The first quarter had more billion-dollar IPOs than were issued in all of last year and was the best quarter in three years, with 43 IPOs raising $15.6 billion, according to Renaissance Capital.

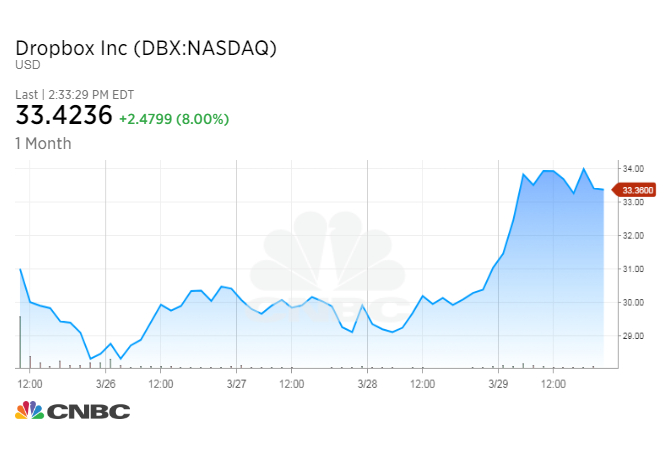

The second quarter also looks to be strong, as big private tech companies finally make their debuts. Dropbox, which raised $750 million in a March 22 offering, was the largest tech IPO since Snap in the first quarter of 2017.

“If this trend continues, it should lead to another multi-year high in the second quarter,” Renaissance wrote. The 43 deals were the most since 64 companies went public in the first quarter of 2014 and are above trend for the past decade.

Next up is Spotify’s direct listing on the NYSE, scheduled for early April. Though not a traditional IPO, the move is being closely watched on Wall Street, where only a handful of such deals have been done.

By proceeds, the first quarter was also the best first quarter since 2008, with a number of big deals driving the flow, such as the $1.5 billion ADT offering and the $750 million Hudson deal.

But Renaissance says the important development for the market was the growing presence of Chinese IPOs, making up 21 percent of the proceeds. Eight Chinese companies raised $3.3 billion in the first quarter.

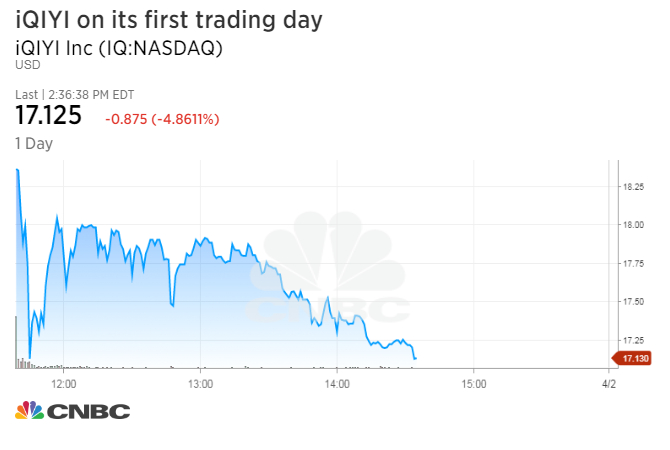

iQIYI, described as a Chinese Netflix, was the largest, going public in a $2.3 billion offering Thursday. Its stock debuted on Nasdaq and was trading about 4.4 percent below the $18 offering price in afternoon trading. Another online video company, Bilibili, debuted Tuesday, raising $483 million, and it also traded lower on its first day.

iQIYI was also one of four deals that raised over $1 billion in the quarter.

The tech sector was responsible for twice as much of the proceeds of any other sector. Renaissance said the number of tech deals doubled from the first quarter of 2017, and its strength is a positive since that sector typically sees more deal activity later in the year, Renaissance said.

The average gain was 9 percent for the first-quarter IPOs, even with the market sell-off. The top 10 deals averaged a 42 percent first-day gain and a 15 percent gain from their debut.

Zscaler, a cloud security company, priced 45 percent above its range and jumped 106 percent on its first day, the best first-day return for an IPO over $50 million since 2016.

Dropbox perhaps received the most buzz, trading 36 percent above its $21 offer price on its first day. Brazilian payment services firm PagSeguro Digital was the largest, raising $2.3 billion. Its stock also jumped 36 percent above its offer price when it went public Jan. 23.

:

EU News Digest Latest News & Updates

EU News Digest Latest News & Updates