Oil storage tanks stand at the RN-Tuapsinsky refinery, operated by Rosneft Oil Co., at night in Tuapse, Russia.

Andrey Rudakov | Bloomberg | Getty Images

Goldman Sachs expects record demand in oil markets to drive crude prices higher in the near term.

“We expect pretty sizable deficits in the second half with deficits of almost 2 million barrels per day in the third quarter as demand reaches an all-time high,” Goldman’s head of oil research Daan Struyven told CNBC’s “Squawk Box Asia” on Monday.

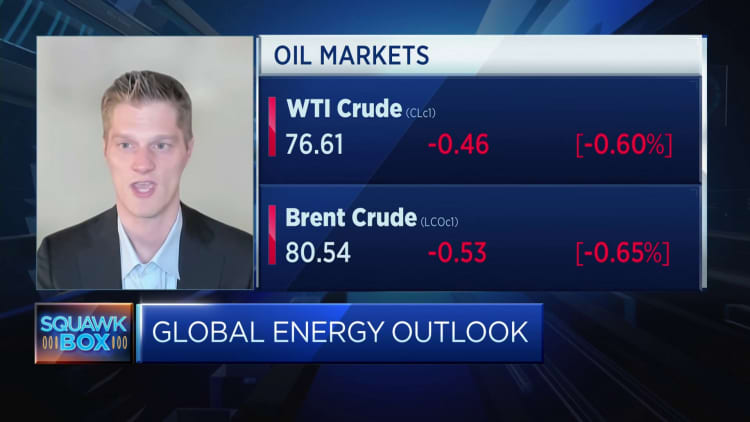

He added that the bank forecasts Brent crude to rise from just above $80 per barrel now to $86 per barrel by year-end.

Global benchmark Brent futures traded 0.39% lower at $80.75 a barrel, while U.S. West Texas Intermediate futures stood 0.42% at $76.75 per barrel.

‘Elevated demand uncertainty’

While Struyven acknowledged that U.S. crude oil production has risen significantly over the past year to 12.7 million barrels per day, he said that pace of growth will slow throughout the rest of 2023.

“We expect U.S. crude supply growth to slow down pretty significantly to a sequential pace of just 200 barrels per day from here,” he said, pointing to the decline in rig counts. That metric, which tallies the number of active oil rigs, is used as an indicator of drilling activity and future output.

The U.S. oil rig count recently hit its lowest level in 16 months, down 15% from its late 2022 peak, a recent Goldman report observed, citing data from Baker Hughes and Haver.

Last week, Baker Hughes reported U.S. oil rigs fell by 7 to 530 the lowest since March 2022.

Struyven suggested that the lack of an agreement following the G20 energy ministers’ meeting indicates “very substantial” uncertainty about long-run oil demand.

The Group of 20 energy ministers met in India over the weekend, but left without reaching a consensus on the phasing down of fossil fuels, complicating the transition toward clean energy.

“Key point here for investors is, with the uncertainty about oil demand being so elevated, investors may require a premium to compensate for the for the elevated risk from such elevated demand uncertainty,” Struyven said.

The International Energy Agency in June had predicted that global oil demand is on track to rise by 2.4 million barrels per day in 2023, outpacing the previous year’s 2.3 million barrel per day increase.

Over the weekend, secretary general of the International Energy Forum Joseph McMonigle had forecast that both India and China will make up 2 million barrels a day of demand pick-up in the second half of 2023.

EU News Digest Latest News & Updates

EU News Digest Latest News & Updates