Iranian President Hassan Rouhani (L) attends the 21st Nationwide Assembly of the Islamic Revolution Guards Corps (IRGC) Commanders in Tehran, Iran on September 15, 2015.

Anadolu Agency | Anadolu Agency | Getty Images

Oil experts surveyed by CNBC do not expect the U.S. to have any meaningful discussions with Iran until at least six months, and more than half see either no direct military confrontation or just minor skirmishes.

Fifty-nine per cent of the 22 respondents said they expect it could take six months or longer before the U.S. and Iran enter discussions, while 23% see negotiations starting within three to six months. President Donald Trump said earlier this week that the U.S. would be willing to negotiate with Iran, with no preconditions, just days after he called off a retaliatory strike on Iran following the downing of a U.S. military drone.

About 36% of the respondents do not expect a military confrontation between the U.S. and Iran, and 18% expect minor skirmishes on the water, but with no injuries. Another 23% expect limited missile strikes. Just 9% expect extended missile strikes or major conflicts on the water.

The participants, polled between last Friday and Wednesday, mostly see oil prices trading in the current range or higher, at the end of the summer, and 95% expect OPEC and Russia to agree to extend an agreement to cut production by 1.2 million barrels a day when they meet next week.

“U.S. shale remains the overhang. When oil barely budges when tankers are literally exploding in the Persian Gulf, then the market clearly thinks we are amply supplied,” wrote Dan Pickering of Tudor, Pickering, Holt.

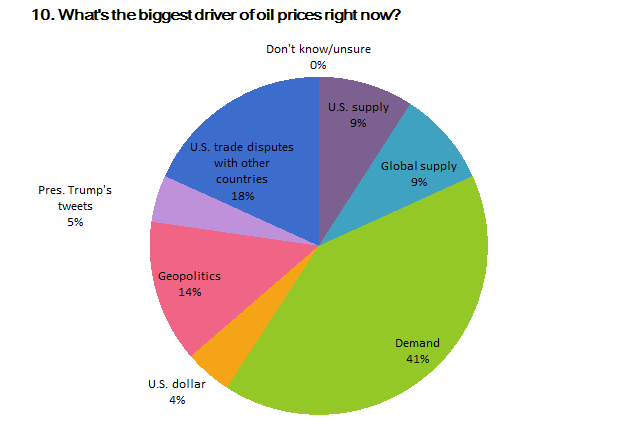

U.S.-Iran tensions are an important factor for the market, but just 14% saw geopolitics as the biggest driver of oil prices. Instead demand issues were the factor for 41%, while 18% cited trade disputes, seen by many in the market as a reason for weak demand.

CNBC Oil Survey

“We believe the weak demand outlook, primarily due to escalating trade tensions, warrants continued production restraint from the Declaration of Cooperation members to keep the oil markets balanced in the second half,” wrote Amarpreet Singh, energy analyst at Barclays.

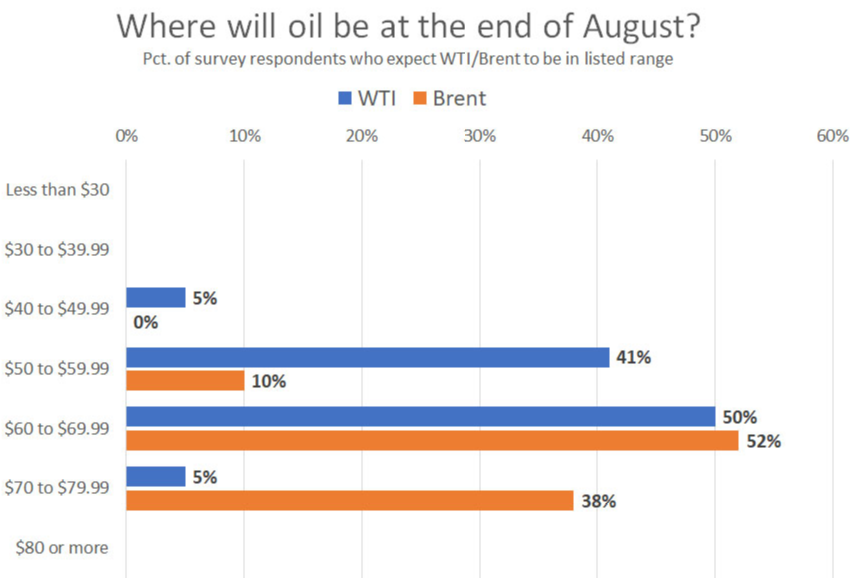

Many participants see oil trading somewhat higher or in a current range by the end of August. They expect to see a bigger rise in U.S. oil prices this summer, with 50 percent expecting West Texas Intermediate to trade at $60 to $70 per barrel at the end of August. That’s above the current price of WTI futures of just under $60. But 41% said WTI could stay in the current $50 to $60 range.

Fifty-two percent expect the international benchmark Brent crude to trade at $60 to $70 per barrel. Brent was in the middle of that range, at $65.43 per barrel, on Thursday. Another 38% see prices rising above $70 but trading below $80 per barrel by the end of August.

CNBC Oil Survey

U.S. oil production is expected to continue to rise, with production averaging 12.5 million barrels a day at the end of the year. About 37% expect the U.S. to be producing 12.3 million to 12.5 million barrels a day by the end of the year. Just one participant said the U.S. would produce less than 12 million barrels, while 13.5% expect the U.S. to produce 13 million barrels a day or more. Last week, the U.S. produced 12.1 million barrels a day, but production has hit 12.3 million barrels a day recently.

Nearly two-thirds expect Russia to comply with the joint production agreement with OPEC, and the same amount expect Russia and OPEC to move toward a more formal agreement. Another 18% believe Russia will end its agreement with OPEC within the year.

OPEC was viewed by 73% of the respondents as “very important” to oil prices, but 59% said OPEC will be less relevant in five years.

About 68% of participants expect fuel prices to rise toward the end of the year as the shipping industry transitions to a new lower-sulfur fuel.

The required transition to lower-sulfur marine fuel for the shipping industry at the start of next year is expected to drive fuel prices higher, according to 68%. About 41% expect the gains in fuel to be between 5% and 10%, but another 18% expected gains between 10% and 15%.

“The narrative in oil has changed. Last fall, all anyone wanted to talk about was the supply-side of the equation, especially as it applied to the looming reinstatement of sanctions on Iran, along with sanctions on Venezuela and civil unrest in Libya,” said Stephen Schork of the Schork Report. “Today it is all about the demand side, such as the deleterious impact on the Chinese and U.S. economies from the extant trade war and the inversion in the U.S. yield curve.”

EU News Digest Latest News & Updates

EU News Digest Latest News & Updates