Here are the most important things to know about Tuesday before you hit the door.

A monitor displays Peloton Interactive Inc. signage during the company’s initial public offering (IPO) across from the Nasdaq MarketSite in New York, U.S., on Thursday, Sept. 26, 2019.

Michael Nagle | Bloomberg | Getty Images

1. Economic data

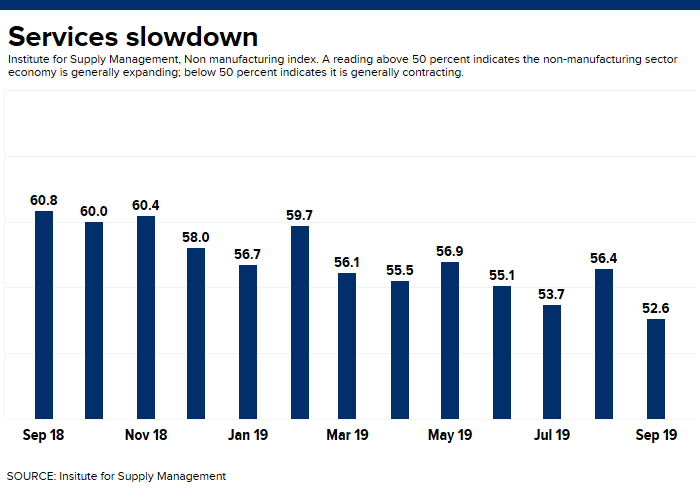

Tuesday, we’ll get insight into economic sentiment after the October ISM Non-Manufacturing Business Activity Index report is released at 10 a.m. The survey measures the percentage of companies from the services sector that are expecting to expand their business, so it can be an indicator for the overall health of the economy.

A reading above 50 represents growth, and the consensus estimate for October is 53.5.

In the month of September, the services sector expanded, but the 52.6 reading missed estimates of 55.3, and it was the weakest reading since August of 2016. It was also down sharply from August’s 56.4 print.

Tuesday’s data comes after Friday’s mixed read on the economy. The jobs report showed an unexpected jump in nonfarm payrolls, while manufacturing data showed the third straight month of contraction.

IHS Markit will also release its October US Services PMI number tomorrow.

2. China President Xi speaks

Chinese President Xi Jinping will deliver the opening remarks at the second annual China International Import Expo which kicks off tomorrow in Shangai.

The event, which lasts a week, is supposed to demonstrate that China is open for business despite the ongoing trade war. More than 3,000 companies will be hosted at the event, with U.S, companies accounting for the largest portion.

This comes after the U.S.-China trade war rages on.

China said on Friday that it had reached a consensus with the United States on trade deal principles. Phase one of the deal was supposed to be signed at the APEC summit later this month in Chile, but last Wednesday the South American country said it would no longer host the summit following a series of protests over public transport fares. President Donald Trump said that a new location for the meeting will be announced soon.

3. A first for Peloton

Tuesday before the market opens the exercise-equipment maker will release its first quarterly report since going public on September 26.

Analysts are expecting Peloton to post a loss of 36 cents per share on $199.1 million in revenue, according to estimates from FactSet.

The report comes as the Street has turned a sharper eye to high-flying tech names that don’t actually make money, so investors will be watching for guidance from Peloton on the company’s path to profitability.

.1572895758889.jpeg)

The stock has struggled in the public market, with shares down 14% since the debut. Uber, Lyft and SmileDirectClub are among the other highly anticipated unicorn IPOs this year that have posted negative returns since going public.

Despite the lackluster stock performance, the Street is bullish on Peloton. Not a single analyst has a sell rating on the stock, according to estimates from FactSet. Nineteen analysts have a buy, 2 have a hold, and the average target of $30.85 implies a 23% upside ahead.

Major events (all times ET):

7:30 a.m. Federal Reserve Bank of Richmond President Thomas Barkin

9:45 a.m. US Services PMI

10 a.m. ISM Non-Manufacturing

Major earnings:

Regeneron (before the bell)

Arconic (before the bell)

Tapestry (before the bell)

Peloton (after the bell)

Match Group (after the bell)

EU News Digest Latest News & Updates

EU News Digest Latest News & Updates