Interest rates are hitting multiyear highs at a time when most portfolio managers have never dealt with this phenomenon before.

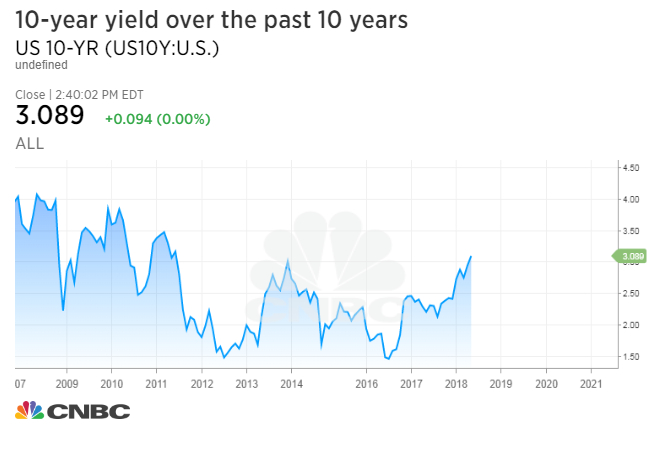

The U.S. 10-year Treasury note yield rose to its highest level since 2011 on Tuesday, while the short-term two-year yield traded near levels not seen in about a decade, raising concern about how portfolio managers will navigate this changing investment landscape.

But most of them have never operated in a rising rates environment. Themedian tenure of an active equity manager is eight years, according to Fundstrat, citing figures gathered from Morningstar.

The last time rates were in a significant uptrend was from 2003 to 2006 before the financial crisis struck.

“There are a lot of people that haven’t been through many things in this youthful industry,” said Timothy Parton, a portfolio manager at J.P. Morgan. “The time when rates are rising coincides with a period in the cycle that is tough for any manager. You don’t want to be too cautious, but you don’t want to be too aggressive too early.”

The Fed slashed the overnight rate down to zero in 2008 during the aftermath of the financial crisis. The central bank’s goal at the time was to stimulate the economy. Now that the economy is out of its financial-crisis trough, the Fed has started to gradually hike rates closer to historical levels and market rates have responded.

Since late 2015, the Fed has raised rates a total of six times — including once this year —bringing the overnight rate to a range of 1.5 percent to 1.75 percent. Market participants are expecting the Fed to raise rates at least twice more in 2018 and many think they may even raise four times.

“We’re concerned about rising interest rates,” said Walter Price, senior portfolio manager at Allianz Global Investors. “Last year, we got a lot of multiple expansion. We think that’s unlikely in a rising rate environment.”

J.P. Morgan’s Parton and Allianz’s Price have seen their share of rising-rate cycles. Parton has worked in portfolio management since the late 1980s, while Price has 45 years of experience in the financial industry.

EU News Digest Latest News & Updates

EU News Digest Latest News & Updates