U.S. companies on balance already are paying well below the 20 percent tax level targeted in the Republican reform plan, according to an analysis by Yardeni Research.

In fact, the typical effective tax rate — the amount paid minus deductions — could be as low as 13 percent over the past years, Yardeni concluded when looking at a cleaner number of how much the government is really collecting.

That’s well below other estimates that sought to clarify the impact of the tax reform proposal that would take the current nominal rate from 35 percent to 20 percent. Multiple firms have concluded the benefits will tilt to specific sectors and provide a limited aggregate windfall.

The Institution on Taxation and Economic Policy, for instance, looked at 258 Fortune 500 companies that were “consistently profitable” from 2008 to 2015 and found they paid an effective rate of 21.2 percent.

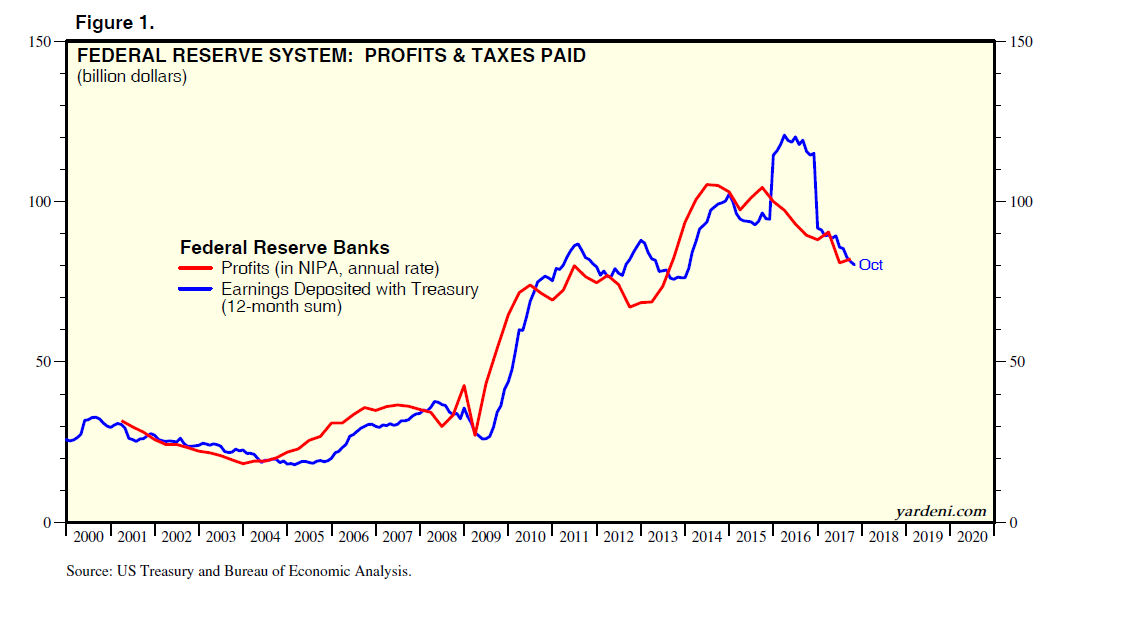

But Yardeni found those estimates may be overstating what the government is actually getting from corporations. For instance, the Bureau of Economic Analysis, which compiles quarterly GDP reports, includes taxes collected from state and federal governments as well as the hundreds of billions the Fed remits to the Treasury each quarter from its $4.5 trillion bond portfolio.

The Fed’s profits from the bonds it bought during three rounds of quantitative easing swelled from $27 billion at the beginning of 2009 to a record $105 billion in the second quarter of 2014.

The bureau uses something called the National Income and Product Accounts that Yardeni said could be distorting the corporate tax picture by including the state and local as well as the Fed receipts.

“The obvious conclusion is that measuring the average effective federal corporate tax rate using the NIPA data will overstate it by the amount of ‘taxes’ collected from the Fed and by the amount of taxes paid to taxing authorities other than the IRS,” Ed Yardeni, founder of Yardeni Research, said in a note.

Still, even using the NIPA-based data yields an effective rate below 25 percent since 2008, and 20.7 percent over the past four quarters. Excluding the Fed’s contribution to that data set takes the effective rate all the way down to 13 percent, Yardeni said.

Yardeni concedes that there could be some holes in his method, such as the small business contribution, but he sees on whole the numbers are right.

EU News Digest Latest News & Updates

EU News Digest Latest News & Updates