Traders work on the floor at the New York Stock Exchange.

Brendan McDermid | Reuters

Investors and economists are chasing a moving target of strong and weak economic data, making it increasingly confusing what the state of the economy really is.

Credit Suisse said weak manufacturing data accompanied by healthy economic data elsewhere lands the economy in a middle ground.

“While investors debate whether we’re entering a recession, we believe the backdrop is better described as a ‘Semi-Recession,'” said Credit Suisse Chief U.S. Equity Strategist Jonathan Golub in a note to clients Wednesday.

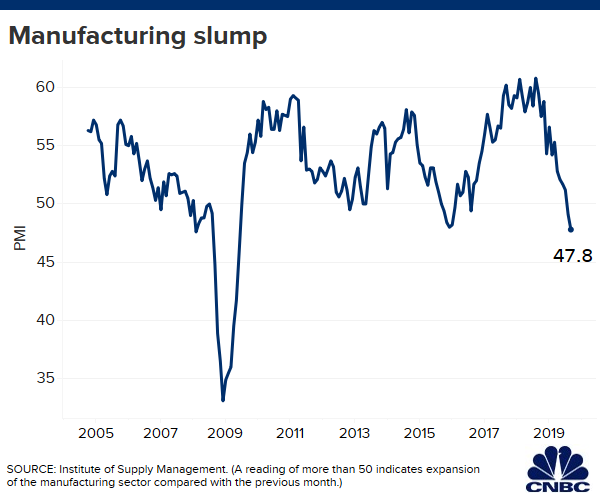

Tuesday’s gauge of the U.S. manufacturing sector showed the lowest reading in more than a decade in September as exports fell amid a U.S.-China trade war. The ISM U.S. manufacturing purchasing managers’ index came in at 47.8% in September, the lowest since June 2009. Any reading below 50 signals a contraction.

Meanwhile, industrial production has been in a year-long deceleration, despite a positive reading in August. Manufacturing, which accounts for about 11% of the U.S. economy, is being hurt by a trade war between the United States and China and slowing global economic growth. The 0.6% increase in industrial production in August was the largest gain in industrial output since August 2018 and followed a 0.1% dip in July, according to the Federal Reserve.

Alongside weak manufacturing data, the yield curve is inverted on the short end, meaning the 10-year Treasury note has a lower yield than the 3-month Treasury bill. This bond market phenomena is regarded as a recessionary signal.

“Recessionary risks are clearly rising,” said Golub. “Absent a reacceleration in cyclical data, stock upside appears limited,” said Golub.

To be sure, Golub said, “recessionary indicators have weakened but do not point to a broad-based downturn.”

Weak data is offset by a strong labor market, said Golub. September’s jobs report, set to release on Friday, is expected to show 148,000 new payrolls and jobless claims continue to decline, he said.

Golub noted inflation, jobs data and credit performance are all still expansionary for the economy. While earnings and housing activity are neutral.

—with reporting from CNBC’s Michael Bloom.

EU News Digest Latest News & Updates

EU News Digest Latest News & Updates