The oil market’s rally toward 2018 highs broke down on Wednesday as U.S. crude stockpiles jumped, geopolitical tensions faded into the background and a firmer dollar put pressure on the commodity.

Futures extended early losses after the U.S. Energy Information Administration reported the nation’s stockpile of crude oil jumped by 1.6 million barrels in the week through March 23. Stocks also jumped by 1.8 million barrels at the closely watched delivery hub for U.S. crude located in Cushing, Oklahoma.

Inventories at Cushing “might be rebuilding rather rapidly, so that would be a big negative,” said John Kilduff, founding partner at energy hedge fund Again Capital.

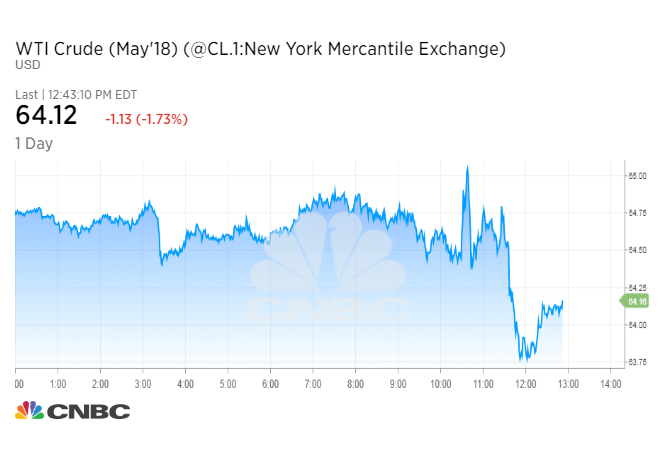

U.S. West Texas Intermediate crude futures sank more than 2 percent at the bottom of the session, drifting further from Monday’s peak, which nearly established a new three-year high. Prices were last down $1.17, or 1.8 percent, at $64.08.

International benchmark Brent crude also extended losses, with the most heavily traded contract for June delivery also dropping by about 2 percent, before recovering slightly to trade down $1.11, or 1.6 percent, at $68.35. The May Brent contract, which expires on Thursday, was down 97 cents, or 1.4 percent, at $68.14 .

The weekly EIA report was not all bad, according to Kilduff, who noted higher-than-usual activity at the nation’s refineries and strong gasoline consumption, both of which boost demand for feedstock crude oil.

But the geopolitical tension and threats of supply disruptions in the Middle East that boosted oil prices somewhat receded as the week wore on.

Those tensions included the launch of rockets from Yemen into neighboring Saudi Arabia, the world’s largest oil exporter, and saber-rattling from Saudi Crown Prince Mohammed bin Salman in the kingdom’s long-simmering feud with regional rival Iran ahead of his U.S. visit.

“I think some of it is just the easing of geopolitical worries. That rocket fire from Yemen on Sunday night sent a shudder through the market,” Kilduff said.

“With MBS here running around trying to cut deals, it looks like they’re not going to be focused on it right now,” he added, using a nickname for the Saudi crown prince.

EU News Digest Latest News & Updates

EU News Digest Latest News & Updates