Germany will auction a 30-year bond with a 0% interest rate for the first time on Wednesday, according to several media outlets.

The bond sale expected to take place at 10:30 a.m. London time will mean the German government will not make any interest payments to those buying the bond until it matures in August 2050.

Bondholders would usually receive both the face value back as well as interest payments over the assets lifetime. But a zero-coupon bondholder would only receive the face value back.

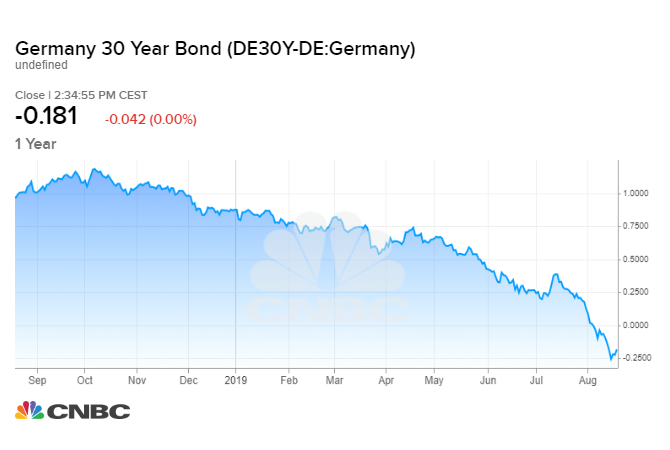

The sale of 2 billion euros of the long-term bond that was announced last week comes at a time when the yields of these fixed-income assets have hit record lows, with many moving into negative territory as investors look to shelter from market turbulence and capitalize on central bank easing.

A zero-coupon bond from the German government is an option for investors to park their money in a longer term safe-haven asset and lock their cash for a 30-year period amid global uncertainties.

In a challenging market environment, investors tend to move their investments from riskier assets into safe-havens like gold and government bonds, thereby bumping up demand and prices. Bond yields move inversely to prices, and hence have been turning negative.

A bond’s coupon rate is the rate of interest it pays annually, while its yield is the measure of return based on coupon and purchase price.

Germany in recession mode?

Germany is on the brink of a recession after new economic data showed the economy shrank by 0.1 percent in the second quarter of 2019. The slowdown along with uncertainty around trade wars and Brexit is ramping up the pressure on the government to deliver a fiscal stimulus package.

Germany previously sold a 10-year zero-coupon bond in April 2015 — a move that is often noted as being the spark for a bund “tantrum” after a lack of interest in the sale led to a sell-off. However, Ralf Preusser, global head of rates strategy at Bank of America Merrill Lynch, said in a note last week that while there are “concerning parallels to today’s market environment,” there are also some “crucial differences.”

“In 2015, the ECB (European Central Bank) had ruled out cutting rates any further — a promise they would renege on in late 2015 and early 2016. In contrast, the ECB has reopened the door to rate cuts without giving any indication of the new floor for the ECB deposit rate,” Preusser said.

He further highlighted that with the sale of the German 30-year bond on Wednesday and the 10-year bond on August 28, the risk is that at these yield levels, the German Finance Ministry will “eventually encounter a buyer’s strike.”

The German 30-year is currently trading at a yield of -0.15%. All other German government bond yields are also in the negative territory.

EU News Digest Latest News & Updates

EU News Digest Latest News & Updates