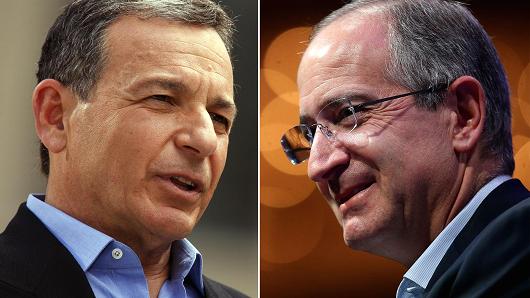

Getty Images

Robert Iger, chairman and chief executive officer of Walt Disney Co. and Brian Roberts, Comcast chairman and CEO.

The irony of the Comcast-Disney battle to buy the majority of 21st Century Fox is that CEOs Brian Roberts and Bob Iger could both walk away happy. All they’d have to do is split up Fox. And yet, it doesn’t look like that’s going to happen.

Disney wants Fox’s movie studio and owned content properties to boost a digital streaming service that Iger plans to launch in 2019.

“The aim of this combined company is to create even more high-quality content and then to distribute it in ways that consumers prefer and consumers demand in today’s world,” Iger told CNBC in December.

Comcast, on the other hand, is most interested in acquiring Fox’s international assets — European telecommunications company Sky and Indian media conglomerate Star India. Here’s what Roberts said on a call with Comcast investors on June 13:

“We firmly believe that that the truly great media companies of the next century will be large, integrated entities with multiple growth engines across a wide swath of the global entertainment industry. And we believe our proposed acquisition of Fox would not only enhance our domestic positions in distribution and content, but would take us to global reach and additional growth in these businesses.”

It doesn’t take a fission scientist to come up with a solution — Comcast takes the international assets and Disney takes the domestic ones. And if both Comcast and Disney want Hulu, they can halve Fox’s 30 percent ownership.

But it may be too late. There are no talks between the two companies about splitting Fox, according to people familiar with the matter.

That’s because Disney had no need to invite Comcast to split the assets when it reached a deal with Fox last year. But Judge Richard Leon’s ruling on Wednesday that AT&T could buy Time Warner without conditions changed the calculus.

Now Comcast has overbid Disney by $13 billion for the same Fox assets. If Iger wants to avoid a bidding war and split the assets now, Fox would need to release him from the companies’ signed deal agreement. That’s unlikely to happen, because it could prevent Fox from getting the highest price for the assets it wants to sale — a bidding war is just fine for Fox shareholders.

EU News Digest Latest News & Updates

EU News Digest Latest News & Updates