Microsoft is on a rocketship this year.

The stock is the second best Dow performer in 2019, up 52%. It is also likely to close out its eighth positive year in a row, a record stretch.

Matt Maley, chief market strategist at Miller Tabak, sees signs its massive run may be done.

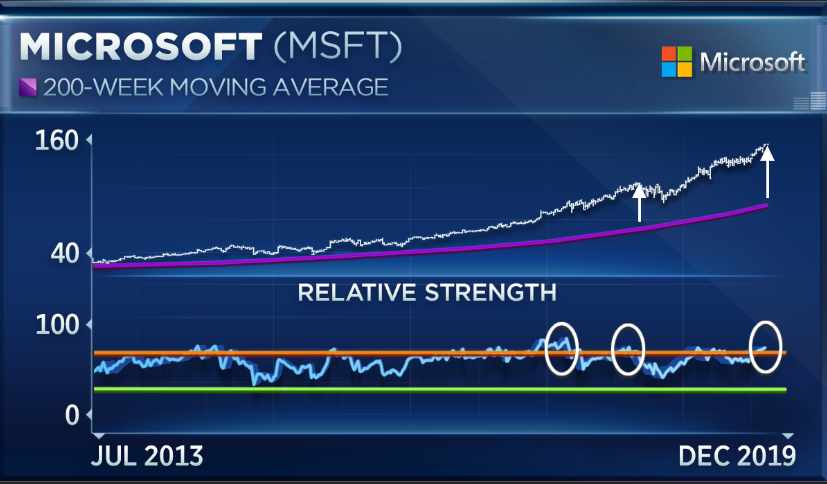

“This is purely a technical call. It’s a great company with a great fundamental outlook. But if you look at the long-term chart, its weekly RSI chart [see relative strength index chart below] is becoming quite overbought,” Maley said Tuesday on CNBC’s “Trading Nation.”

He noted that the stock could rally a little more into the end of the year, but this overbought condition leads him to believe any rally might not have legs. Microsoft’s relative strength index, a measure of momentum, has reached 75 on a weekly basis. A reading of 70 and above typically suggests a stock has become overbought.

Another chart signal is giving him pause.

“It’s now trading at a 72% premium to its 200-week moving average. There’s only been one other time since the great tech bubble of the late 1990s when it’s been this high. It reached 75% back in late September of last year, but of course the stock rolled over and sold off 18% over the next three months,” said Maley.

This isn’t looking like the dot-com bust just yet, he said. Microsoft topped out at a 150% premium to its 200-week moving average at the beginning of 2000.

“I certainly wouldn’t short it especially before the end of the year, but it’s one you might be able to pull back and get a cheaper price at some point,” Maley said.

Another top Dow stock could be hitting the pause button, according to Boris Schlossberg, managing director of FX strategy at BK Asset Management.

“Apple doesn’t look like a great risk-reward, not because I think it’s in danger of falling, but I think it’s in danger of stalling,” Schlossberg said during the same segment. “It’s been a real juggernaut this year, but I think a lot of the good news is kind of baked in.”

Apple is the best Dow stock in 2019, surging 78% — its best year in a decade.

“The one outlier bullish case here is if 5G in China really takes off. If their 5G product in China really creates a huge amount of demand, then I think there’s still upside to the stock but given other factors, I think it’s actually kind of peaked out at this point. It’s had a very, very big stretch on valuation,” said Schlossberg.

Apple trades at 21 times forward earnings. By comparison, the S&P 500 trades with an 18 times forward multiple.

Disclaimer

EU News Digest Latest News & Updates

EU News Digest Latest News & Updates