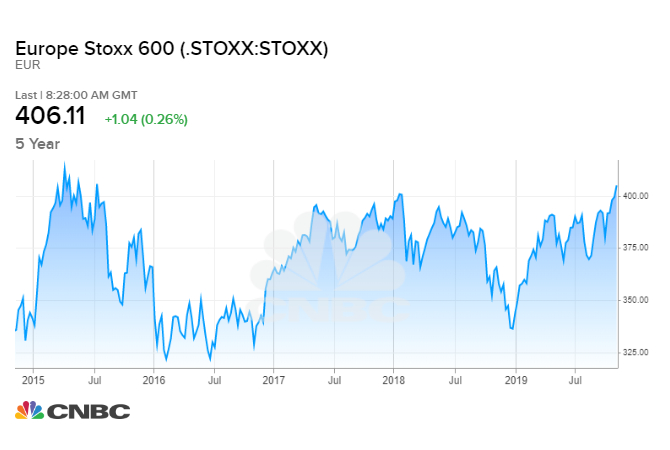

European shares touched a four-year high Thursday morning after China said the world’s two largest economies had agreed to cancel additional tariffs imposed in their months-long trade war.

The pan-European Stoxx 600 climbed 0.4% in early trade to hit its highest point since July 2015, with basic resources, autos and travel and leisure stocks all rising more than 1% as most sectors and major bourses entered positive territory. Utilities and telecoms were the main outliers, each shedding 0.6%.

China’s Commerce Ministry said Thursday that Washington and Beijing had over the past two weeks agreed to a phased removal of duties on billions of dollars’ worth of each other’s goods.

Commerce ministry spokesman Gao Feng said that the cancellation would be important for the two sides to reach a “phase one” trade deal, Reuters reported.

Sources told Reuters on Wednesday that the signing of the long-awaited “phase one” deal could be delayed until December. Investors had been hoping that the preliminary deal, which could lift some pressure from the global economy, may be signed as early as this month.

According to reports, the location of a meeting where U.S. President Donald Trump and Chinese leader Xi Jinping would sign the deal has added an obstacle to proceedings. Reuters said Wednesday that London was now being floated as a possible venue.

Asian shares traded in mixed territory Thursday on the back of the earlier reports. MSCI’s broadest index of Asia-Pacific shares, excluding Japan, dipped 0.3%, with many of the region’s indexes hovering around the flatline.

Back in Europe, the Bank of England’s Monetary Policy Committee (MPC) is set to make a decision on interest rates on Thursday. The central bank is widely expected to keep rates steady ahead of the U.K.’s general election in December, having held rates at its last MPC meeting in September, bucking the rate-cutting trend seen among central banks globally.

Earnings in focus

Siemens on Thursday reported fourth-quarter revenue of 24.5 billion euros, an 8% year-on-year increase, while German lender Commerzbank announced a 35% increase in net profit for the third quarter. Siemens shares rose by more than 3% in early trade while Commerzbank slipped 2% lower.

Italy’s UniCredit climbed 4.6% after backing its full-year guidance, reporting a net profit of 1.1 billion euros for the third quarter, and Lufthansa backed its full-year outlook after the airline’s third-quarter profit rose 4% to 1.15 billion euros. Lufthansa shares jumped 6.2%.

Shares of Arcelormittal climbed 8% after the world’s largest steelmaker reporting a second consecutive quarterly loss before the bell, but topped earnings expectations.

Vestas Wind surged 7.7% after beating third-quarter earnings expectations, while Tate & Lyle also jumped 7.4% after reporting a 45% rise in first-half profit and backing its full-year guidance.

At the other end of the European blue chip index, ProSiebenSat.1 shares fell 7% after the German media company reported a dip in third-quarter profit and warned of a potential hit to earnings in the final quarter of the year.

EU News Digest Latest News & Updates

EU News Digest Latest News & Updates