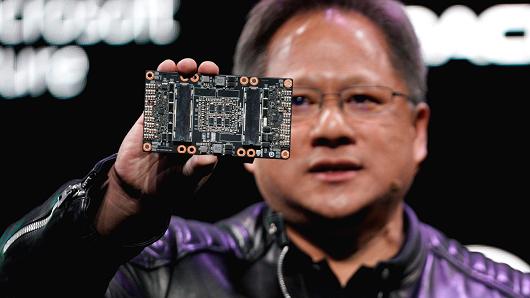

Rick Wilking | Reuters

Jensen Huang, CEO of Nvidia, shows the NVIDIA Volta GPU computing platform at his keynote address at CES in Las Vegas, January 7, 2018.

The volatility inherent in the cryptocurrency mining business is making a top Wall Street firm slightly less bullish on Nvidia.

Goldman Sachs reiterated its buy rating for Nvidia shares, but removed the chipmaker from its “conviction list,” citing concerns over its digital currency business.

“While we continue to see meaningful upside to FY2019/2020 estimates and maintain our Buy rating, we believe a) the long-term secular growth angle in Datacenter is now better-understood, and near-term dynamics in Cryptocurrency demand may lead to increased earnings volatility,” analyst Toshiya Hari wrote in a note to clients Wednesday.

Nvidia shares are down 2 percent on Thursday.

Hari raised his 12-month price target to $281 from $228 for Nvidia shares, representing 14 percent upside to Wednesday’s close.

The analyst noted graphics chip competitor AMD said 5 percent to 6 percent of its 2017 sales or $300 million came from cryptocurrency miners. The price of ethereum, a popular digital currency mined by using AMD and Nvidia cards, more than doubled during the last two months last year. It is now up over 10,000 percent over the past 12 months, according to data from industry website Coinbase.

“While the increase in GPU demand from Ether miners is boosting fundamentals in the near-term, increased exposure to the Crypto market will, in our view, increase uncertainty and volatility, which are typically dilutive to valuation multiples,” he wrote.

Nvidia is up 116 percent over the last 12 months, the best return of any chip stock in the S&P 500 and the fourth-best change of any stock in the benchmark.

— CNBC’s Michael Bloom contributed to this story.

EU News Digest Latest News & Updates

EU News Digest Latest News & Updates