Credit Karma, known for offering consumers access to free credit scores, is jumping into the high-yield savings game. The company announced Thursday that it will start offering consumers the option to open a high-yield savings account and manage their funds through its app and website.

Credit Karma’s new savings option, which will not charge any fees and does not require a minimum deposit to open, is set to offer a savings rate of 2.03% APY. That’s over 22 times the average rate of 0.09% for savings accounts nationwide, according to the FDIC.

Consumers can start signing up for the new savings feature on Oct. 28, 2019, the company tells CNBC Make It.

“We want to make savings accessible to every American in the same way we have with credit scores,” Credit Karma founder and CEO Ken Lin said in a statement Thursday. “We spent the first 12 years focusing on helping Americans manage their debt. With more than 100 million members around the globe, it made sense for us to jump across the balance sheet with Credit Karma Savings.”

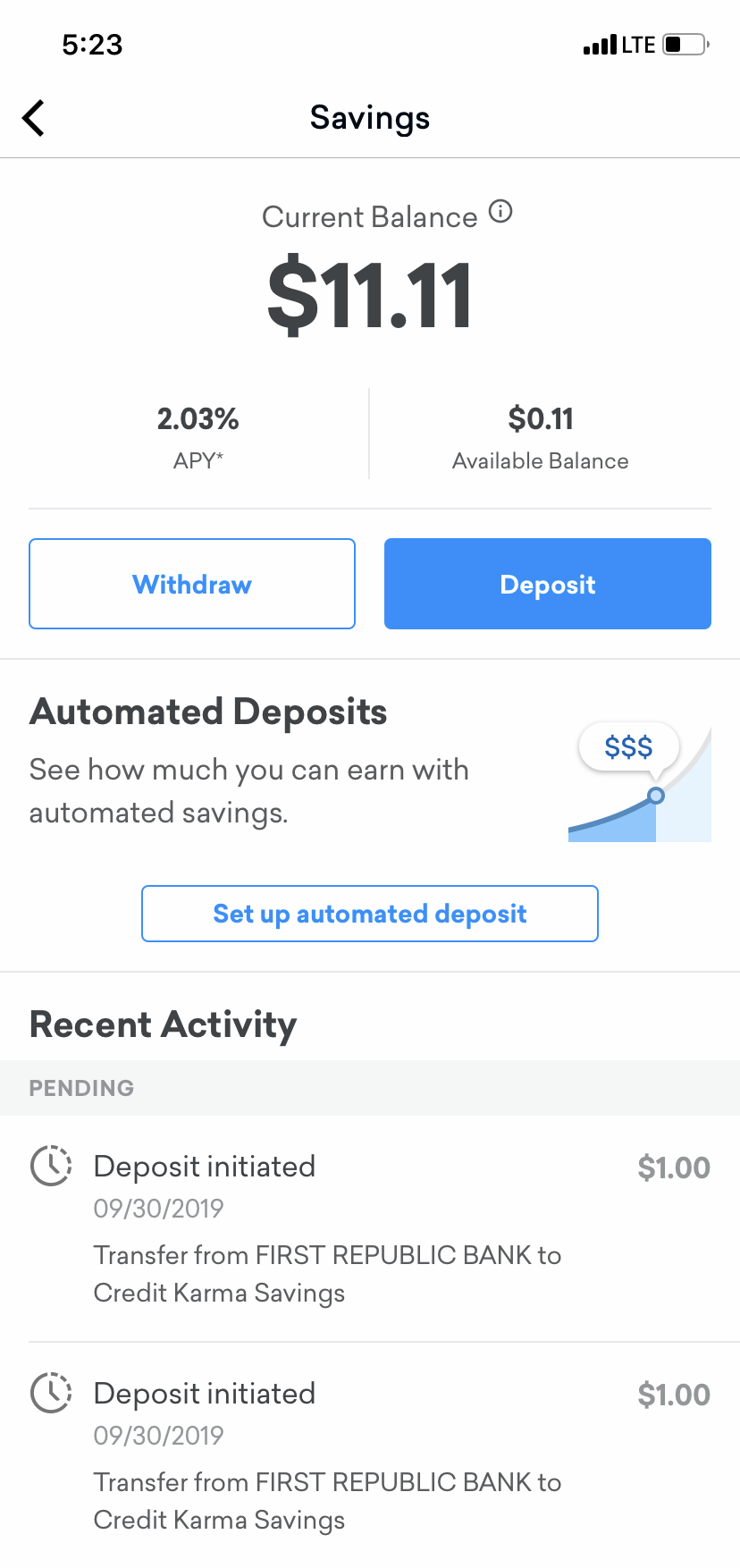

A view of the new savings dashboard screen in Credit Karma’s app.

Like other fintech companies that have jumped into the space, including Betterment and Wealthfront, Credit Karma is not a bank. Instead, the company is partnering West Virginia-based MVB Bank, which will house the funds and offer consumers FDIC insurance on their savings for up to $5 million. Once your cash is at the partner bank, the FDIC insurance kicks in so you can rest assured that your money is safe.

While interest rates are constantly changing, Credit Karma says it’s leveraging technology and a network of 800 banks to optimize the best APYs for its customers.

But unlike Betterment and Wealthfront — which earn money by taking a “small portion” of the overall APY — Credit Karma doesn’t take any of the interest you earn. “One hundred percent of the interest earned is delivered back to the member,” the company tells CNBC Make It.

While Credit Karma’s new savings option has a generous rate, it’s not the highest on the market. Online bank Vio has a high-yield savings account that pays 2.42% on all balances, with a minimum of $100 required to open. Wealthfront currently offers a cash savings account with a 2.07% interest rate, while Betterment has a promotional APY of up to 2.11% if you sign up to be on a waitlist for the company’s upcoming checking product coming later this year.

No matter what option you choose, funneling your savings into a secure account that earns a high interest rate can really boost your long-term gains. Yet many Americans aren’t taking advantage. Just 14% of Americans have a savings account that pays more than 2% APY, according to a Bankrate survey.

Let’s say you have $1,000 in your savings account at a brick-and-mortar bank earning the average interest. After five years, you’d earn about $14. But if you save your money in an online savings account that earned 2% APY, you’d have $104 at the end of five years.

And the bigger your balance, the more it adds up.

Don’t miss: Here’s why a CD may not be your best savings option when interest rates drop

Like this story? Subscribe to CNBC Make It on YouTube!

EU News Digest Latest News & Updates

EU News Digest Latest News & Updates