Pension funds, wealth managers and insurance companies are increasingly looking outside of traditional stocks and bonds to find new investment products as the bull market ages.

“You’re seeing a lot more competition for assets. A lot of players are trying to figure out what are the new areas,” said Craig Hapelt, partner at The Boston Consulting Group in Toronto.

Second quarter earnings from major private equity firms that wrapped up this week reflected a greater interest in alternative assets.

The four largest publicly traded private equity firms, Blackstone, KKR, The Carlyle Group and Apollo Global Management, reported a total $921 billion in assets under management, a 6.5 percent increase from the prior quarter.

That marked the biggest quarterly increase since the third quarter of 2013, according to CNBC analysis of company reports and S&P Global Market Intelligence data.

Private equity funds typically invest in companies by acquiring them, growing their bottom lines through cost cuts and other strategic changes and then selling them at a profit. The funds are part of a broader investment class called alternative assets, which includes real estate, commodities, infrastructure projects and hedge funds.

The top 100 alternative asset managers in the world saw assets under management rise 10 percent to $4 trillion in 2016, according to an annual report from Willis Towers Watson released July 17.

Pension funds contributed about $100 billion to that increase and had the largest share at one third, while wealth managers held 15 percent, according to the study. Insurance companies increased their share of the $4 trillion in alternative assets to 12 percent from 10 percent last year, the Willis Towers Watson study said.

The firm’s North America head of manager research, Brad Morrow, attributed much of the greater interest in alternatives to a search for better investment returns.

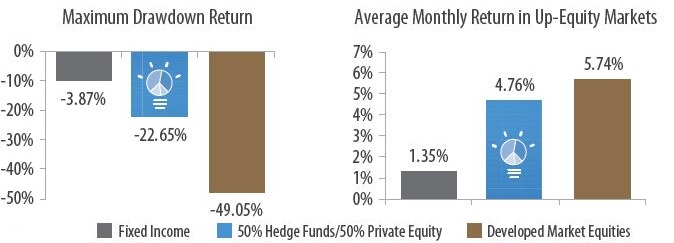

Historical performance indicates that alternatives can help insulate investors from sharp market drops. That’s an increasingly important consideration to many as expectations of a stock market pullback build.

Between 1990 and 2016, developed market stocks fell a maximum of 49.05 percent, while a fund half allocated to hedge funds and half to private equity fell only 22.65 percent, Wells Fargo Investment Institute said in a June 22 report.

Performance from Jan. 1, 1990, to Dec. 31, 2016

Source: Wells Fargo Investment Institute

“We suggest that investors consider alternative investments as a way to participate in the upside potential of financial markets while potentially mitigating the effects of inevitable market corrections,” Wells Fargo said.

The report showed the average monthly return for the hedge fund and private equity mix over that time was 4.76 percent a month, about 1 percent less that of developed market stocks.

Alternative investments are also a better business for asset managers.

Although the alternative products account for only 15 percent of $69 trillion in global assets under management, they take 42 percent of the asset management industry’s total revenues, excluding performance-based fees, according to a July 11 report from The Boston Consulting Group.

Global revenues by fund product, from 2003 to 2021 (estimated)

Source: The Boston Consulting Group

“Alternatives, solutions, and specialties will drive revenue and, with Passives, dominate [assets under management] growth,” The Boston Consulting Group study said, “while traditional active assets will continue to be squeezed, losing share.”

Investors have already been shifting away from more traditional, actively managed funds in favor of lower cost exchange-traded funds. Reflecting the changing industry environment, about 60 mutual fund executives met in November for a forum to discuss ways to stop clients from withdrawing their money, The Wall Street Journal reported.

A few private equity funds are also making it easier for more people to invest in those alternative assets, which historically have been the territory of those with a million or far more to invest.

Anecdotally, some private equity and private credit funds are lowering their investment minimums to $250,000 or even $25,000, according to State Street’s Cesar Estrada, who is global head of product management for private equity and real estate fund services.

The lower investment minimums are “certainly attracting a much bigger universe of investors,” he said “It’s an emerging trend.”

To be sure, hedge funds are one alternative investment that have grown less popular.

In the second quarter, the amount of assets in global exchange-traded funds and other exchange-traded products topped those in the global hedge fund industry by $1 trillion for the first time, research firm ETFGI said Monday.

EU News Digest Latest News & Updates

EU News Digest Latest News & Updates