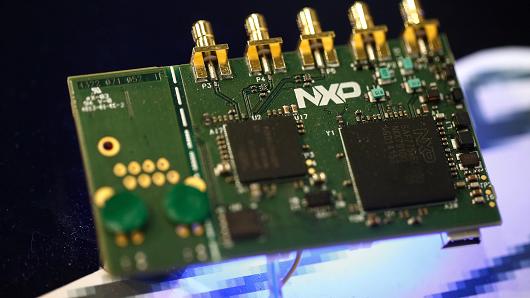

Simon Dawson | Bloomberg | Getty Images

Microprocessors sit on a circuit board displayed on the NXP Semiconductors NV pavilion at the Mobile World Congress in Barcelona, Spain, on Monday, March 2, 2015.

U.S. chipmaker Qualcomm raised its offer to buy NXP Semiconductors to $127.50 per share from $110, after being pressured by shareholders led by activist hedge fund Elliott Management Corp.

Qualcomm said it need to buy a minimum 70 percent of NXP’s outstanding shares in a tender offer, instead of the 80 percent it required under the earlier terms. The latest offer values NXP at $44 billion.

NXP’s shares were up 6.5 percent at $126.15 in premarket trading. The stock has traded above the original offer price for nearly seven months as investors expected a revised offer.

The buyout of NXP will help Qualcomm, which provides chips to Android smartphone makers and Apple, to expand in the fast-growing market for chips used in automobiles and reduce its dependence on a cooling smartphone market.

San Diego-based Qualcomm agreed to buy Netherlands-based NXP for about $38 billion more than a year ago, but some NXP shareholders resisted a sale seeking a better price.

Elliott said in January that NXP was worth much more than its previous assessment of $135 per share.

Broadcom, which is seeking to buy Qualcomm for $121 billion, has said its offer was contingent on either Qualcomm buying NXP at $110 per share or the deal being terminated.

Qualcomm had resisted increasing the offer price and last month boosted its buyback plan as an alternative to buying NXP.

“Our preference is to close NXP, but not at all costs,” Qualcomm Chief Financial Officer George Davis said on a post-earnings conference call in January.

Qualcomm, Broadcom, and NXP were not immediately available for comment.

Shares of Qualcomm and Broadcom were trading marginally below their Friday close.

EU News Digest Latest News & Updates

EU News Digest Latest News & Updates