Market watcher Dan Suzuki warns that correction risks are rising, and there’s nothing the Federal Reserve can do about it.

The Richard Bernstein Advisors portfolio strategist believes Wall Street is erroneously expecting that a July interest rate cut will propel stocks further into record territory.

“When the Fed has historically cut rates, unless you had some kind of combined effort from the fiscal stimulus side of things, it’s been generally more of a bearish sign than it has a bullish sign,” he told CNBC’s “Trading Nation ” on Wednesday. “All this emphasis on the Fed coming in on its white horse to save the day is probably a bit overdone.”

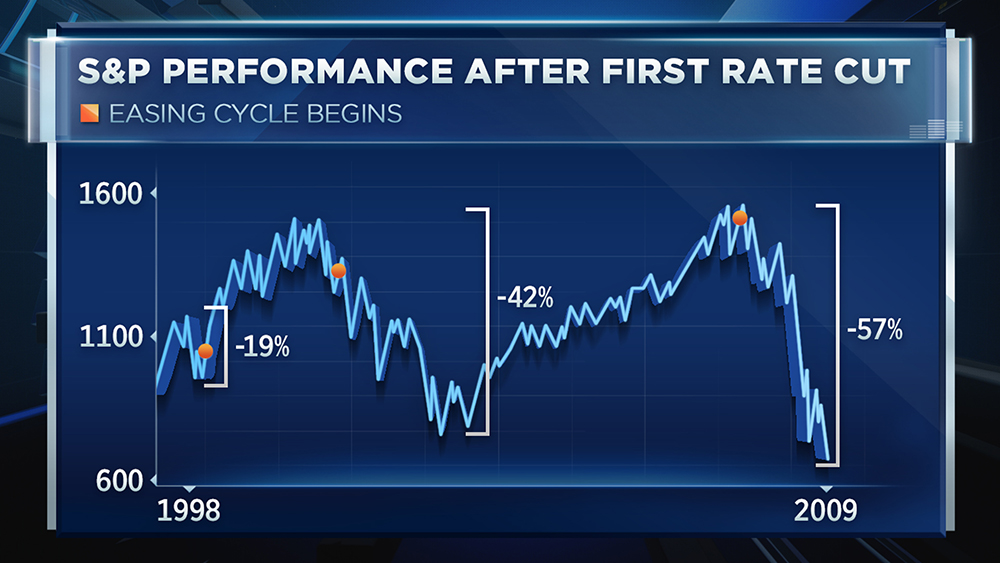

Suzuki builds his case in a chart going back more than two decades. It shows the S&P 500’s performance after the first rate cut in a Fed easing cycle.

“Even without a recession, if you think back to 1998, they [the Fed] started cutting about halfway down into what turned out to be a 19% correction in the market,” said Suzuki.

He finds it happened two more times in the past 20 years.

“The last time the Fed started cutting rates was September 2007…. a month before the peak of the last bull market. And, then the time before that was about nine months into the tech wreck, so lagging the peak of the bull market,” he added.

According to Suzuki, the issues facing the market right now is more about underlying fundamentals and how they’re putting pressure on corporate profits.

“Whether the Fed cuts 25 or 50 basis points [next week,] I don’t think it really changes the story and the story is that growth is slowing,” Suzuki said.

With the S&P 500 hitting a fresh high Wednesday, Suzuki sees pullback risks rising to levels not seen in years. He expects investors will ultimately realize a Fed rate cut or two won’t reinvigorate the economy and says it could lead to 5% to 10% sell-offs through the end of the year.

“The markets tend to be overly focused on the Fed as sort of a panacea for the weakening fundamentals,” Suzuki said.

EU News Digest Latest News & Updates

EU News Digest Latest News & Updates