Despite headlines of record low unemployment and a booming economy, just 43% of Americans are certain they could come up with $2,000 for an unexpected expense.

That finding comes from new research by the FINRA Investor Education Foundation, which has been documenting Americans’ financial knowledge and perceptions for years.

More people are prepared for an emergency today than they were in 2012, when just 35% of people were certain they could cover a $2,000 bill, according to the foundation.

More from Personal Finance:

Holiday debt could take years to pay off: report

3 steps to keeping your resolutions to spend less, save more

7 shopping hacks to keep your spending under contro

Still, nearly half of Americans don’t have an emergency fund.

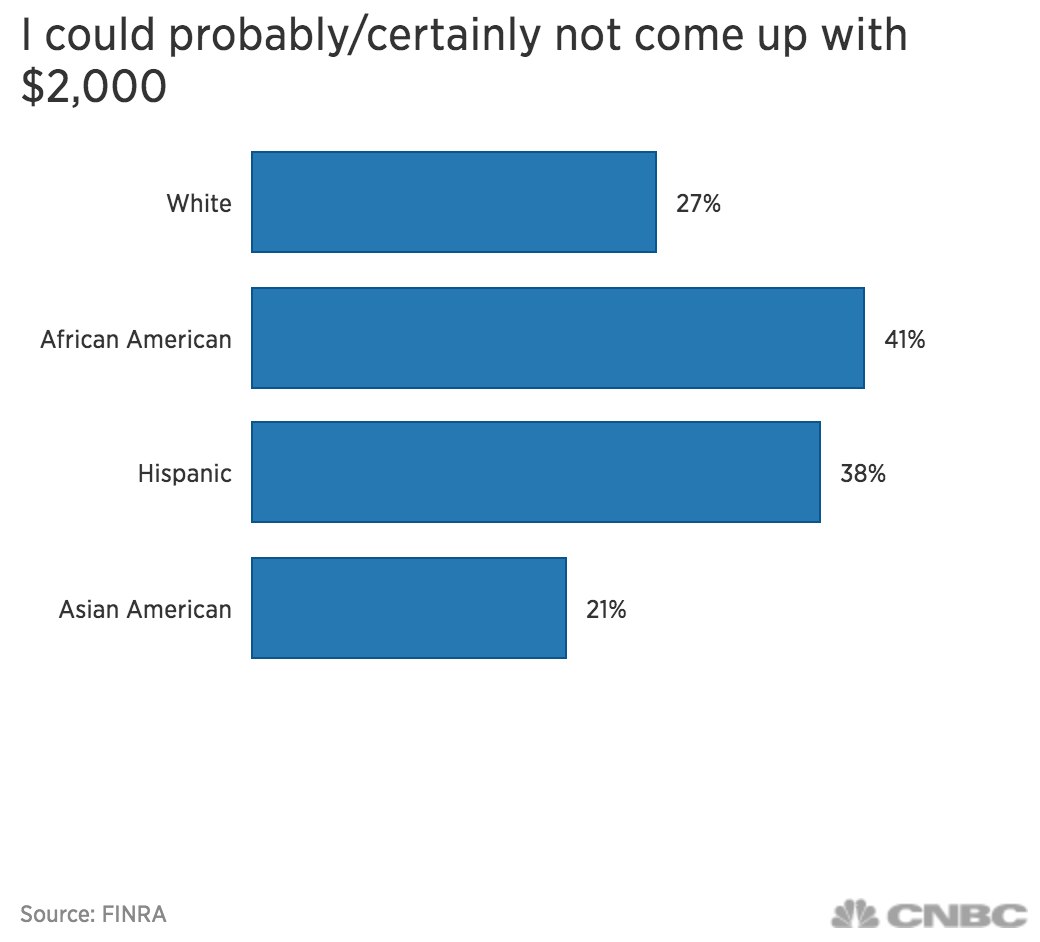

“While we’ve seen improvements in key measures of financial capability over the years, the 2018 findings suggest we have hit a plateau — and that not all Americans have recovered at the same rate,” said Gerri Walsh, president of the FINRA Foundation, which surveyed some 30,000 people.

How to grow an emergency savings account

Automate your savings, so that a set amount of money is routed directly into your savings account each week or month, said Erin Lowry, author of “Broke Millennial: Stop Scraping by and Get Your Financial Life Together.”

Try naming your bank account “Emergency Savings,” so you’re reminded why that money is there and why you should keep contributing to it, she said.

“Many banks will allow you to change the name of your savings account from a generic ‘Bank Account 39341029’ to something with actual meaning,” Lowry said.

You might also want to open your emergency savings account at a different bank than the one you normally use, she added.

“This reduces the likelihood that you’ll be tempted to move money, even just a little bit, to your checking account for today’s wants,” she said. Plus, it typically takes a few days for money to move between banks, and so you won’t be able to use the funds for an impulsive purchase.

Consider putting your savings in an online bank, which typically offer higher interest rates than brick-and-mortar ones.

Don’t be overwhelmed by the fact that you might not be able to save a lot, said Annamaria Lusardi, academic director of the Global Financial Literacy Excellence Center and a member of the CNBC Financial Wellness Council.

“One could put away a few dollars a day, or $10 a week, or an amount within reach,” she said. “That, done regularly, will bring in a small buffer that can prove very useful when things go sour.”l

EU News Digest Latest News & Updates

EU News Digest Latest News & Updates