Stocks notched small gains on Monday as the major averages try for their third straight week of gains. The Dow Jones Industrial Average, S&P 500 and Nasdaq Composite have all logged gains of more than 5% in the past month through last Friday. But investors remain cautious and on the lookout for signs of what could cause the market’s momentum to stall.

This week investors will be will be watching the Federal Reserve closely. The Fed is scheduled to start a two-day monetary policy meeting on Tuesday.

“This week is all about the Fed, ” Michael Reynolds, investment strategy officer at Glenmede, told CNBC on Monday.

According to the CME Group’s FedWatch tool, the market is not forecasting a policy change from the Fed this week but is anticipating multiple interest-rate cuts this year, beginning in July and continuing through September and December. One influential bond expert, Jim Grant, thinks the Fed may not even wait that long.

As stocks enter the second half of June, a look back at the last decade shows why investors are pinning hopes for continued market gains on a dovish Fed.

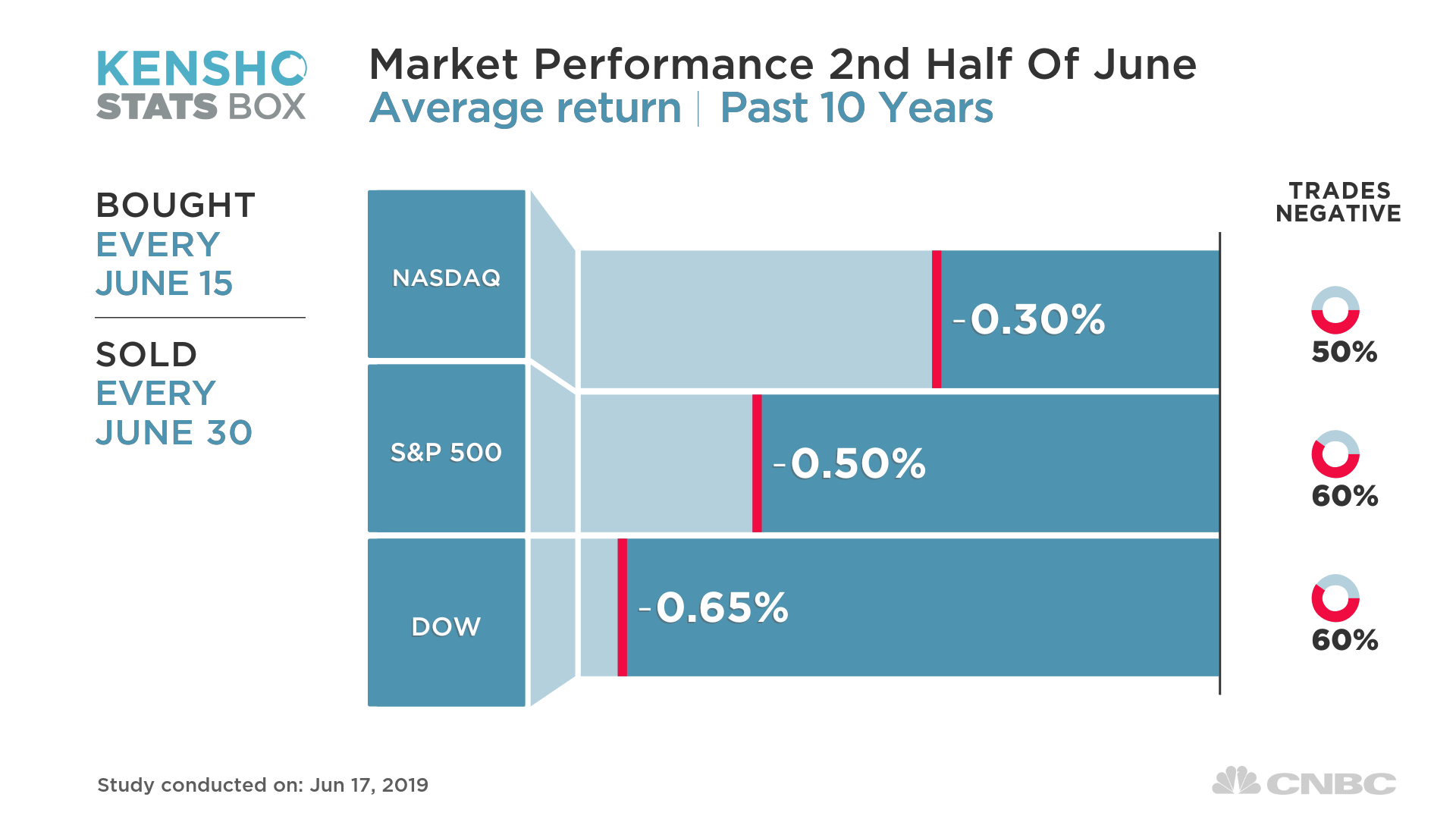

This is a seasonally challenging period for the market. Over the past decade, the S&P and Dow have traded negatively 60% of the time in the latter part of June, each shedding about half a percent, according to a CNBC analysis of Kensho, a machine-learning tool used by Wall Street banks and hedge funds to identify potential trading opportunities based on market history. The Nasdaq fares a touch better, with a positive trade just half of the time, but has still lost an average of 0.3%.

