This year’s worst-performing sector looks like it’s getting an energy boost.

S&P 500 energy stocks, tracked in part by the Energy Select Sector SPDR Fund (XLE), have charged 3% higher in the last week, a somewhat encouraging sign of life for a group that’s up just 6% for the year, well off the S&P’s nearly 27.5% gain.

But as the only S&P sector with a single-digit gain for 2019 — the second-worst performer is health care, up nearly 18% — energy will need some time to prove itself before it’s safe to buy, traders say.

Katie Stockton, founder and managing partner at Fairlead Strategies, is watching the group’s technical trajectory, particularly in the context of crude oil prices. U.S. crude prices dropped slightly Wednesday after domestic inventories had a lower-than-expected decline the prior week.

“The energy sector is really one of the few places that we can find persistent long-term downtrends, both in absolute and relative terms, within the broader market,” Stockton said Wednesday on CNBC’s “Trading Nation.”

“That is obviously a check against it,” she said, even as investors “can argue for a loss of long-term downside momentum. That is definitely evident.”

Although the sector has broken above a key area of resistance, Stockton still needs more confirmation of the move to start trusting it.

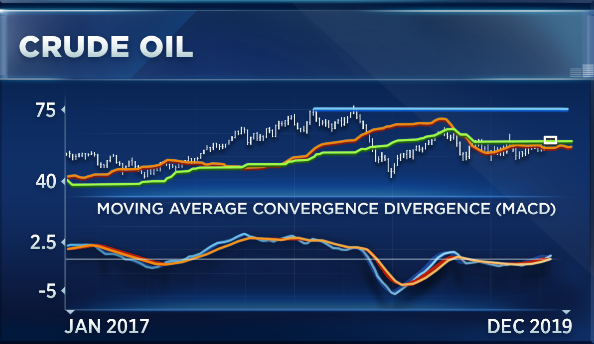

“We have seen some stabilization, in relative terms, for certain [energy] stocks or segments, but I think it’s a little bit too early to suggest that we’re seeing a meaningful long-term turnaround,” she said. “We’re not really getting a lot of breakouts on this move, but what I think we can attribute it to, in part, is the fact that crude oil, or WTI, climbed above very key resistance around $60 per barrel.”

With U.S. crude hovering above $61 per barrel Thursday, the strength Stockton wanted to see seemed to already be creeping back.

“That [$60] level, now that it’s been surmounted pretty decisively, has … become support going forward, and it does target longer-term resistance around $75 per barrel,” she said. “So, that would obviously have an impact and could make the energy sector at least less of a laggard in Q1.”

John Petrides, a portfolio manager in Tocqueville Asset Management’s wealth management group, called on viewers to “think about how the perception” of energy stocks has transformed over the years.

“How many segments did [CNBC] do seven, eight, nine years ago in the Bakken or in the Permian [Basin] talking about the growth of the shale boom?” Petrides asked in the same “Trading Nation” interview. “And here we are years later where perception has entirely changed.”

Now, Wall Street is “constantly” hearing about oversupply, leading energy companies to cut back on capital spending in favor of growing their cash hoards and paying out dividends to loyal shareholders, Petrides said.

But with the sector so drastically underperforming its peers on a relative basis, Petrides is betting that “there’s value to be had” in the space.

“One of the places that we like is Kinder Morgan for our enhanced income strategy,” he said of the energy infrastructure giant and pipeline operator. Kinder Morgan said in early December that it expects earnings to decline next year.

“The [master-limited partnerships] and the pipe[line companies] suffered three, four, five years ago, [but] the company has right-sized its balance sheet, it carries nearly 40% of the country’s natural gas, and in 2020, if we get expansion of [liquefied natural gas] exporting out of the U.S., Kinder Morgan and the energy sector could get a catalyst pop for that,” Petrides said.

Energy stocks in both the broad sector and the XLE ended trading slightly higher on Wednesday, up less than half of 1%.

Disclosure: Petrides owns shares of Kinder Morgan.

Disclaimer

EU News Digest Latest News & Updates

EU News Digest Latest News & Updates