Oil prices could tumble as much as $8 a barrel in the coming weeks as one of the three legs propping up an unexpected rally looks “wobbly,” Societe Generale’s Mark Keenan warned on Friday.

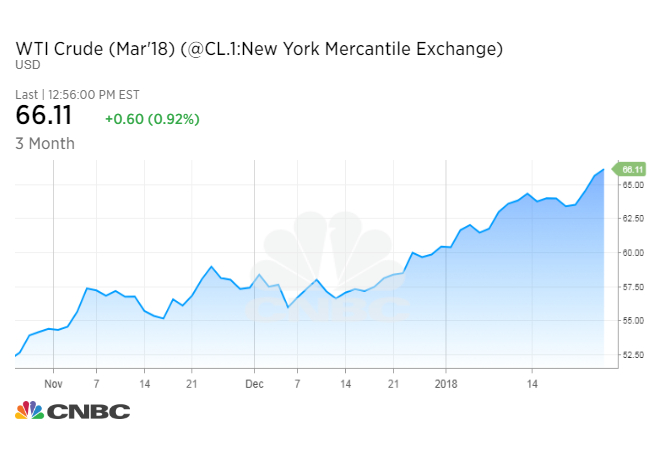

The rally in oil prices has exceeded many analysts’ expectations, leading to a flurry of revised forecasts as benchmark crude futures surged by about $10 a barrel in the last six weeks to their highest levels since early December 2014.

Brent crude oil touched a three-year high of $71.28 on Thursday, while U.S. crude topped out at $66.66 during the same trading session.

“We think of the oil market right now as a three-legged stool and all three of these legs have provided a degree of uplift to prices,” said Keenan, global commodities strategist and head of research for Asia-Pacific at Societe Génerale.

The first leg, the fundamentals of supply and demand, remains positive, he told CNBC Asia’s “Capital Connection.” OPEC, Russia and other oil-producing nations continue to limit their output in order to shrink global crude stockpiles, while the simultaneous growth in economies around the world is boosting demand for energy.

The second, geopolitical landscape, has also been supportive. Tensions in the Middle East; crisis-stricken Venezuela’s steadily falling output; and President Donald Trump’s threats to restore sanctions against Iran, OPEC’s third largest producer, are some of the risks to the oil market.

But the third leg, investor positioning, is the one that looks wobbly to Keenan. Traders have built up “massive” long positions, or bets that oil prices will keep rising, while short positions — wagers that futures will fall — are “nonexistent.”

EU News Digest Latest News & Updates

EU News Digest Latest News & Updates