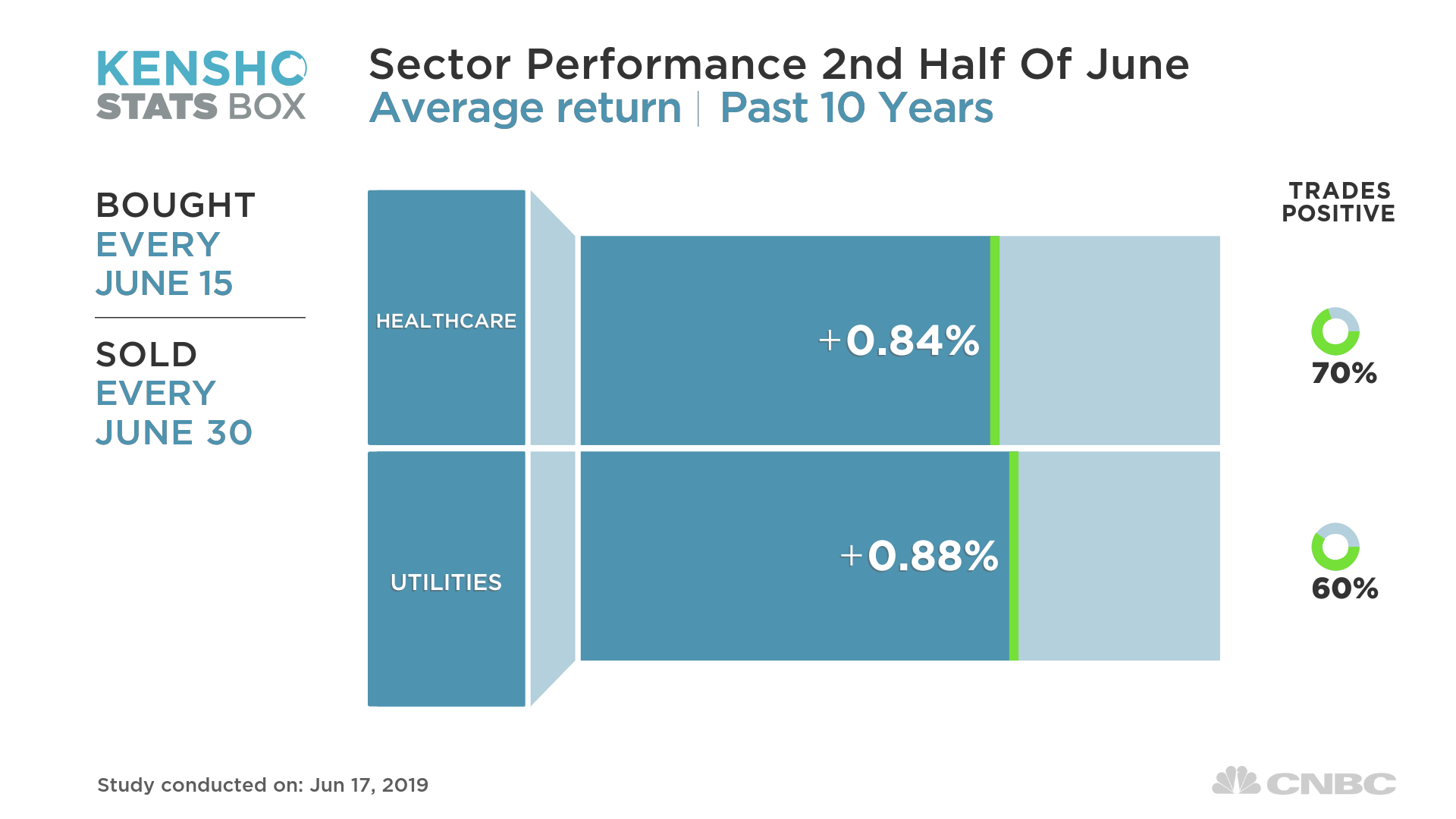

Defensive sectors tend to lead, with the S&P health-care and utilities indexes outperforming in the final two weeks of June.

EU News Digest Latest News & Updates

EU News Digest Latest News & Updates