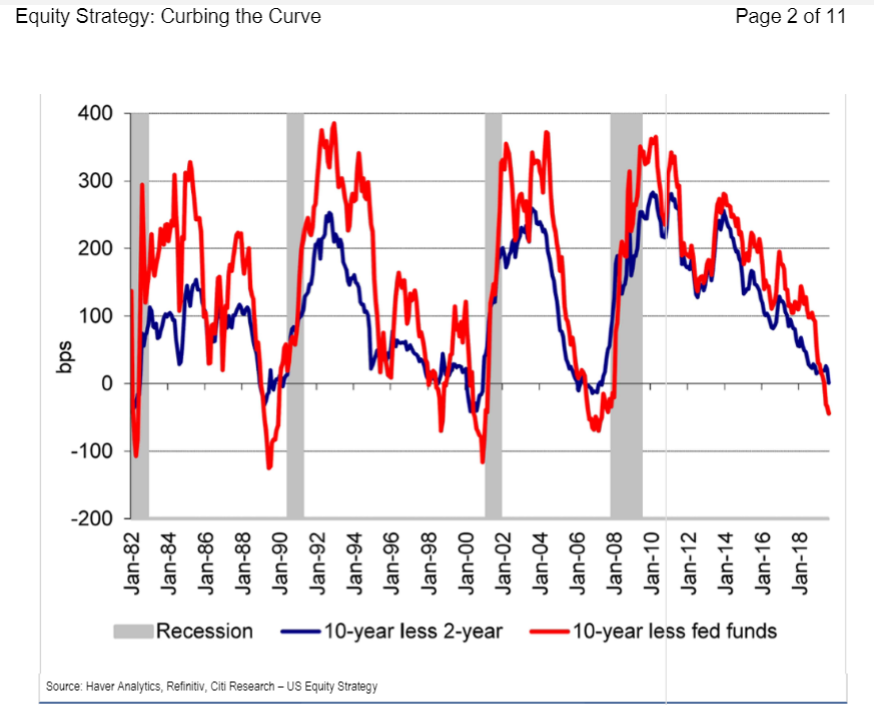

Many are worried that the inversion in the yield curve is a scary recession warning, but in fact, it can be even scarier when the curve reverses and begins to steepen again.

That’s also when investors could see a recession coming head on, and sell stocks.

The so-called inverted curve, in this case, means that investors are seeking a higher yield on the shorter term, 2-year Treasury note, than they are on a 10-year note. The 10-year yield, which moves opposite price, fell below the 2-year yield for the first time since 2007 on Wednesday.

Steepening, on the other hand, would be a reversal of that move, where the 10-year reclaims the higher yield.

The inverted curve does not always mean a recession is coming, but it often does. Since the late 1990s, it has taken an average 22 months for the economy to fall into recession after the curve inverted, according to Credit Suisse.

Another common market fear is that the Fed will react, but not soon enough or aggressively enough to stop the recession.

“One should be more worried when a rapid re-steepening occurs, as that is a better signal for an imminent downturn, at which point risk-off strategies make more sense,” notes Tobias Levkovich, chief U.S. equities strategist at Citigroup. “Economic retrenchment appears to emerge once the Fed seemingly reacts aggressively to counter GDP weakness but may be too late, aside from mitigating the extent of business activity declines.”

Stocks typically continue to move higher for months after the inversion, but once the steepening begins, investors could become nervous and dump stocks.

When the curve steepens again, that means the front end of the curve— or the 2-year yield in this case—would be under pressure, as the Fed cut rates. The 2-year most reflects the Fed funds target rate level and would move lower as the Fed eases, or cuts interest rates. The 10-year currently is reflecting a flight-to-safety and worries about the economy.

“If you look into the last couple of recessions, the trough in the yield curve inversion occurs before the recession starts,” said Jon Hill, rate strategist at BMO.”Then the curve starts to steepen, and we fall into recession. What really happens is when the curve steepens, the market prices recession with really strong conviction. It’s the moment when a recession starts to appear rather likely that the front end rallies like crazy and the curve steepens.”

That means the 2-year yield would see downward pressure, as investors buy safety and the Fed moves. That could drive it below the 10-year yield and the curve would steepen as the trade continues. The yield curve was no longer inverted Thursday but it could become so again. The 2-year was yielding 1.55%, and the 10-year was at 1.57%.

“Recessions tend to occur 12-15 months on average after the Treasury curve inverts, but that also can stretch out two years. Thus, just making a single input investment decision can prove hasty and inaccurate,” notes Levkovich.

Levkovich said stocks should be helped initially by the attraction of higher dividend yields, over falling bond yields.

He notes that he continues to expect the S&P 500 to be at 2,850 at the end of 2019, and he also expected significant volatility. The S&P 50 closed at 2,840 Wednesday, down 85 points.

“We also believe the pounding taken by banks or energy, while understandable, looks overdone. We further argue that health care could be a safe haven vs. hiding out in the dollar, gold or US Treasuries,” he wrote in a note. He added that he had raised food and staples retailing to overweight last month.

Levkovich said he’s unsure if the way to play the market right now is through higher dividend-yielding stocks, since REITS could see a decline in underlying property values in an economic downturn.

“We do understand a preference for Utilities, however, as the business is arguably more stable,” he said.

EU News Digest Latest News & Updates

EU News Digest Latest News & Updates