Worries of escalating trade wars could be a longer term negative for the dollar, even as the currency gets a temporary lift ahead of the Fed’s meeting next week.

The dollar is seeing some support as the markets anticipate that the Fed will raise interest rates by a quarter-point next Wednesday. But the dollar has also been buffeted by other headlines, including threats of a trade war with China and a tumultuous reshuffling of cabinet members, with Secretary of State Rex Tillerson the latest to leave and others rumored to be fired by President Donald Trump.

“It’s not helping that he’s firing everybody. That’s getting a little bit more dramatic, even than when we had the Tillerson and Cohn news,” said Jens Nordvig, CEO of Exante Data, referring to the announced departure of top economic advisor Gary Cohn.

Cohn announced plans to leave last week and was replaced this week by former CNBC senior contributor Larry Kudlow, who had worked in the Reagan White House.

The dollar was mixed Friday, higher against the euro and many other currencies but lower against the yen. The dollar should be supported, just by the fact the U.S. is ahead of other central banks in normalizing interest rates.

“Trading into the Fed, the dollar could have a bounce, but if the tariffs come in after that could take the dollar down against the yen,” Nordvig said. “It’s going to be bifurcated.”

Four Fed rate hikes this year instead of three would be positive for the dollar. But that sets up a tug of war between the Fed tightening and the negatives of potential protectionism.

President Donald Trump has imposed tariffs on steel and aluminum imports from many countries, and his administration this week threatened tariffs on $60 billion in Chinese goods.

“I think trade is very complicated for the dollar,” said Ben Randol, G-10 currency strategist at Bank of America Merrill Lynch. “If we get trade retaliation and things degenerate, it could turn into a more complex situation.” He adding it’s hard to generalize because the trade actions are still unclear and the reactions are hard to anticipate.

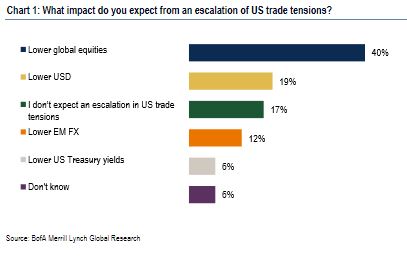

Bank of America Merrill Lynch strategists in Europe released results of a global survey of 66 fund managers, who said the immediate reaction of building U.S. trade tensions would be lower stocks and a lower dollar. On the other hand, the same survey showed that 42 percent of the fund managers believe central bank policies will be the biggest driver of the dollar this year, while just 11 percent thought trade issues would be.

“If the European commission responds in a very negative way, you could have a series of cascading responses that rattle markets,” Randol said. Europe has already threatened tariffs on blue jeans and bourbon.

More worrisome than Europe is what reaction could come from China.

“That’s a complete unknown question—what’s China going to do,” said Boris Schlossberg, managing director, foreign exchange strategy at BK Asset Management.

Schlossberg and others said concern is that trade frictions will escalate. A trade war with China would be a negative for the dollar and send investors into the safety trade in the yen.

A longer term worry for the dollar is that a protectionist U.S. could mean it loses some of its status as a reserve currency, with the yen and even euro looking more attractive.

Schlossberg also sees a strengthening yen if U.S. trade tensions escalate. He said the Japanese currency was providing a flight to safety for investors concerned about political risk in the U.S., as well as Japan, where Prime Minister Shinzo Abe is embroiled in scandal.

“The chaos in Washington, higher U.S. yields, and the scandal in Japan. It’s a perfect storm for risk aversion trades,” he said. “It just simply people unwinding risk trades, and the yen gets instantly stronger.”

Schlossberg said once the risk aversion fades, the dollar may also run into trouble if the economy is beginning to sputter, with recent weakness in housing data and this week’s soft February retail sales.

He said the outcome of trade wars could mean central banks will aggressively talk down their currencies, as the ECB is beginning to do. “You’re already seeing the response in soft measures where policy makers who never really cared about the strength of the currency until it was extreme have become proactive in trying to manage the exchange rate. People are trying to find levers,” Schlossberg said.

EU News Digest Latest News & Updates

EU News Digest Latest News & Updates