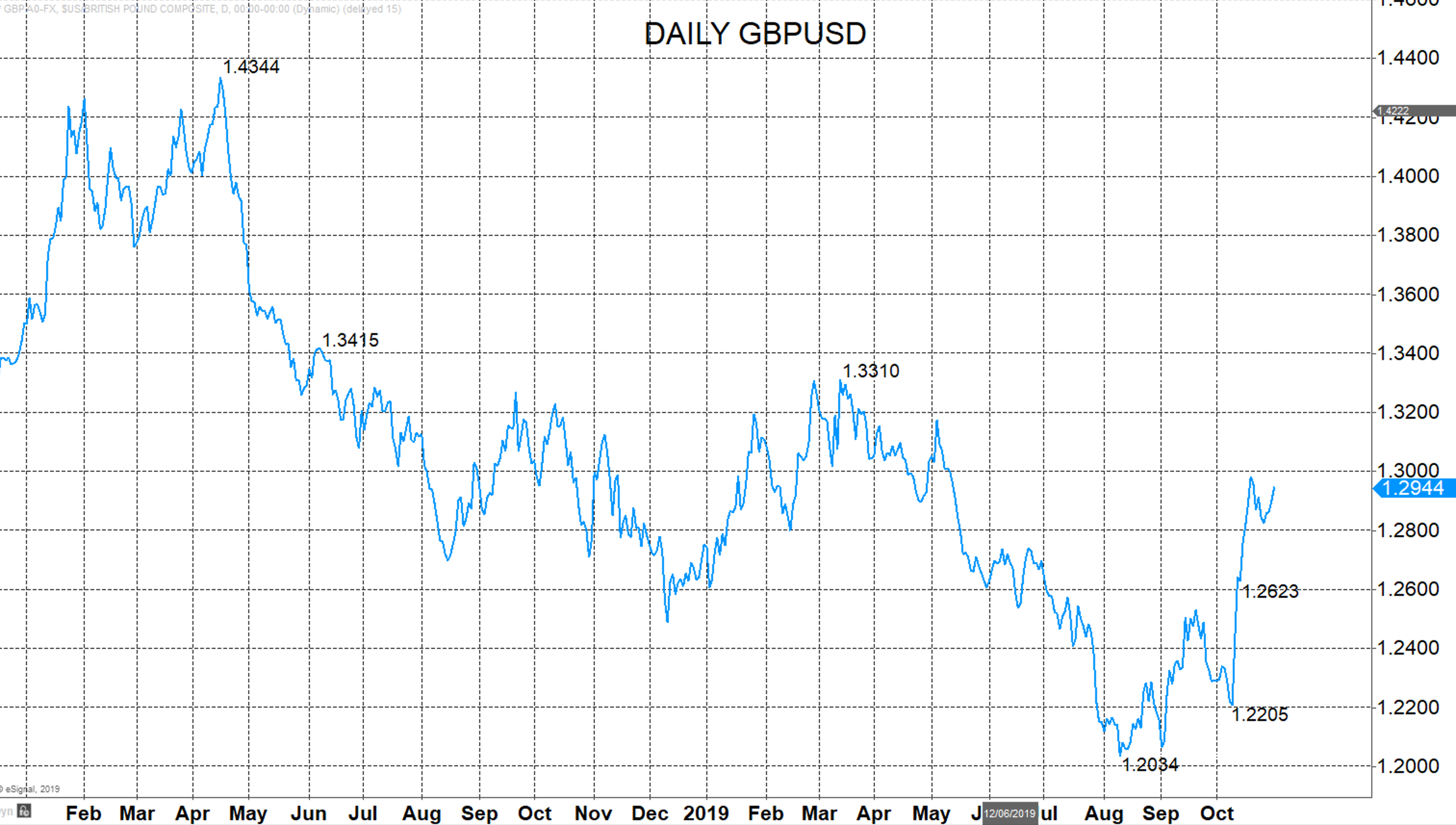

The British pound has been on a roller-coaster ride in the years since the U.K.’s EU membership referendum back on June 23, 2016 (subsequently better known as the Brexit referendum).

It’s seen a range against the U.S. dollar between $1.50 on the night of the referendum, sinking as low as $1.1450 at the flash crash low in October 2016, back up to $1.43, and then back down to $1.19 again as recently as September 2019. Against the euro, the pound has seen a range 0.76 to 0.93 over this same timeframe.

Moreover, the sterling-dollar rollercoaster has been on a sharp incline since early October, driven from $1.22 to above $1.30 by two factors. One, fading risks of the U.K. crashing out of the EU on a no-deal basis and secondly, U.K. Prime Minister Boris Johnson managing to negotiate a new deal with the EU.

However, the latest twist for the pound has been that the Labour party has conceded to Conservative Party demands for a snap general election on December 12. This new twist has raised fresh uncertainty for sterling.

A Conservative majority

The threat that currency traders now have to contend with is that the Conservatives don’t manage to secure the parliamentary majority they desperately want in order to complete the passage of the new Brexit deal through Parliament (if they do even pursue this route after securing a majority).

If the Conservatives succeed, the expectation would be for them to seal the Brexit divorce deal and sterling would likely rally further. But what if the party fails?

Over the past eight weeks, as Johnson and his government have been pushing for a general election, nearly 2 million new voters have registered at an average of about 250,000 a week. This is almost twice the figure compared to the prior eight weeks, with nearly 60% of these newly-registered voters under 34-years old. This could be seen as a positive for Labour as it tends to attract a larger percentage of its support from younger voters.

A harder Brexit?

In addition, much has been discussed and analyzed with respect to a winter election. Could this be detrimental to the Conservatives, given they command a larger number of elderly voters, who may not be inclined to vote in poor weather conditions? Evidence suggests that this is not necessarily the case. Moreover, a mid-December election that is near the end of term for students could impact the student vote. Students could be registered to vote at university but may have gone home by election day.

A final factor to consider is the potential impact of the Brexit Party. The general election will be fought as a vote on the U.K.’s divorce for the EU. Nigel Farage’s Brexit Party could do well and offer a lifeline to a Conservative Party that even with a majority may be short of votes to pass its deal. However, this could also raise the potential for a move toward a harder or a no-deal Brexit, a clear negative for the pound.

A center-left coalition

There are real risks that the Conservatives do not secure a majority and although we do not foresee a Labour majority, there’s a significant threat of another hung Parliament. The question then would be, who would “get into bed with” the Conservatives, except the Northern Irish Democratic Unionist Party or the Brexit Party? This leaves risk for either a center-left coalition or a minority government. Regardless of your political persuasion, neither of these options would be viewed as positives for sterling.

Furthermore, we must not forget the greenback’s own volatility. On Wednesday, the Federal Reserve cut interest rates for the third time since July. Although the dollar sold off in reaction to the cut, it had been broadly rallying before this. From the Fed’s policy statement, we see a less dovish tone (so de-facto more hawkish) and we feel going forward this leaves risks for a further strengthening of the currency in the short to intermediate-term.

A possible correction

The combination of these factors could see sterling-dollar undergo a notable correction going into December, before a potentially more bullish tone resumes after the election and in early 2020.

In summary, the intermediate-term view for sterling is probably still positive, with risks after the general election and into year-end for a push through $1.33 and $1.34, maybe closer to $1.43 into 2020. However, in the short-term, political shenanigans and uncertainties leave the risks skewed toward a more negative tone for the pound, with a possible correction to $1.26, or maybe even deeper for $1.22.

The currency was trading at 1.2948 against the dollar on Friday morning.

EU News Digest Latest News & Updates

EU News Digest Latest News & Updates