Source: taxjusticenow.org

Jeff Bezos out $107 billion. Warren Buffett short $77 billion.

That’s how much the net worth of each man would have been cut since the 1980s if Sen. Bernie Sanders’ tax policy had been adopted at the time, according to two University of California economists who study the growing concentration of wealth in the U.S.

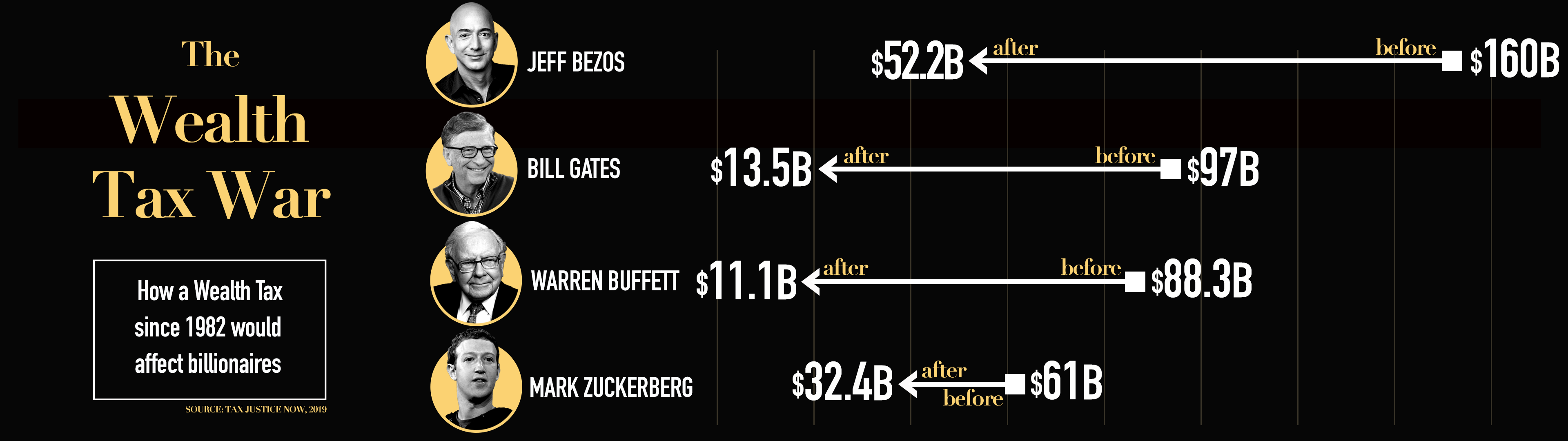

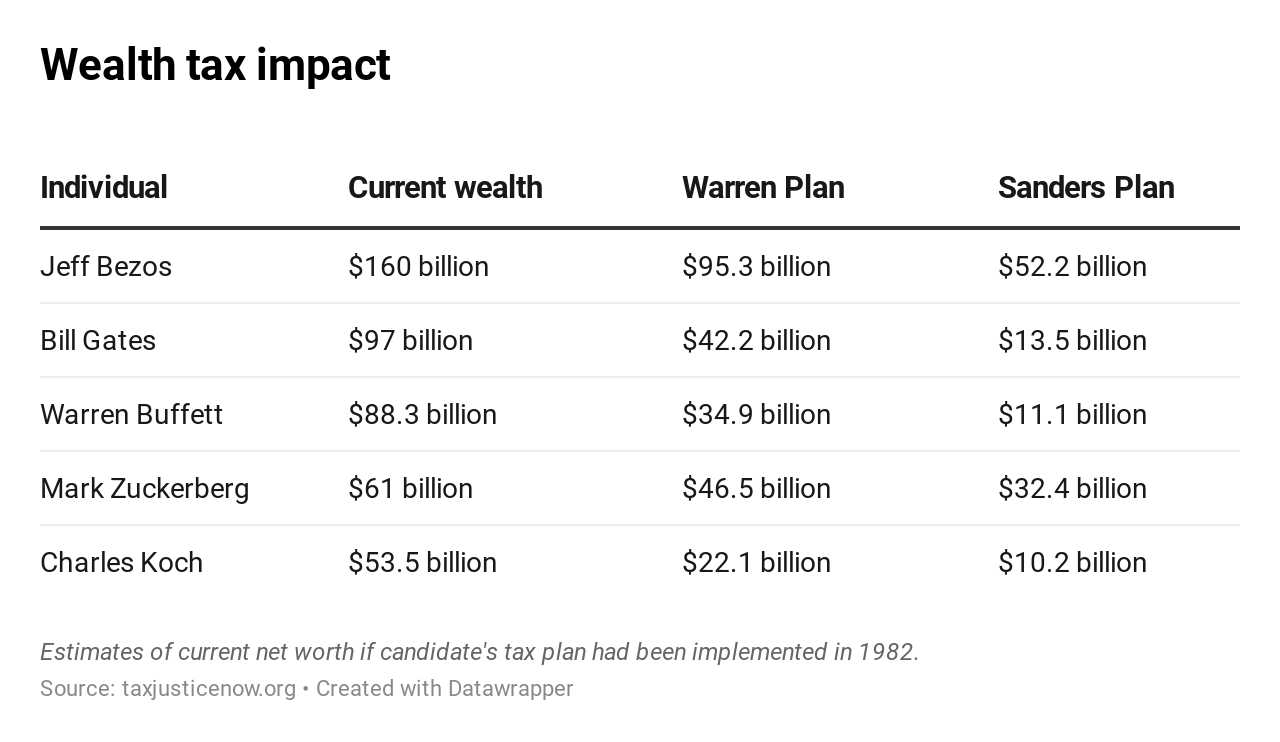

Instead of his current net worth of $160 billion, Amazon CEO Bezos’s fortune would only be worth $52.2 billion had Sanders’ plan been adopted in 1982, per the website. Buffett would only be worth $11.1 billion as opposed to his current $88.3 billion.

Facebook founder Mark Zuckerberg would only be worth a net $32 billion versus his current $61 billion. As a younger billionaire, he would have seen less of an absolute tax effect on his wealth to date since he amassed his fortune more recently.

Bezos would pay about $9 billion in taxes this year alone under Sanders’ proposed wealth tax, more than the net worth of the 50 richest Americans as listed by Forbes. The Sanders campaign said the levy would raise an estimated $4.35 trillion over the next 10 years to help pay for key agenda items like “Medicare for All” and affordable housing.

“I don’t think billionaires should exist,” Sanders told The New York Times earlier this year. If lawmakers approved his wealth tax, the new levies would halve billionaires’ wealth in 15 years, provided all other factors (like their stock prices or business values) remained constant.

The impact of Sen. Elizabeth Warren’s wealth tax is estimated to be a bit more modest: Bezos would now be worth $95 billion, Buffett worth $34.9 billion and Zuckerberg at $46.5 billion.

Here’s what some of the wealthiest Americans would now be worth had the tax plans of either Sanders or Warren been introduced in 1982.

The effect of the tax systems is according to taxjusticenow.org, a website founded and led by University of California-Berkeley economists Emmanuel Saez and Gabriel Zucman.

Warren often cites work published by the academics and relied on their figures to claim that her new wealth tax would raise $2.6 trillion over 10 years. The plans proposed by Sanders and Warren hope to introduce a new gauge of progressive tax policy based on what Americans own, not just what they earn.

Warren later increased the top rate in her wealth tax to 6% from 3%, a move she says could generate an additional $1 trillion over 10 years. Her campaign just bought airtime on CNBC to run a new ad attacking billionaires.

A Sanders administration’s tax regime would take an even greater toll on the wealth of the nation’s richest: The current net worth of Bezos, Buffett, and Bill Gates would all have been curbed by at least 50% had his tax system been introduced in 1982, according to the website.

EU News Digest Latest News & Updates

EU News Digest Latest News & Updates