Is it time to put your cash into some catch-up trades?

The major averages are notching record high after record high as the end of 2019 approaches despite lingering trade uncertainty and jitters around slowing economic growth.

But a handful of stocks have fallen behind Wall Street’s expectations, and some may offer investors a way into a market that’s having a banner year — the S&P 500’s best since 2013.

Among them are General Motors, Under Armour, Ulta, Halliburton and PayPal, all of which are trading well below their average analyst price targets.

As of Tuesday’s close, General Motors was 24% off its average analyst price target of $47.35, Halliburton was 20% off its $25.98 target, Ulta was 17% under analysts’ $283.10 goal price, Under Armour was 14% below Wall Street’s $20.88 target and PayPal was 16% below its $125.87 target.

Out of those, Miller Tabak’s Matt Maley found Halliburton and PayPal to be the most promising plays, offering a technically framed bull case.

“The oil sector … has badly underperformed. But now it’s gotten to the point where it’s very oversold, it’s very over-hated and it’s very underowned,” Maley, his firm’s chief market strategist, said Tuesday on CNBC’s “Trading Nation.”

“The thing with Halliburton … [is] it is starting to see some daylight here, at least on a technical basis,” Maley said, pointing to a chart of the stock going back to early 2018.

“First of all, it’s broken above its trend line going back to the middle of 2018, and it’s also made a higher low. If you can follow that up with a higher high that would be above [$]22.50 … that would be quite bullish for this stock, and if it can move above its most recent highs of 23.80, that’s going to confirm that at least its short-term trend has changed and give it some upside movement,” Maley said.

Halliburton shares closed down more than 2% on Tuesday at $20.83. The stock has fallen nearly 22% for the year.

Maley’s other pick, PayPal, hasn’t had quite as rough of a ride in 2019, with a more than 26% gain. But shares of the financial technology giant have fallen nearly 12.5% since its second-quarter earnings report at the end of July despite a third-quarter beat in late October.

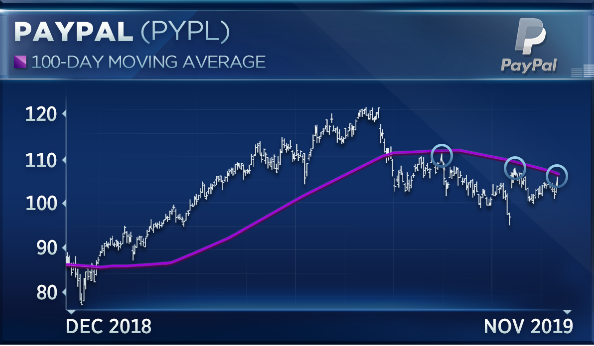

“This stock is one that’s been sliding lower for the last three or four months, but it’s now trying to bounce back and it’s bumping up against its 100-day moving average,” Maley said, referring to PayPal’s chart.

“That moving average has provided some tough resistance for this stock on several occasions this year, so if it can finally break above that, it’s probably going to give some of the momentum players some impetus to buy the stock,” Maley said. “Not only is that 100-day moving average a key level, [but] it’s also the neckline of an inverse head-and-shoulders pattern. So, if it can break above that line, it’s going to be very, very good, especially if it can take out its September highs of 110. That’ll confirm that its intermediate-term trend has changed and that it’s going higher.”

PayPal shares closed nearly 2% higher on Tuesday at $106.20, just 44 cents below their 100-day moving average at $106.64.

Quint Tatro, chief investment officer at Joule Financial, only had eyes for PayPal.

“We’re coming into the end of the year, where we’ve got thinly traded environments,” Tatro said in the same “Trading Nation” interview. “You’ve got managers that are going to be looking for those high-beta names. If you can couple that with a fundamental case, you’ve got, really, the mix for some great opportunities. The only one on the list where I find that is within PayPal.”

High-beta investments are those that tend to make outsized moves relative to the broader market. They tend to carry a higher degree of risk, but also greater momentum, than their more stable peers.

“Here’s a stock that … has an opportunity to gather some significant beta to try and get that performance edge that managers are looking for, but it’s also a stock that, from a [price-to-earnings-growth] ratio standpoint, [is] trading at 30 times forward earnings, which at first glance you’re like, ‘Wow, that’s very expensive,'” Tatro said of PayPal.

But given PayPal’s track record, Tatro wasn’t worried it could make good on those estimates.

“Fortunately, those earnings are growing at 65%. So, you have a fundamental case for growth for that stock,” he said.

Disclaimer

EU News Digest Latest News & Updates

EU News Digest Latest News & Updates