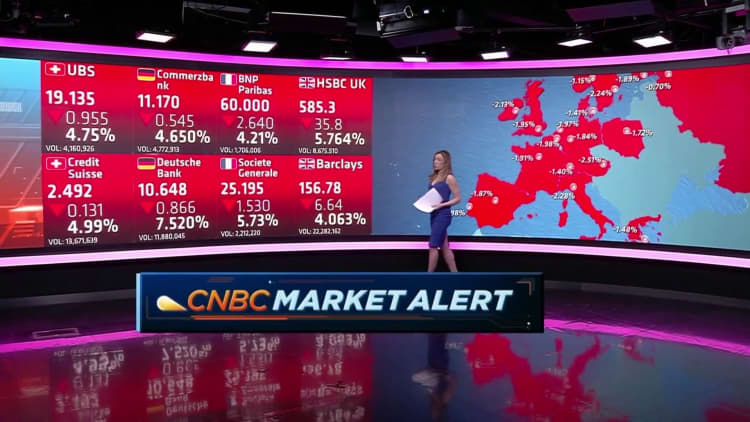

European banking stocks sold off sharply in early trade Friday as jitters surrounding U.S. bank SVB Financial — which plunged 60% Thursday — spread around the world.

It followed an announcement by the tech-focused lender of a capital raise to help offset bond sale losses.

The Euro Stoxx Banks index was on pace for its worst day since June, led by a decline of more-than 8% for Deutsche Bank. Societe Generale, HSBC, ING Groep and Commerzbank all fell more than 5%.

Silicon Valley Bank caters heavily to startup firms, particularly venture-backed tech and life sciences companies in the U.S. The 40-year-old company was forced into a fire sale of its securities on Thursday, dumping $21 billion worth of holdings at a $1.8 billion loss while raising $500 million from venture firm General Atlantic, according to a financial update late Wednesday.

The company said in a letter from CEO Greg Becker on Wednesday that it had sold “substantially all” of its available-for-sale securities and was aiming to raise $2.25 billion through common equity and convertible preferred shares.

The U.S. Federal Reserve has hiked interest rates aggressively over the past year, which can cause long-dated bond values to fall, and SVB plans to reinvest proceeds from its sales into shorter-term assets.

Billionaire investor and Pershing Square CEO Bill Ackman said in a tweet on early Friday that should SVB fail, it could “destroy an important long-term driver of the economy as VC-backed companies rely on SVB for loans and holding their operating cash.”

“If private capital can’t provide a solution, a highly dilutive gov’t preferred bailout should be considered.”

This is a breaking news story and will be updated shortly.

EU News Digest Latest News & Updates

EU News Digest Latest News & Updates