Shares of General Electric, already trading near an 8-year low, may take another hit as steel and aluminum prices rise as a result of President Donald Trump’s tariffs, according to Deutsche Bank.

“We believe GE to be among the most at fundamental risk from rapidly rising steel and aluminum prices – both directly in terms of competitive cost pressures and indirectly in terms of the risk of reduced global economic activity due to trade/tariff retaliation by other countries,” wrote Deutsche analyst John Inch. “General Electric produces a suite of very large/heavy, expensive equipment made significantly of metal that includes steel and aluminum.”

Many market analysts expect such a rise in prices after President Trump declared a 25 percent tariff on steel imports and a 10 percent tariff on aluminum last Thursday. Though the president has not made the move official yet, it looked increasingly likely after the resignation of free-trade advocate Gary Cohn from the White House on Tuesday.

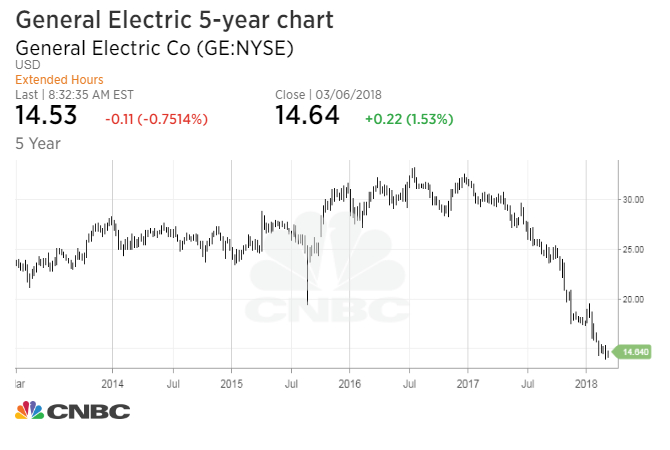

For its part, General Electric posted a $10 billion loss in the fourth quarter and was the worst-performing stock on the Dow Jones industrial average last year. The Boston-based conglomerate recently slashed its renowned dividend and cut expectations for the coming years as CEO John Flannery attempts to turn the company around.

The company has dropped 51 percent in the last 12 months and was down another 0.75 percent in premarket trading Wednesday morning after the analyst’s call. In addition to rising material costs, Inch added, the company will also likely have to compete in a souring international market as Trump’s taxes on foreign goods spark foreign frustration.

“The preponderance of GE’s served industries are highly competitive global oligopolies,” the analyst explained. “In turn, GE’s international competitors that maintain production operations weighted overseas could leverage higher U.S. metals pricing to capture market share.”

Inch, who has a sell rating on General Electric, previously wrote that he expects the original Dow component to be removed from the 30-stock index.

EU News Digest Latest News & Updates

EU News Digest Latest News & Updates