Parents may have a new source of money to tap to help with any expenses tied to adding a new child to the family.

This week, the Senate is expected to pass a $1.4 trillion spending deal that, among other provisions, contains retirement legislation known as the SECURE Act. The Setting Every Community Up for Retirement Enhancement Act passed the House over the summer, but remained stalled in the Senate — until now. Lawmakers attached the bill to must-pass spending legislation that sailed through a House vote on Tuesday and is expected to pass the Senate and then be signed by President Trump by the end of the week.

The SECURE Act contains a number of provisions aimed at expanding Americans’ access to retirement accounts, including raising the age when people need to take minimum withdrawals, giving small businesses the ability to band together to participate in multi-employer 401(k) plans, allowing people to invest in annuities within their 401(k) plans and granting consumers roughly two more years to contribute to traditional individual retirement accounts.

While much of the legislation is aimed at older workers and retirees, there are some benefits for younger savers, including those looking to start families. The SECURE Act allows Americans who just had a baby or adopted a child to take a withdrawal of up to $5,000 from their retirement accounts, including a 401(k) or IRA, without the typical 10% penalty.

The new rule allows each parent to use the $5,000 exemption, which means a couple could take up to $10,000 out penalty-free if they each had separate retirement accounts. While new parents can opt to repay the withdrawal amount, this is not a loan and does not need to adhere to the strict 401(k) repayment process.

Up until now, you could only take withdrawals from your 401(k) before 59½ if you had education expenses, bought a home for the first time, incurred massive medical debts or were required by a court to provide alimony or child support. Some retirement plans also allow withdrawals when experiencing a financial hardship, but about 15% of 401(k) plans do not. For any other circumstances, you’d need to pay a 10% early withdrawal penalty, plus taxes on the funds you withdrew.

Angelique Rademakers | Twenty20

While the new withdrawal exemption may help cover the short-term expenses associated with welcoming a new child into a family, experts say Americans should think twice before tapping into their retirement funds.

“I’m not enthusiastic about it,” Monique Morrissey, an economist focused on retirement security at progressive think tank Economic Policy Institute, tells CNBC Make It.

“We obviously need to address the fact that people need to take [parental] leave and that they have expenses upon the birth of a child,” she says, adding that she doesn’t believe withdrawing retirement dollars is the answer. “At best, it’s a stop-gap measure, at worst it’s just one more way your funds will leak out before retirement. It’s tempting people to drain their funds,” she says.

Childcare costs do send some parents into debt

Having a baby or adopting a child is an expensive endeavor these days, one many families struggle to afford.

Across the country, the hospital bill for vaginal delivery costs an average of $30,570, according to estimates from the independent nonprofit organization FAIR Health. Women who undergo a C-section delivery stay in the hospital an average of three days and are typically billed $47,360. Depending on the mother’s insurance plan, she’ll likely pay out-of-pocket for some portion of the bill.

Meanwhile, the average cost of adopting a baby through a private agency in the U.S. is about $43,000, according to a report from Adoptive Families Magazine.

Even when it comes to non-essential expenses for their children, classified as things such as designer clothes, concerts and organic food, parents are willing to pay. Over half of U.S. parents say they’ve spent money they don’t have — borrowing the funds, using credit cards or taking out loans — to provide even these less important items for their kids, according to a Credit Karma survey of 1,000 parents in the U.S.

Of course, there are some stipulations to when parents can take an early withdrawal, says Jeff Levine, a certified financial advisor and CEO of New York-based Blueprint Wealth Alliance.

New parents have a year to take the withdrawal after the birth or adoption of a child and it needs to take place after the child’s arrival, which means it can’t be used for costs incurred leading up to a planned birth or adoption. It only applies to living children, stillborn children won’t qualify. For those adopting, the exemption only applies to adoptees under 18.

Consider the big picture before simply taking the money

While the new rule allows for penalty-free withdrawals, the money isn’t totally free. You can’t forget about taxes. “The withdrawal would still be taxed at the person’s ordinary income rate,” says John Petrides, a wealth management expert with Tocqueville Asset Management.

A married couple with a household income of $100,000 and one child would typically owe $6,684 in federal taxes using the standard deduction, according to Credit Karma’s Income Tax Calculator for 2019. But let’s say the couple took a combined $10,000 penalty-free withdrawal from their retirement accounts. That bumps their household income up to $110,000 for that year and they now may owe roughly $8,500 in taxes.

While the increased access to funds is great, Petrides says it is important for people to understand how taking a withdrawal will affect their financial situation, including any potential liabilities. “It’s not perfect, but it’s better than nothing,” he adds.

There is also an opportunity cost to raiding your retirement savings early. A $5,000 balance today could be worth $57,900 in 35 years, assuming a 7% annual rate of return. Many times, every dollar counts when attempting to save for retirement.

