The Treasury market was buzzing with tax talk this week, and yields quickly moved higher.

But all the chatter about a bigger deficit, more government debt issuance and fears of faster Fed interest rate hikes could take a rest next week—and bond prices could move higher.

The 10-year yield was at about 2.38 percent on Monday, shooting to 2.50 by Wednesday, but it has been stalling out at that psychological level and backing down. The 10-year was yielding 2.48 percent Thursday afternoon.

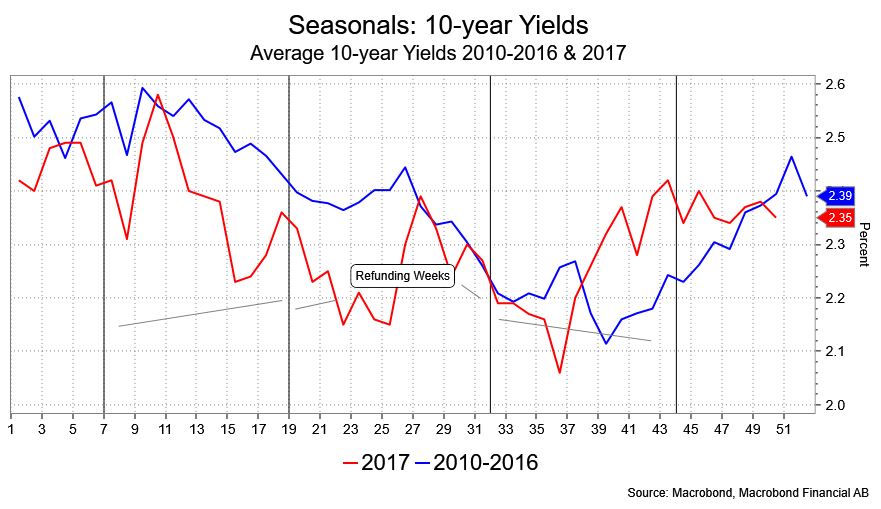

“I don’t think this is going to prove thematic. Meaning I don’t think this is the start of the big upward move in interest rates,” said David Ader, chief macro strategist at Informa Financial Intelligence. Ader said rates very well could calm down and move lower in the final week of the year, and he points to recent history, post-financial crisis as a guide.

Ader said in recent years, the final week of the year has broken from a broader year end trend which has been negative for bonds, meaning yields rise. “It’s illiquidity and all that. It does just seem the final week of the year is a countertrend trade to the bearishness at year end,” he said.

The 10-year yield’s behavior may already be signaling that, as it hovers under 2.50.

“I do think yields are going to be higher next year. but I don’t’ think we’re going to see 3 percent. 2.75 to 2.90 probably,” said Ader.

Chris Rupkey, chief financial economist at MUFG Union Bank, said the move higher could end at about this level for now. “Deficit spending, greater supply was part of it. But I think the market is very thin here and I look at it as a good old fashioned breakout, within a narrow range we’ve seen. You could sense people are pushing it around and gained control,” he said.

Strategists said some asset allocations trades could draw buyers into bonds next week, as some investors take profits in stocks.

The 10-year yield started 2017 at about 2.45 percent, and has moved in just a 0.59 percentage point range since then. That is the smallest range since the 10-year moved just a half percent in 1965.

Source: Informa Financial Intelligence

EU News Digest Latest News & Updates

EU News Digest Latest News & Updates