Marillyn Hewson, the Chairman, President and Chief Executive Officer of Lockheed Martin.

Carl Court | AFP | Getty Images

WASHINGTON — Nearly seven years ago, Marillyn Hewson became the first woman to run Lockheed Martin — America’s biggest defense contractor — and investors have reaped the rewards of her leadership.

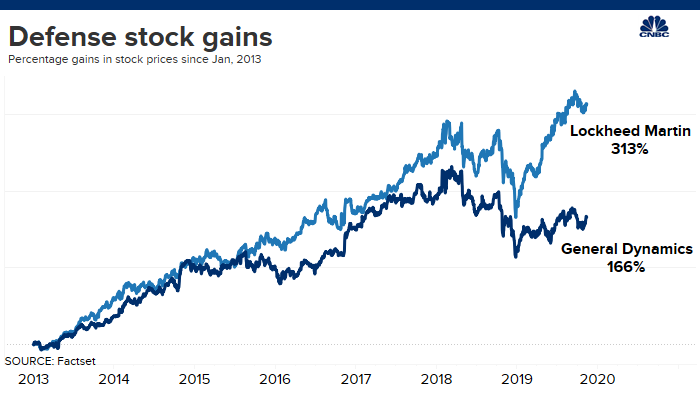

Under Hewson, Lockheed has seen its stock surge more than 310% through Tuesday’s session and its market capitalization expand to $108 billion from just under $30 billion.

Hewson, who is chairman, president and CEO of Lockheed Martin, joined the defense titan more than 35 years ago as an industrial engineer. She has held more than 20 different leadership positions within the company before ascending to the top spot in January 2013.

When asked by Economic Club President David Rubenstein last year about the success of Lockheed under her leadership, Hewson downplayed her influence.

“It isn’t all about me on the performance of our company, but I’m really proud about what our team has been able to accomplish … in my sixth year as CEO,” Hewson told Rubenstein. “We have some happy shareholders, yes, but they always keep a beat on us,” she added.

In addition to pleasing the company’s shareholders, the Kansas-native has had to navigate testy waters with America’s commander-in-chief.

Before taking the highest office in the land, then-president-elect Donald Trump lambasted the crown jewel in Lockheed’s portfolio: the F-35.

A day after meeting with Hewson at his Mar-a-Lago resort in Florida, Trump announced via tweet that he asked Boeing to “price-out a comparable” jet because the F-35 program had “tremendous” cost overruns.

Trump’s tweet knocked Lockheed’s stock down about 2% while Boeing shares were up 0.5%. At the time, the tweet shaved off about $1.2 billion of Lockheed Martin’s market value.

But it didn’t matter in the long run.

Last month, the Pentagon announced a $34 billion F-35 contract with Lockheed Martin, the largest contract yet for the defense company’s costly fighter program.

Overall, defense stocks have been a winning investment under Trump.

Since his inauguration, the iShares U.S. Aerospace & Defense ETF (ITA) is up more than 60% to outperform the S&P 500, which is up about 36% in that time. What’s more, the Pentagon’s spending power has catapulted to a little over $700 billion — the most in its history.

The women running the defense industry

Phebe Novakovic, CEO of General Dynamics, speaks at the Joint Systems Manufacturer on March 20, 2019 in Lima, Ohio.

Andrew Spear | Getty Images

Of the top five U.S. defense firms — Lockheed Martin, Boeing, Raytheon, General Dynamics and Northrop Grumman — three are led by women.

In January, Kathy Warden became the first woman CEO of aerospace giant Northrop Grumman. In 2013, Phebe Novakovic became the CEO of General Dynamics and Hewson became CEO of Lockheed Martin. And in 2016, Leanne Caret took over as CEO of Boeing’s multi-billion-dollar defense business.

Together, these women represent an elite club that brought in more than $185 billion over the past year in defense revenue.

Under Novakovic’s tenure as CEO, which began the same day Hewson took on the C-suite role at Lockheed, General Dynamics shares have swelled.

The company’s stock is up more than 166% since 2013. What’s more, General Dynamics’ market capitalization has also shot up to around $53.4 billion from about $25 billion in that time.

Fred Imbert contributed to this report from CNBC’s global headquarters in Englewood Cliffs, New Jersey.

EU News Digest Latest News & Updates

EU News Digest Latest News & Updates