The 10 best Januarys for stocks have two things in common — the full year ended with a gain, and there was a fairly significant sell-off.

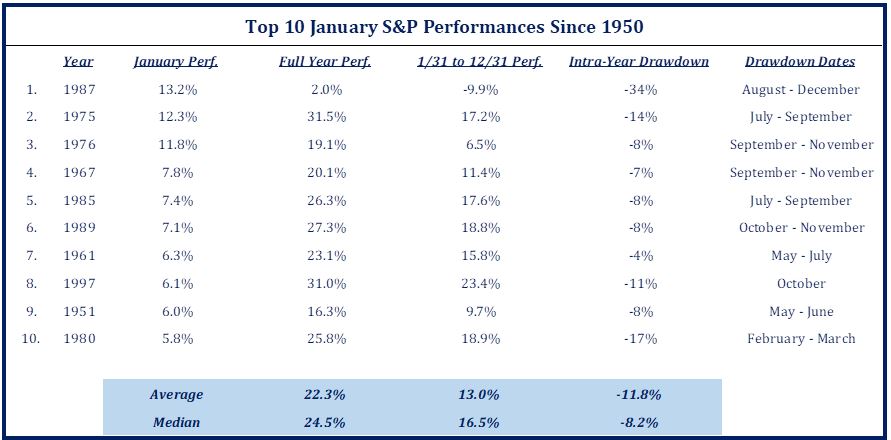

Strategas studied the 10 biggest January gains for the S&P 500 since 1950 and found the advances ranged from 5.8 percent, in 1980, to 13.2 percent, in 1987. If the S&P ends the month where it is now, it would be No. 6 of the top 10, with a 7 percent gain.

Each of those strong January performances led to a full-year gain, averaging about 22.3 percent. Wall Street strategists surveyed by CNBC expect the S&P to rise to 3,000 by year end from its current 2,860 level.

So in the top 10 January years, the old Wall Street adage “So goes January, so goes the year” worked well, but it left out the part about the correction.

In each of those years, there was a sell-off ranging from a low 4 percent to as much as 34 percent, in 1987. The median loss in the intrayear sell-offs was 8.2 percent, and the average correction was 11.8 percent.

After January, the S&P had a positive 11 months from Feb. 1 to Dec. 31, in all of the top years except for 1987. In 1987, the year of the crash, it lost 9.9 percent in that period and was up only 2 percent for the year. The other nine years averaged an 11-month gain of 13 percent.

“A strong January typically bodes well for the rest of the year, but we shouldn’t ignore the possibility of a correction. You typically see some form of a pullback, but the end result is a typically strong full-year performance,” said Todd Sohn, technical strategist at Strategas.

Source: Strategas Research

EU News Digest Latest News & Updates

EU News Digest Latest News & Updates