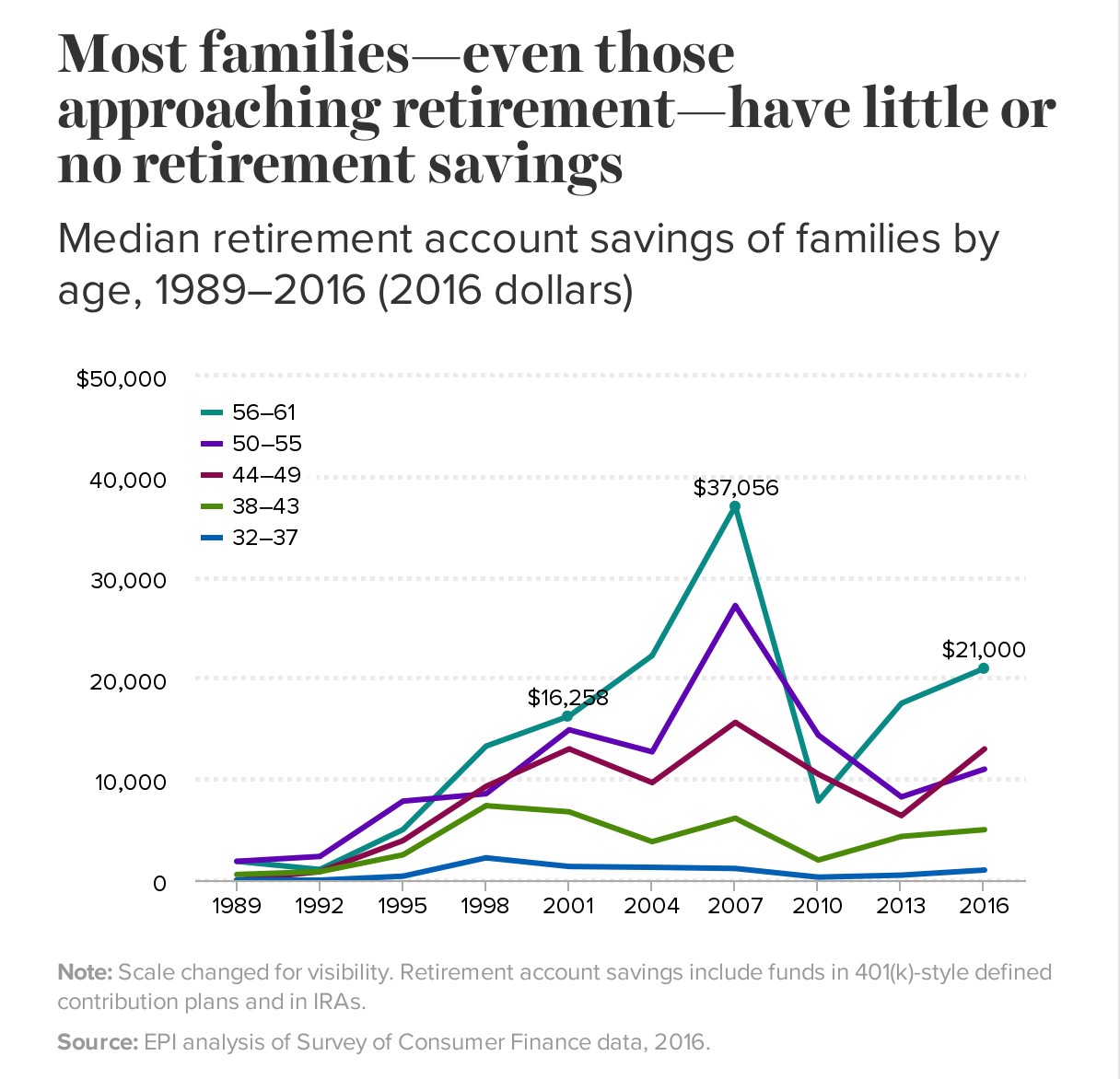

A recent report found pre-retirees, Americans 56 to 61, had a median balance of $21,000 in their 401(k) accounts in 2016, which is the most up-to-date data on file. That total reflects almost 30 years of savings. Younger generations do not fare much better. Older millennials (32 to 37) have about $1,000 saved in their 401(k)s.

Adding a new way to drain those funds isn’t going to help the situation, Morrissey says.

That said, the ability to funnel cash from a retirement account may help some Americans avoid sliding into debt, especially those who would otherwise need to turn to using a high-interest credit card or personal loan. “Ideally, people would have savings to cover these life events, but that is not always possible,” Autumn Campbell, a certified financial planner with the Planning Center, tells CNBC Make It. Although the 401(k) withdrawal should not the first line of financial support, it could very well be a needed one, she adds.

That’s because at the end of the day, parents will do anything for their kids, which means getting the money from somewhere, Levine says. “As a parent of three amazing kids myself, there’s no amount I wouldn’t pay (or account I wouldn’t raid) to come up with the money necessary to bring them into this world healthy and happy.”

Don’t miss: Economist: The system is ‘flawed’ when most Americans have little or no retirement savings

Like this story? Subscribe to CNBC Make It on YouTube!

EU News Digest Latest News & Updates

EU News Digest Latest News & Updates