It’s time to roll out the red carpet for Netflix. The streaming giant reports earnings Wednesday afternoon, and as the company gets ready to pull back the curtain on this quarter’s results, not everyone is convinced the stock can avoid the same fate as last quarter.

In July, the results wiped out the stock’s entire 2019 gains. Since then, shares have bounced back into positive territory, but the options market is still predicting a double-digit move after Wednesday’s report.

“If you look at the at-the-money straddle, it’s implying about an 11% move. That’s pretty significant. The last four quarters have moved, on average, 5%,” XP Investments’ Bonawyn Eison said Tuesday on “Fast Money.”

Bullish call volume slightly outpaced puts in Tuesday’s trading as investors jockeyed for position ahead of Wednesday’s report, but that doesn’t mean sentiment around Netflix is firmly positive.

“Open interest leans more towards the puts,” said Eison, “So it’s kind of tough to see whether traders are coming in with a bullish or bearish bet. Net net, people are expecting a volatile move.”

The fact that the options market isn’t jumping at the chance to take one side or the other on Netflix points to the caution surrounding the stock, but it also highlights something else about the options market: While playing a catalyst could be the ticket to a big payout, there are also plenty of ways to get it wrong.

“If you look at historical implied volatility, it’s tough to be long options and get this right. You can get the direction right and still end up losing money because the options premium is just so robust,” said Eison.

Of course, you can also get the direction, the time horizon, or the levels at which you place your bet wrong.

However, if you’re inclined to place a bet, it’s helpful to know where the stock might head from a technical perspective. If Netflix fails to deliver, Eison sees it testing a key level of support.

