Customers browse wine for sale at a Costco store in San Francisco in December 2018.

Bloomberg | Bloomberg | Getty Images

It’s been a train wreck for many retail stocks over the past few weeks, but some companies have still managed to pull ahead.

And this one statistic could explain why Walmart, Target and America’s dollar stores are thriving, while department stores and specialty apparel chains are not.

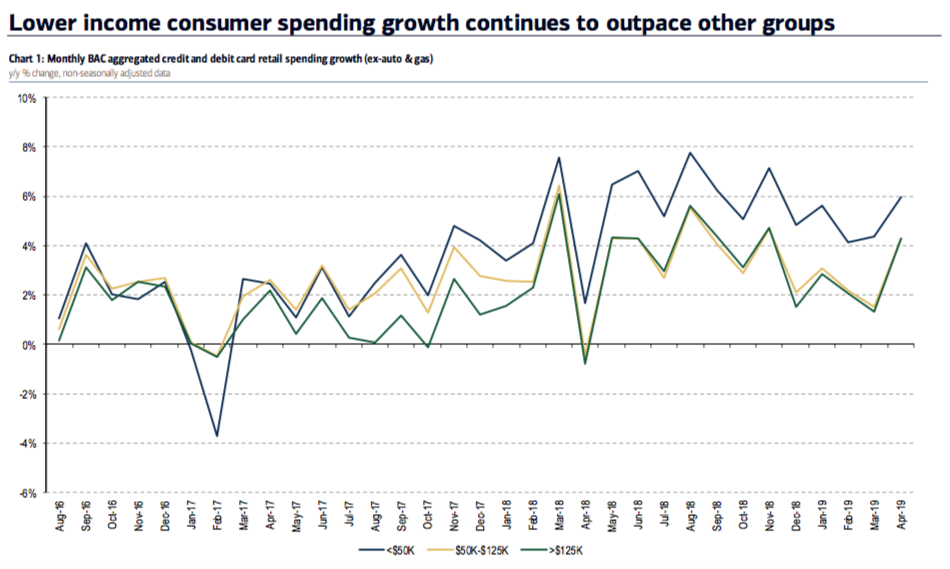

Retailers should take note that the spending power of sticker-conscious shoppers is on the rise. Bank of America Merrill Lynch in a new research report said purchases made by low-income consumers (U.S. households making less than $50,000 per year) grew 6% this past April from a year ago, outpacing both middle- and upper-income consumers’ spending growth across the country.

Consumer confidence remains high despite an ongoing trade war between the U.S. and China, and unemployment levels remain low. And so many low-income shoppers have been encouraged at the start of the year to spend a little more. But they’re not going to Tiffany or Nordstrom to do that. They’re just spending more at places like Walmart and Dollar Tree.

Source: Bank of America

This demographic trend is a key factor helping to support what the research report calls the “discount store decade.”

The impact of shoppers flocking to discount retailers is only expected to continue to hit enclosed and outdated shopping malls, of which the U.S. arguably still has far too many today. And Bank of America says additional store closures by mall-based retailers will only continue to benefit the likes of Walmart and Target, as the pool for competition over shoppers’ dollars shrinks further.

Meantime, spending is moving away from department store chains like J.C. Penney and Sears — which have been forced to shut stores in bulk — and apparel-based specialty chains. Dressbarn is going out of business. Forever 21 is considering restructuring. And companies like Abercrombie & Fitch and Gap at the mall are struggling to grow sales.

Investors clearly have noticed. Walmart shares are up about 10.5% this year, Target’s stock is up 30%, Costco shares are up 20.5%, Dollar General is up almost 20% and Dollar Tree is up roughly 11.5% so far in 2019. That all far outpaces the S&P 500 Retail ETF (XRT), which is only up 0.25%.

“We moved tens of millions of Americans to empty parcels of land with cars and more stores, per capita, than any place on earth,” retail subscription platform 2PM founder Web Smith said in a recent report, referring to the birth and boom of the department store-anchored suburban mall in the 1950s and decades thereafter. “And we told ourselves that the bubble would never pop.”

But it’s definitely started to pop, and at a faster pace now. Already, more than 7,150 store closures have been announced by U.S. retailers in 2019, according to Coresight Research. That’s from companies including Dressbarn, Charlotte Russe, Payless ShoeSource, Gymboree and Victoria’s Secret. Last year, Coresight tracked 5,524 store closures, down more than 30% from an all-time record 8,139 closures announced in 2017.

All that said, there are “no signs of a slowdown” in low-income consumers’ spending, Bank of America said.

— CNBC’s Michael Bloom contributed to this reporting.

EU News Digest Latest News & Updates

EU News Digest Latest News & Updates