Worst to first. Zeros to heroes.

However you want to characterize it, a handful of stocks have made meaningful strides this year after a brutal 2018, reversing course from being some of last year’s worst performers to becoming some of 2019’s best.

Among those in the comeback zone are:

- Coty, down 67% for 2018 and now up 78% so far in 2019;

- General Electric, down 57% for 2018 and up 51% this year;

- Perrigo, down 56% for 2018 and up 39% this year;

- Lennar, down 38% for 2018 and up 52% this year;

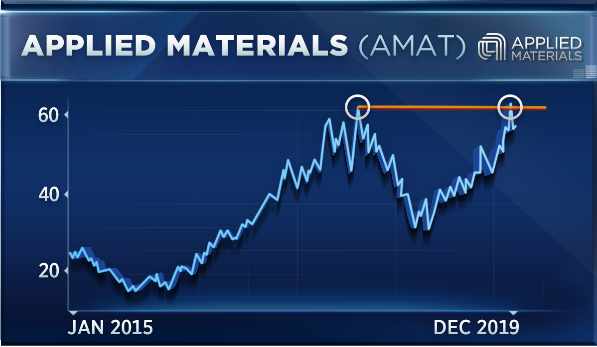

- Applied Materials, down 36% for 2018 and up 78% this year;

- and Tyson Foods, down 34% for 2018 and up 66% this year.

For some, their winning streaks look set to continue, at least on a technical basis, Matt Maley, chief market strategist at Miller Tabak, told CNBC’s “Trading Nation” on Tuesday.

“There are two names that look pretty good, and the first one is Perrigo,” he said. “The stock, even though it’s seen this nice rally, has actually just broken out of a two-year downward trend channel.”

After breaking above that two-year trend line several months ago, then pulling back and successfully retesting that newfound floor of support, Perrigo’s recent bounce could set it up for success in the new year, Maley said.

“If it could move above its September highs of $53 after following that successful retest, it’ll be very bullish for the stock on a technical basis,” the strategist said.

Perrigo shares were trading just below the $54 level early Wednesday.

“The other one is Applied Materials,” Maley said. “The stock is pulling back a little bit because it had gotten very overbought on a short-term basis, but as it works off this overbought condition, it’s setting itself up nicely to take another run at this 61½ level, which is a double-top all-time high from 2018 and 2019.”

With Applied Materials shares hovering above $58 just after Wednesday’s open, up about 3%, that move looked increasingly possible for the stock in the near term.

“If it can break meaningfully above that level as we move into the new year, it’s going to be very bullish for the stock on a technical basis,” Maley said.

Quint Tatro, chief investment officer at Joule Financial, had his eye on some of this year’s laggards that he thought could become leaders in 2020.

“In a year from now, I think that we might be talking about Slack,” the investor said in the same “Trading Nation” interview. “[It’s] one of the beaten-up IPO darlings of this year, not so pretty here, but obviously had a recent standout quarter, raised guidance, and we really believe that this is a company that is turning around and we’re going to see some real significant upside.”

Slack went public via a direct listing in June. The stock has fallen by nearly 20% since its debut to $20.93 as of Wednesday. The shares fell by more than 6% early in the session.

“Now, if investors want to stay a little bit closer to home and not dig around in the trash, we think that some of the areas like the financials still work into next year,” Tatro added.

He especially liked the stock of Goldman Sachs, which he found to be underappreciated on Wall Street.

“Goldman Sachs trading around one times book [value], still looking exceptionally undervalued here, we think can play catch-up to some of the other, more notable names that have acted so well this year,” Tatro said. Book value refers to what a company would be worth if it liquidated all its assets.

Miller Tabak’s Maley agreed with Tatro about Goldman’s prospects. The bank stock was flat early Wednesday, up 33% for the year at about $222 per share.

“On a technical basis, the stock has already broken well above its trend line from early 2018,” the strategist wrote in a Tuesday email to CNBC.

“It is now testing the $220-$225 range once again,” Maley wrote. “That range has provided tough resistance for the stock over the past six months. Therefore, if/when it can finally break above that range in any meaningful way, it will be very bullish for GS.”

Disclosure: Joule Financial has long positions in Slack Technologies and Goldman Sachs.

Disclaimer

EU News Digest Latest News & Updates

EU News Digest Latest News & Updates