporate venture capital deals reached peak levels this year, according to CB Insights. But capital markets corporate VC with names like CME Ventures, Monex Ventures and Nasdaq Ventures, is slowing, according to CB Insights.

It’s not just corporate venture capital. Overall, fintech funding is surging, with start-ups bringing in a record $24.6 billion in funding through September, according to CB Insights. This week, California-based private equity firm Centana Growth Partners announced a new $375 million fund — 50% larger than its inaugural 2015 fund.

EU News Digest Latest News & Updates

EU News Digest Latest News & Updates