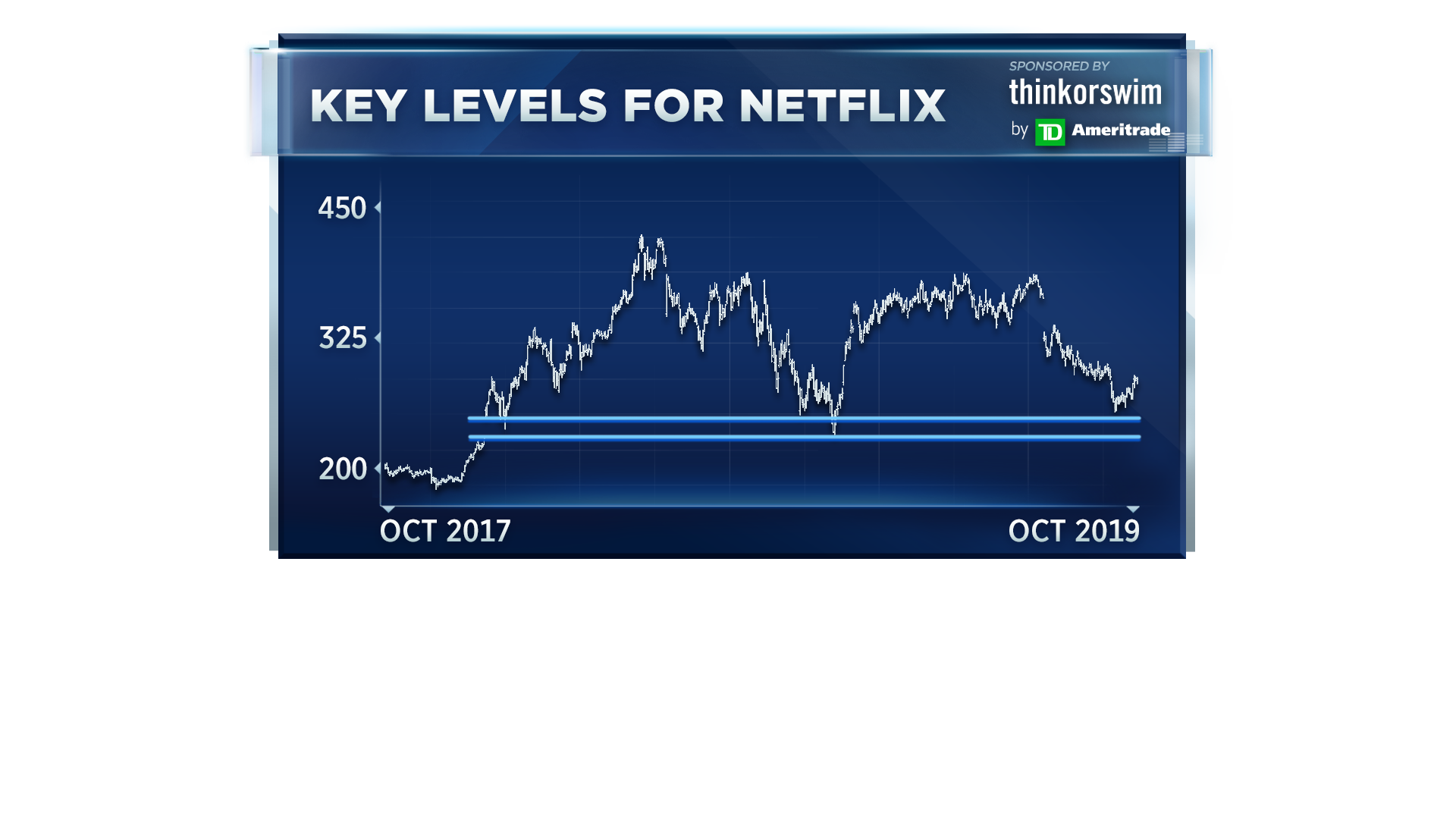

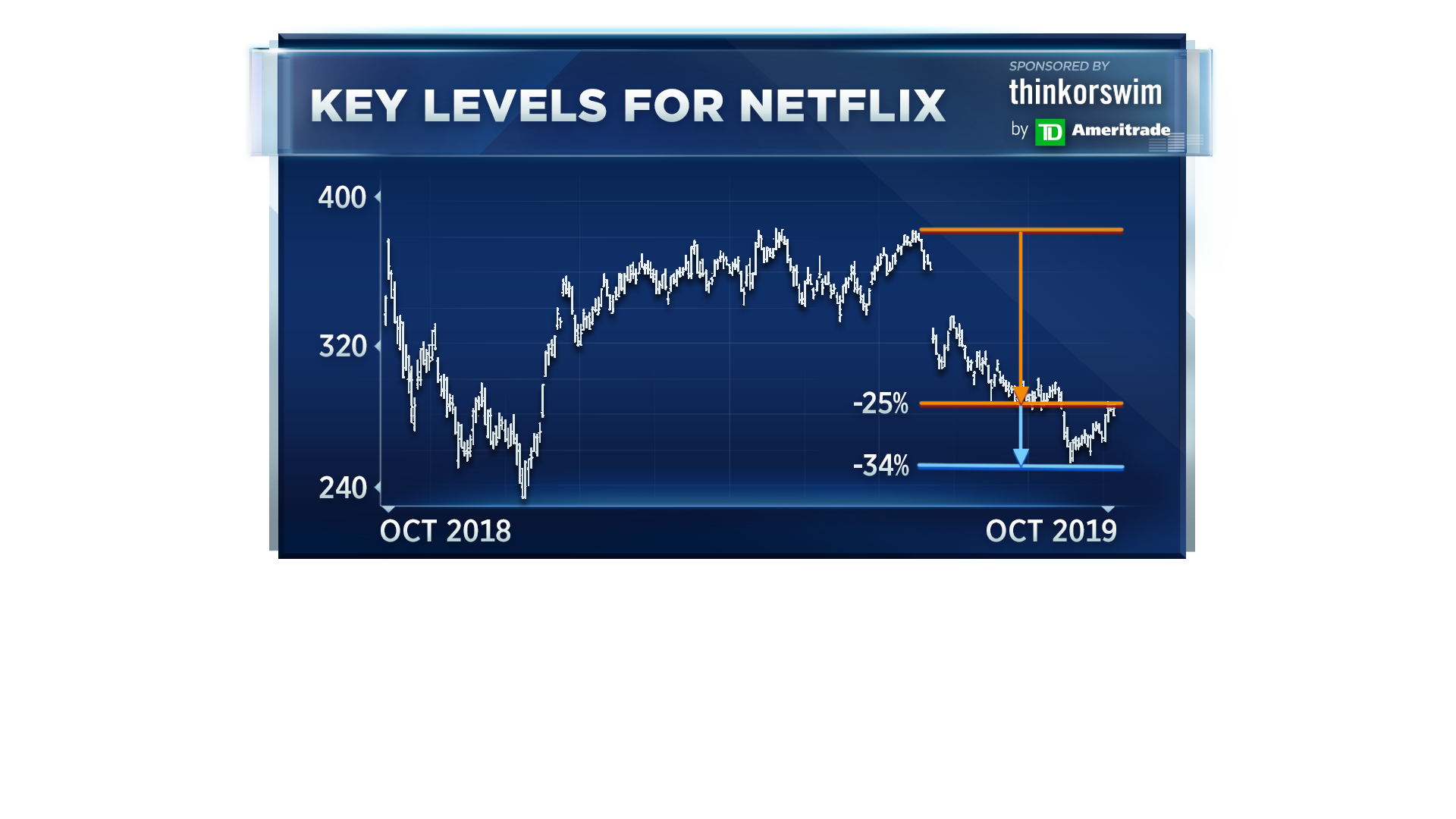

“There’s like a two-year support channel down around $240-$250. That’s going to be a real pressure point in the stock there. That’s where I’m looking,” said Eison.

On the flipside, if Netflix can deliver a show-stopping performance, the way investors are positioned in the stock could pave the way for a big move to the upside.

“On the upside, given all the short interest in the stock, we could see a pretty aggressive move back up, kind of retracing some of the losses we’ve experienced this year,” said Eison.

Netflix was trading slightly lower in Wednesday’s session, above $284 per share.

Disclaimer

EU News Digest Latest News & Updates

EU News Digest Latest News & Updates