Mark Mobius, Executive Chairman of Templeton Emerging Markets Group.

Anjali Sundara | CNBC

India’s central bank was wrong to keep its benchmark interest rates unchanged on Thursday, according to veteran emerging markets investor Mark Mobius.

The Reserve Bank of India surprised markets by keeping its repo rate — the rate at which it lends to other banks — unchanged at 5.15%. Prior to the decision, economists predicted a sixth rate cut from the central bank amid a notable slowdown in the Indian economy.

“I think they did the wrong thing,” Mobius, who is founding partner at Mobius Capital Partners, told CNBC’s “Street Signs” on Friday about the RBI. “I think they were reacting to the short-term situation with inflation, which is mainly caused by food prices, and, specifically, onion prices.”

In October, India’s annual retail inflation rose to 4.62% on the back of higher food prices, Reuters reported. That was a tick above the RBI’s medium-term target of 4%.

“They should have lowered rates,” Mobius said, adding it could improve business confidence in the country and may help to solve some of the debt problems in India’s financial services sector. He explained that the country is “going through a big adjustment right now because of the reforms that have taken place, particularly on the taxation side,” referring to Prime Minister Narendra Modi’s landmark Goods and Services Tax reforms.

The government has struggled to collect sufficient revenue since its new tax schemes went into effect in mid-2017. Recent reports said the GST structure is set to be reviewed.

“This is an adjustment that people have to be accustomed to and it takes time. But next year, I believe that this will do well — they would have made this adjustment and realize the reforms are having an impact,” Mobius said, adding he remains bullish on India. Many micro, small and medium-sized businesses have struggled as a result of the new value-added taxes.

‘Puzzling’

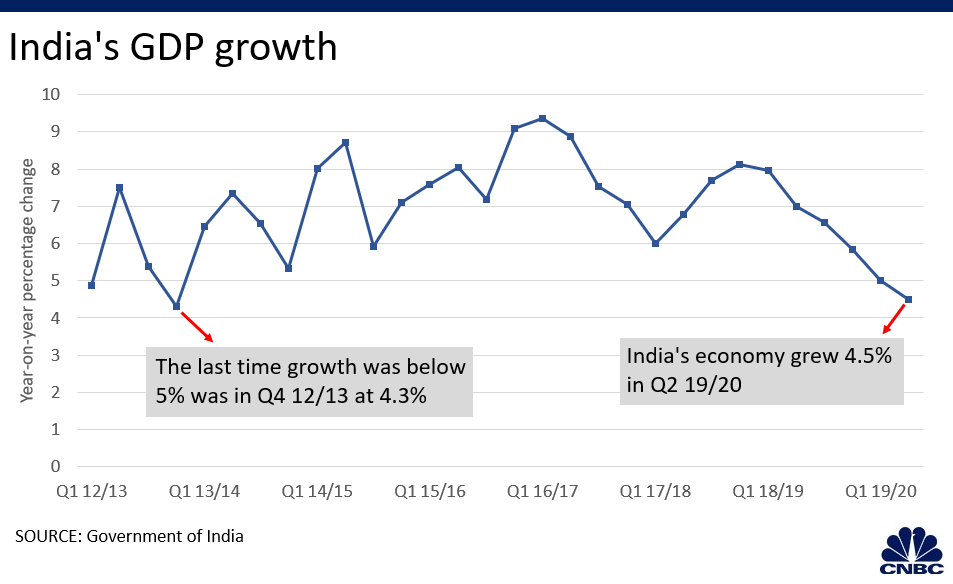

The central bank had already cut the repo rate by 135 basis points this year to stem the economic slowdown. Last week, India reported its economy grew at the slowest pace since 2013.

That made Thursday’s move “more than surprising,” according to Jehangir Aziz, chief emerging markets economist at J.P. Morgan. “I thought it was very puzzling.” Aziz explained on CNBC’s “Squawk Box” that since monetary policy is forward-looking, the RBI’s decision was confusing in terms of the “framework within which they are operating.”

For its part, the RBI said in its policy statement it felt appropriate to pause at this stage in light of the current growth-inflation dynamics.

Aziz said apart from inflation concerns, another reason that could explain the central bank’s decision Thursday is a worry over India’s growing fiscal deficit.

“I think the other reason could be, which they did not state, is that they are concerned about what happens to the fiscal deficit outturn,” he said, adding, “there’s a possibility that in February, when the (new) budget comes out, the outturn could be much worse than what people are thinking.”

The budgeted fiscal deficit target at the moment is 3.3% of GDP and if it widens too much, then investor confidence could be affected. India surprised with a $20 billion fiscal stimulus package in September, which mostly focused on a corporate tax cut that analysts agree makes the country more competitive. More fiscal measures are expected next year.

Aziz, however, pointed out that the corporate tax cut would not help to shift demand in the near term. Instead, if India had reduced its GST rates, there would have been an immediate impact on consumer demand, he said.

“There was a way in which they could have better utilized the space,” Aziz said. “Unfortunately, they did not. So, we really have to wait and see whether truly in the medium term, this corporate tax cut actually helps India or not.”

EU News Digest Latest News & Updates

EU News Digest Latest News & Updates