SurveyMonkey data shows that passengers have gotten so hooked on Uber and Lyft that the companies could raise prices further if they were so inclined, said Zander Lurie, CEO of SurveyMonkey-parent SVMK.

“People are addicted to these services,” Lurie said on CNBC’s “Squawk Box” on Tuesday. “This is what people want to ride.”

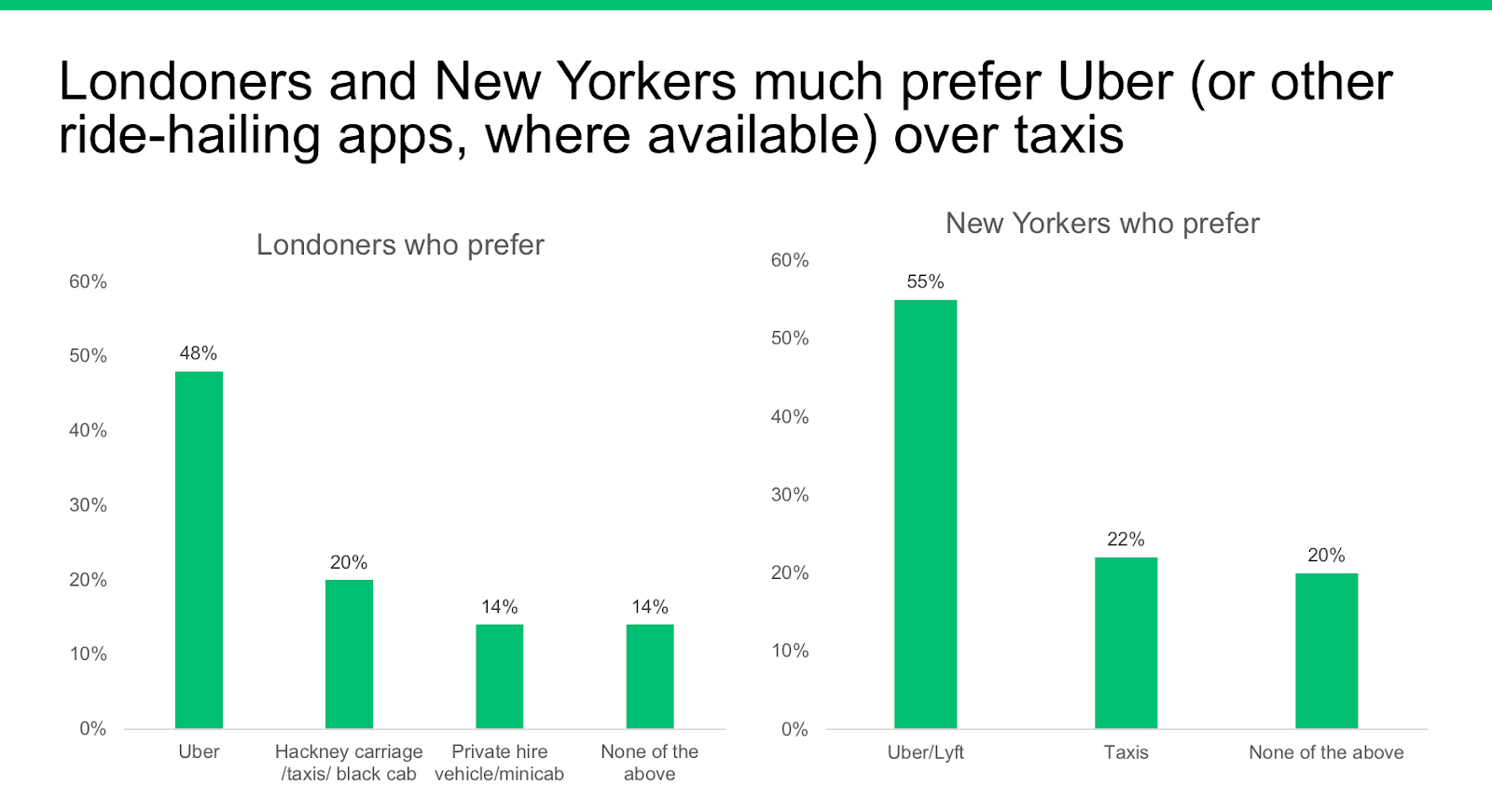

According to a SurveyMonkey survey conducted in December, people in New York City and London like ride-hailing apps over taxis. Fifty-five percent of New Yorkers prefer Uber and Lyft. Londoners prefer Uber by 48%.

Lurie said the survey was being completed as Uber was releasing earlier this month a report that acknowledged 5,981 reports of sexual abuse between riders and drivers on the service between 2017 and 2018. Allegations of sexual assaults during Uber rides have piled up in recent years. Other ride-hailing companies, including Lyft, have faced similar allegations.

Citing a “pattern of failures” on safety, such as allowing unauthorized drivers to upload their photos to other Uber driver accounts, London regulators in November stripped the company’s license to operate in the city. Uber is appealing.

Uber and Lyft, popular despite their problems, are both among the worst-performing initial public offerings of 2019. Lurie said they need to start showing investors a path to profitability.

“Investors are trying to figure out, ‘Are these durable business models with sustainable unit?” Lurie said. “If you find you can’t generate a profit, you’re going to raise prices because you’re not going to go out of business.”

Uber’s and Lyft’s popularity with consumers has not helped pad its pocketbooks. Uber reported a net loss of $1.6 billion in its third quarter, and Lyft reported a net loss of $463.5 million during Q3.

Analysts generally agree with Lurie’s thesis that prices will continue to increase as companies begin to focus on profits rather than just growth in revenue and market share.

“Belts are getting tightened,” said Gene Munster, who was one of Wall Street’s top technology analysts before helping start the venture capital and research firm Loup Ventures. “We’re starting to see some increase in pricing from Lyft and Uber the past six months and would expect other gig economy and service-related companies to follow.”

Logan Green, CEO of Lyft, told investors last week that it implemented “modest pricing increases” over the last two quarters, which he said were matched by competitors.

Lyft’s IPO was priced in March at $72 per share. The stock closed Monday at just over $45. Uber went public in May at $45 per share. The stock closed Monday at nearly $27.

EU News Digest Latest News & Updates

EU News Digest Latest News & Updates