One of the economy’s strongest segments may be showing signs of cracking: job growth.

Economic forecaster Lakshman Achuthan warns that slowing gains in jobs is spelling trouble for consumer spending.

“This is really going to undermine, we believe, consumer confidence,” the Economic Cycle Research Institute co-founder told CNBC’s “Trading Nation” on Wednesday.

As worries about global growth and the U.S.-China trade war weigh on the economy, Wall Street has been depending on strong consumer spending to maintain growth. The consumer, which makes up more than two-thirds of the U.S. economy, has been a bright spot amid uncertainty.

“I would be cautious here on this story that the consumer is going to save the day,” said Achuthan.

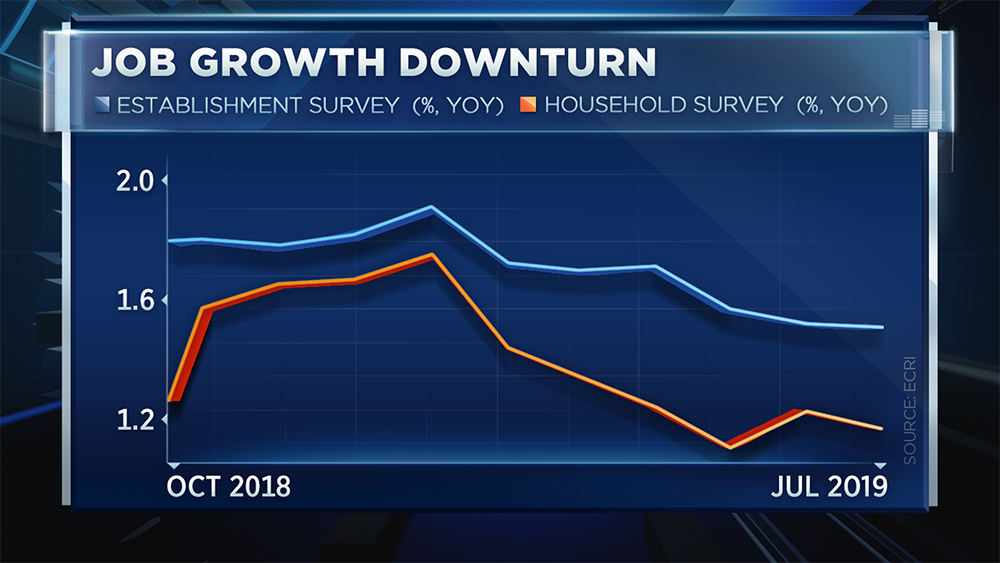

He builds his case in a chart showing a job growth downturn reflected in the U.S. Bureau of Labor Statistics’ enterprise and household surveys.

“We’re in a clear downturn,” he said. “There’s really no debating that, and it looks set to continue.”

Achuthan will get some answers Friday when the government releases its August employment report. FactSet data show the Street expects nonfarm payrolls to grow by 150,000. It would be a decline of about 14,000 new jobs from July. The unemployment rate is expected to hold steady at 3.7%, its lowest level since 1969.

“All of those numbers are in that chart, and they are still decelerating,” he said. “Anybody could eyeball that chart and see the decline, and it’s there.”

For almost two years, Achuthan has been warning investors of a “stealth” global slowdown. He updated his warning to include the United States early last year before the trade war heated up.

“It has everything to do with the cycle,” he said.

Despite Achuthan’s concerns, he doesn’t see a recession unfolding yet.

“We are slow walking toward some recessionary window of vulnerability. We are not there today,” Achuthan said. “But this piece of the puzzle is looking a bit wobbly. I think that is the main message that Wall Street is missing every time the jobs report beats some consensus estimate.”

Disclaimer

EU News Digest Latest News & Updates

EU News Digest Latest News & Updates