Traders work the floor at the NYSE in New York.

Brendan McDermid | Reuters

A dovish tilt from the Federal Reserve sent everything from stocks to bonds to gold rallying in unison, but stocks with this one feature are poised to crush the market after a rate cut, according to Goldman Sachs.

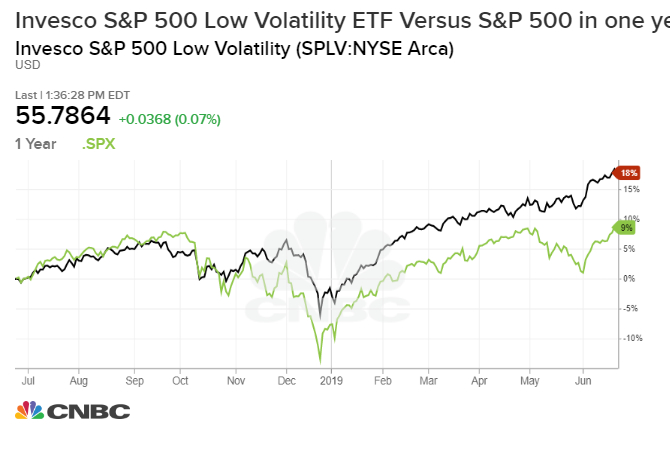

And that feature is low volatility. With muted price swings, low-volatility stocks tend to perform like bond proxies such as utilities and high-dividend payers. They have historically outperformed during the 12 months following the beginning of the Fed’s rate cut cycles, according to Goldman’s chief U.S. equity David Kostin.

“Low volatility stocks have outperformed significantly since the start of May as economic uncertainty and the odds of a Fed rate cut rose. In addition to monetary policy, intensifying trade rhetoric, slowing economic growth, and rising geopolitical tensions have dominated investor attention in recent weeks,” Kostin said in a note Friday.

Because these placid stocks are also classic defensive plays, investors have been flocking to the group amid the intensifying trade war and signs of an economic slowdown. Two largest low-volatility exchange-traded funds — iShares Edge MSCI Min Vol ETF and Invesco S&P 500 Low Volatility ETF — have reeled in $8 billion of inflows this year, a quarter of total inflows to all U.S. equity ETFs, according to Goldman.

Goldman has a screen for low-volatility stocks and the basket has returned 7% since the start of May, beating the S&P 500’s flat performance in the same period. The bank’s picks include Warren Buffett’s Berkshire Hathaway, Caterpillar, Chevron, eBay, Honeywell, Kimberly-Clark and Coca-Cola.

The Fed last week dropped the word “patient” in its statement and Fed chair Jerome Powell said the case for more accommodative policy has strengthened, causing traders to increase bets a cut is coming. They now see a 100% chance of at least a quarter-point cut next month, according to the CME FedWatch tool.

Goldman now sees two rate cuts this year as well as an early end to the balance sheet rolloff.

— With reporting by Michael Bloom

EU News Digest Latest News & Updates

EU News Digest Latest News & Updates