An Aramco employee walks near an oil tank at Saudi Aramco’s Ras Tanura oil refinery and oil terminal in Saudi Arabia.

Ahmed Jadallah | Reuters

Saudi Arabia’s oil exports are down by about as much as an average 1.5 million barrels a day since its state run oil company was attacked Sept. 14, researchers who track shipping said.

That could speed up a tightening of global oil supplies, even though the U.S., Brazil and other countries are expected to continue to add oil to the global market.

Saudi Aramco’s trading arm has been buying crude from neighboring countries, including Kuwait and United Arab Emirates, among others, to fulfill its commitments, according to Reuters. S&P Global Platts reports that the kingdom is buying diesel fuel from India and the UAE, and is also looking for jet fuel and naphtha.

The attack, believed to be the work of Iran, knocked out about 5.7 million barrels a day of Saudi production. Saudi Aramco is working to bring back the operations which Saudi officials say they hope to have completely restored by the end of the month.

“The jury is out as to whether or not they are going to get back to full strength as quickly as they claim. If they are able to, we won’t have a problem. If they aren’t, the problems start now,” said John Kilduff of Again Capital. “If they can’t get back to normal rapidly, we’ll approach shortages particularly in refined products.”

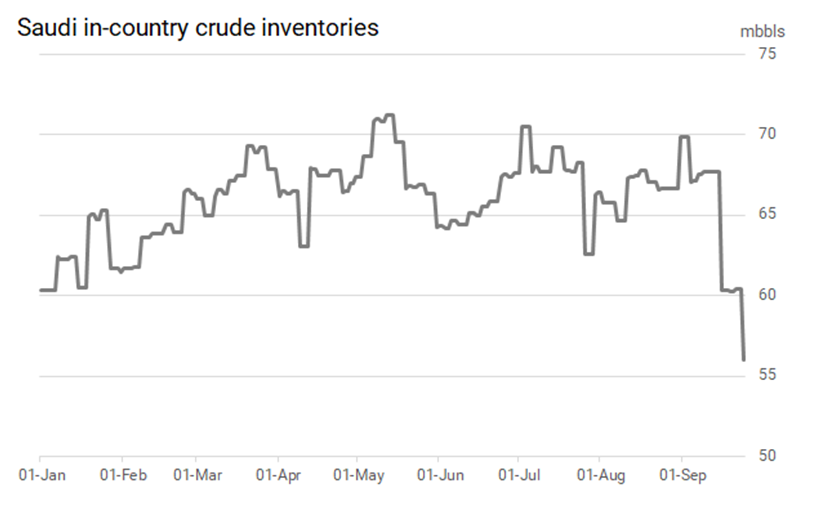

Both Kpler and ClipperData report that Saudi Arabia has seen a significant drop in its exports. Kpler said Saudi’s domestic inventories have fallen by 10 million barrels to 56 million barrels since the beginning of September. However, Saudi Arabia also has oil in storage in Rotterdam and Egypt.

Source: Kpler

“[Saudi Exports] should be closer to 7 million barrels per day, and we’re seeing it verge on 5.5 million since the attack,” said Matt Smith, director of commodity research at ClipperData. “It does include the 15th when there was just one loading.”

Kpler’s Reid I’Anson said he believes Saudi is down about 1 million barrels a day, but the amount of exports fluctuate daily.

“They have just over 55 million barrels left..They could go another four or five weeks realistically from the rates we’re seeing. That could change based on the internal situation, if they are able to get some of this back on line,” said I’Anson, global energy economist at Kpler. I’Anson said it is unclear how much oil is being stored in Rotterdam or Egypt, and even Japan.

“We have seen them purchasing petroleum products in order to lower runs through their domestic refineries,” he said.

I’Anson said the market that could be impacted is Asia, since China and East Asia are the biggest buyers of crude from Saudi Arabia, which has filled the gap for Iran.

The U.S. could be sending barrels to cover the lower Saudi exports, and the U.S. is expected to export about 3 million barrels a day. That amount could increase as more pipeline capacity comes on line this year, to bring more crude from the Permian Basin in Texas to the Gulf of Mexico.

“If it persists, the curve ball to watch out for is you could see a decided spike higher in U.S. crude exports in the next couple of weeks,” said Kilduff. There were seven empty ships that were hanging in the Gulf of Mexico over the last couple of weeks. I could see 4 million barrels per day export weeks very shortly.”

EU News Digest Latest News & Updates

EU News Digest Latest News & Updates