Luke Sharrett | Bloomberg | Getty Images

A worker loads automotive tires onto a conveyor belt at the Continental Tire Sumter plant distribution warehouse in Sumter, South Carolina.

A fresh profit warning from the world’s second-largest automotive parts supplier is pressuring a number of auto-related stocks across Europe and the U.S.

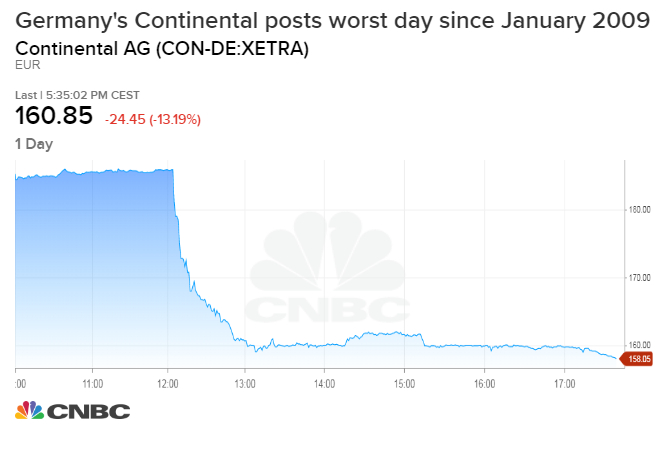

German-based Continental AG cut its 2018 revenue outlook – pointing to weak car sales in Europe and China, higher costs for electric vehicle technologies and warranty claims. That weak guidance sent Continental’s stock plunging by more than 13 percent, ending European trading with its worst day in nearly a decade, dating back to January 2009. Continental shares are now down more than 28 percent since the start of the year.

Continental also cut its profit margin guidance and cited weak demand for tires as another factor pressuring sales expectations for the rest for the year. The company now expects consolidated sales of approximately 46 billion Euros in 2018, 1 billion Euros lower than its previous forecast.

Continental’s profit warning is its second this year and comes one month after the company revealed a broad restructuring that includes potentially a partial listing of its powertrain business as early as next year. While Continental is among the world’s largest tire manufacturers, the company also develops specialized brake and safety systems, as well as new technologies including automated driving tools.

Continental is the first in a series of European auto companies to issue profit warnings this year. Fiat Chrylser, Volkswagen and Daimler – the maker of Mercedes-Benz – have all cut profit expectations in recent months, blaming both the prospect of new tariffs and new emission tests for weakening demand.

Shares of other European auto parts suppliers – including France’s Valeo, Michelin and Faurecia – all fell 4 percent or more Wednesday. Another German-based auto industry group, Schaeffler AG, fell 5.7 percent. The Stoxx 600 Autos and Parts Index dropped 2.8 percent, the group’s worst one-day drop in a month.

EU News Digest Latest News & Updates

EU News Digest Latest News & Updates