While corporate America frets over the impact the U.S.-China trade war will have on future costs, consumer just keep right on rolling.

The latest evidence of a resilient consumer comes from the July spending numbers, which showed a 0.6% monthly gain in personal spending even amid a more tepid 0.1% rise in personal income. That comes on top of data earlier in the week indicating that personal consumption rose 4.7% in the second quarter and saving compared to disposable income edging lower, from 8% to 7.7%.

At a time when the tariff battle occupies much of the market’s attention, consumers seem to be largely disregarding the issue.

“Despite the concerns about the ongoing trade war between the U.S. and China and slower global economic growth, consumers remain in good shape, continuing to push the U.S. economy forward,” Gus Faucher, chief economist at PNC, said in a note.

The increased spending did not come, as might be expected, with a jump in inflation. The core personal consumption expenditures price index, which strips out food and energy, rose just 1.6% annualized, while the headline number was up a mere 1.4%, according to Commerce Department figures.

That’s well below the Federal Reserve’s target, though the three-month average was right on the 2% level that the central bank considers healthy.

“Net, net, the economy is riding high on the backs of the consumer who is hitting the shops and malls with credit cards out and clearing the store shelves of all that retailers have got this summer,” wrote Chris Rupkey, chief financial economist at MUFG Union Bank. “The consumer isn’t worried, sitting at home watching the political debates concerned about the country’s direction, they are out shopping and dipping into their savings to do it.”

The main question now will be how long it can last.

Faucher said he doesn’t expect the current strong pace to hold up as the trade war continues, particularly if the jobs market starts to weaken. While payrolls rose 164,000 in July, hours worked declined, sparking some concern of an early sign that the decadelong hiring boom was unwinding.

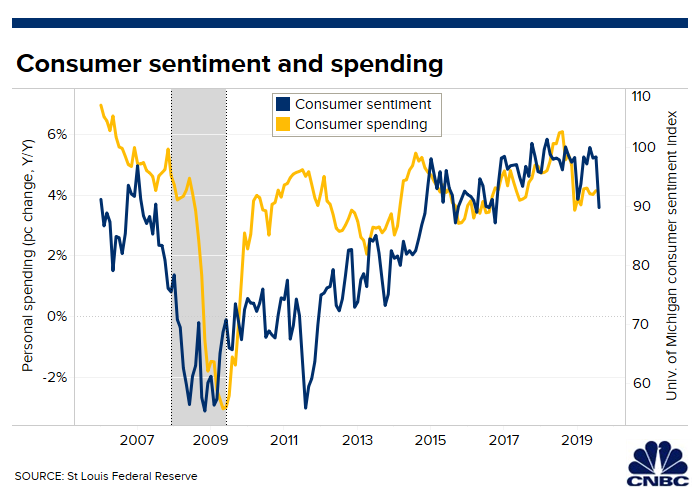

Friday’s data menu also came with some bad news — the closely watched University of Michigan consumer sentiment measure for August was revised lower to 89.8, representing a 9.8-point tumble that was the biggest monthly slide since December 2012.

Indeed, companies and analysts are more concerned about the future than consumers.

The Goldman Sachs Analyst Index, which surveys equity analysts on business conditions across multiple categories, fell to a two-year low in August. Its reading of 48.2 reflects economic contraction and showed across-the-board weakness fueled by tariff concerns.

“Analyst commentary suggests that further tariff escalation has ‘dampened [the] outlook’ for some sectors. Several responses indicated that some companies are rerouting supply chains and relocating production to mitigate exposure to the trade war,” Goldman economist Ronnie Walker wrote.

Still, signs of a recession appear distant, despite what the bond market and its inverted yield curve might be suggesting.

The Atlanta Fed is tracking third quarter GDP at 2.3% following a 2% gain in Q2. After-tax income continues to rise, gaining 3% annualized in July.

“The trade dispute with China may be escalating at a rapid pace but, despite the concerns of Fed officials, there is still little evidence that this is having a significant impact on the economy,” said Andrew Hunter, senior U.S. economist at Capital Economics.

One of the more bearish forecasting firms, Capital has taken up its Q3 growth estimate to 2% from 1.5%, though it still, like most of its peers, doesn’t think that will derail the Fed from again cutting interest rates in September.

“The direct impact of those tariffs should be manageable, but there is risk that uncertainty over the outcome of the conflict starts to weigh more heavily on the economy,” Hunter wrote. “So far, however, there is only limited evidence of that in the data.”

EU News Digest Latest News & Updates

EU News Digest Latest News & Updates