Inflation has been scaring the markets, and investors have been bracing for a CPI report Wednesday that could send interest rates flying and stocks diving.

But some market pros say there may be just too much hype about this number, even though some concede the audience for this particular January consumer inflation report is probably the most attentive since the Fed was last in a rate-hiking cycle more than a decade ago.

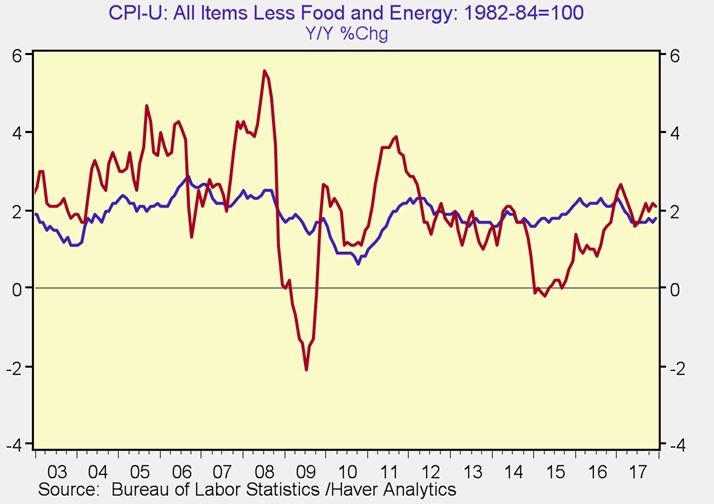

Economists are expecting January core inflation, excluding food and energy, at 0.2 percent or 1.7 percent year over year, a slower pace than December.

Stock investors fear a hotter inflation number could send bond yields higher and ultimately prompt the Fed to raise interest rates faster than the three hikes it currently forecasts for this year.

Stocks went into a tailspin after January’s employment report contained a hotter-than-expected gain in wages, prompting a sharp jump in interest rates. But inflation expectations had already been rising, even though the Fed’s preferred inflation measure, PCE deflator, has been relatively tame at about 1.5 percent, below the Fed’s 2 percent target.

“These things are hard to predict. Most economists have 0.2 percent on core. No one’s sticking their neck out among the forecasters. There’s no real outlier that suggests we’re going to see a break one way or the other,” said George Goncalves, head of fixed-income strategy at Nomura.

Stephen Stanley, chief economist at Amherst Pierpont, said the release is being overhyped. He said inflation should rise this year and it would be a key development for the economy and the Fed. “But surprises on inflation tend to be measured in basis points most of the time, and the inflation story is probably going to play out quite slowly,” he wrote.

Stanley expects inflation to firm, with a higher-than-consensus forecast for headline CPI at 0.4 percent. “I suspect that market participants have worked themselves into such a frenzy on inflation prospects that tomorrow’s release could yield a bit of a relief trade in the bond market.”

CPI headline inflation was below economists’ expectations in eight of the last 10 reports. Economists expect headline inflation to come in at 0.3 percent, or 1.9 percent year over year, down from December’s 2.1 percent pace.

Ian Lyngen, head of rate strategy at BMO, said if the number is hotter than expected, the yield curve could flatten, with the short end rates moving closer to long end rates. That would signal the market expects more Fed rate increases.

If the yield on the 10-year begins to rise, that could pressure stocks.

“I think it’s going to be very exciting for both the Treasury and equity market. This is the first time I’ve heard people in the equity market truly focused on the CPI as it pertains to the next move in stocks,” he said.

Goncalves said he doesn’t expect much in the way of surprises, and the bond market was relatively calm Tuesday, ahead of Wednesday’s 8:30 a.m. ET report. There are also retail sales for January at 8:30 a.m., another usually important number.

“People have been concerned post-wage number. If it doesn’t build the narrative that more inflation is here, and we have evidence, then we’re going to forget about inflation for a little bit,” he said.

For the market to react strongly, he said, the number would have to be a major surprise and show areas where prices could rise persistently, not just one-off instances.

Joseph Song, U.S. economist at Bank of America Merrill Lynch, who had been correct in saying there could be an upside surprise in the January wage number, said, “We’re looking for a gradual pickup in inflation this year. There’s a bit of exuberance in the market after we got that big wage number. That clearly excited markets, but we don’t think that will pass through that quickly into service inflation any time soon.”

Song said he expects core CPI to rise 0.2 percent, or 1.7 percent year over year. He said the comparisons are down year over year because of strength in last year’s numbers.

EU News Digest Latest News & Updates

EU News Digest Latest News & Updates