SpaceX owner and Tesla CEO Elon Musk reacts during a conversation at the E3 gaming convention in Los Angeles, June 13, 2019.

Mike Blake | Reuters

UBS slashed its earnings forecast and price target for Elon Musk’s Telsa, the firm said Friday.

Improved deliveries in the second quarter could drive Telsa shares in the near term but second quarter profits and deliveries in the second half of the year are keeping UBS cautious on Tesla’s stock. UBS maintained its sell rating on the stock and lowered its 12-month price target to $160 from $200. Tesla’s stock fell about 1% to $220.98 in premarket trading Friday.

“Deliveries may provide a pop, but earnings may cause a drop,” UBS analyst Colin Langan said in a note to clients on Friday. “We expect losses in the second half to increase as deliveries likely soften and the impact of pricing actions continues to weigh on margins.”

In April, Tesla’s decline in deliveries in the first quarter worried investors and pressured shares. Shares of the automaker fell by more than 10% after the company said it delivered 63,000 vehicles in the first quarter, while analysts were expecting Tesla to deliver about 76,000 cars.

UBS said if Tesla can show a strong recovery in deliveries in the second quarter, close to its 90,000 to 10,000 target, “it would likely appease bulls,” Langan said.

However, UBS is expecting larger earnings loss in the second half of 2019. Langan lowered Telsa’s earnings per share estimates for the rest of 2019 until 2023. UBS cut Tesla’s second-quarter earnings per share estimate to a loss of 78 cents from a loss of 49 cents.

Langan said a key concern for margins is the $2,400 average estimated Autopilot price cut. There will be a profit decline per car and 70% of buyers chose the autopilot option, UBS estimates.

“As we expect margin headwinds & slowing deliveries, we remain bearish,” said Langan.

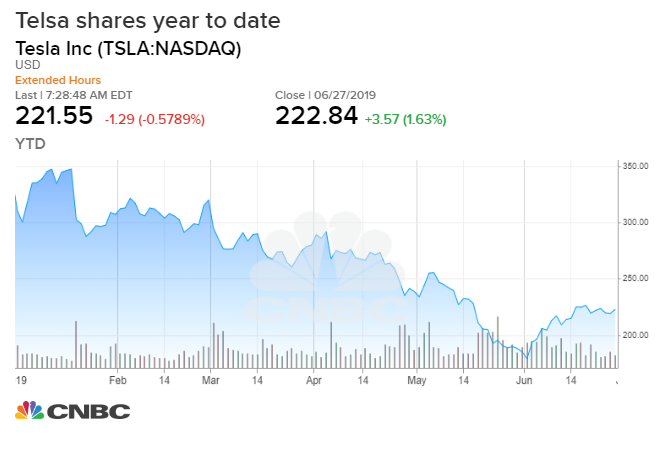

Shares of Tesla have suffered in 2019. The automaker’s stock is down 33% so far this year.

— with reporting from CNBC’s Michael Bloom

EU News Digest Latest News & Updates

EU News Digest Latest News & Updates