Open enrollment season is just about over for most workers.

At the very least, employees should have evaluated their existing coverage to make sure it is still their best option.

“Don’t assume that what’s right for you now is right in the future,” said Suzanne Goulden, the director of total rewards at the Society for Human Resource Management, or SHRM. “Look at everything your employer has to offer.”

This year, in particular, there could be some changes to the plans that are available and the details of those offerings, making it even more important to check in during open enrollment.

“There are many factors, both in a benefits plan and in one’s personal life, that can change every year,” Kelley Long, a CPA and member of the AICPA Consumer Financial Education Advocates, said in a statement.

“By ‘setting and forgetting’ a benefit plan, you not only run the risk of getting stuck in one that isn’t right for you but also one that costs you extra.”

Before the window closes for another 12 months for most of us, here are a few of the things to watch out for in the final days of open enrollment:

1. Health insurance

For starters, health insurance is the most significant component of your benefits. Be aware that premiums — and deductibles — are, in general, going up.

Average annual family premiums for employer-sponsored health insurance rose 5% to more than $20,500 this year, according to the 2019 Kaiser Family Foundation Employer Health Benefits survey, while wages rose just over 3% during the same time period.

Workers are now paying $6,015 toward the cost of their coverage, on average, while employers generally pay the rest.

In addition, more workers have a deductible — the amount you pay before coverage kicks in — and that deductible is also rising. The average deductible for a single person is now $1,655, double what it was a decade ago.

The single biggest issue in health care for most Americans is that their health costs are growing much faster than their wages are.

Drew Altman

president and CEO of the Kaiser Family Foundation

“The single biggest issue in health care for most Americans is that their health costs are growing much faster than their wages are,” Kaiser President and CEO Drew Altman said in a statement.

2. Health savings accounts

One way to help with health-care costs is by looking for ways to use tax-advantaged accounts for medical expenses. Specifically, health savings accounts or flexible spending accounts.

In both cases, you use pretax money to cover out-of-pocket expenses, including doctor visits and prescription drugs.

To be able to use an HSA, you need to be enrolled in what’s called high-deductible health plan, or HDHP.

These plans tend to be better suited for people who do not use a lot of preventative health care. The premiums tend to be lower, but the deductibles and the limit on annual out-of-pocket costs are very high.

More from Personal Finance:

Here’s how much more you’ll pay for Medicare Part B in 2020

Three big mistakes to avoid during Medicare open enrollment

If Medicare coverage changes include Medigap, beware of snags

Because of those high costs, the limit on how much you can save in an HSA is higher, as well. For 2020, employees and employers can contribute a total of up to $3,550 for individual coverage and up to $7,100 for family coverage. (Check to see if your employer offers a flat contribution or matching funds and aim to max out those contributions for the year.)

Contributions then grow on a tax-free basis, and any money you don’t use can be rolled over year to year.

FSAs have lower contribution limits — $2,700 for 2019, with limits expected to increase to $2,750 in 2020.

The upside is that you don’t need to have a high-deductible plan in order to be eligible for an FSA — in fact, you don’t need health coverage at all to sign up for one.

However, you must use the money by year-end or you lose it.

3. Future health-care costs

While you are anticipating your upcoming expenses, it’s a good time to think about how your health issues are changing and if you have any big-ticket items on the horizon, such as orthodontic braces or a planned surgery.

If you have a child trying a new sport and you are concerned about possible emergency room visits in the months ahead, then you may also want to consider accident insurance, advised David Reid, the CEO of Ease, a benefits administration company.

There may even be additional options that haven’t been available before, according to Reid, such as elder care, which helps cover the cost of care for a qualified adult dependent.

As it stands, about a third of adults have taken on the role of caregiver, while 22% expect to in the future, one Northwestern Mutual study found.

Of the respondents who already have stepped into that position, nearly half said their new role was unexpected, and often a financial shock.

Try to figure out your future health-care needs, said Myles Ma, a health-care expert at online insurance marketplace Policygenius. “If you don’t, it could potentially be a costly financial mistake,” he said.

4. Voluntary benefits

In addition to elder care, there are a variety of emerging options that are often overlooked, such as student loan repayment, mental health assistance or pet insurance.

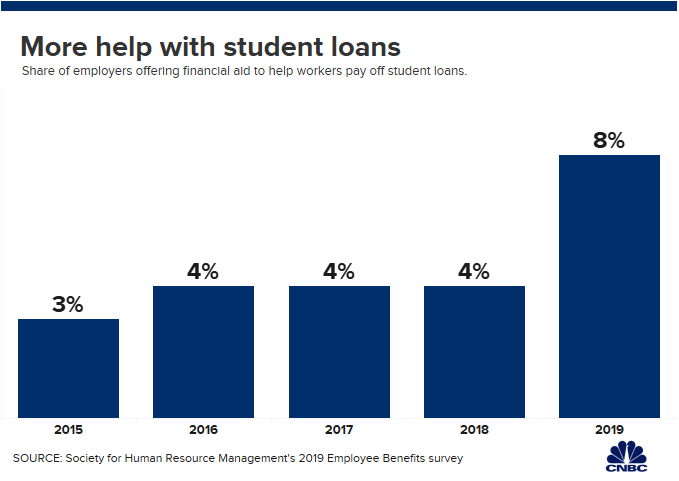

About 8% of companies, including Aetna, Fidelity and PwC, now offer taxable contributions to help employees repay student loans, up from 4% three years ago, according to the Society for Human Resource Management’s 2019 Employee Benefits survey.

Companies such as Cisco have also begun to include mental-health services among health-care coverage options, as well as offerings such as teletherapy to help employees deal with work-life stressors and personal issues.

Similarly, more employers are adding pet insurance to their benefits package. In fact, “it’s one of the fastest-growing areas of coverage out there,” according to William Ziebell, CEO of the benefits consulting division of Gallagher.

Nearly 70% of U.S. households own a pet, according to the American Pet Products Association, and, chances are that 1 in 3 of these pets will need emergency veterinary treatment within any given year.

The average cost of an unexpected visit to the veterinarian can range from $800 to $1,500 — an extra expense many Americans could not otherwise afford.

5. Changes in your current plan

In addition to the number of employers adding more voluntary benefits, your current benefits could also be different — even if you plan to stick with the status quo.

“It’s a constantly evolving landscape,” said Ashley Shope, the assistant vice president of product development at Unum, a benefits provider.

For example, “your employer could have switched medical carriers or switched plans within your current provider, which could impact your drug plan,” she said.

To run through your options and weigh the alternatives, employers often have resources available to enrollees, including online tools and in-person assistance.

“The benefits team is there to help — especially at the 11th hour,” said SHRM’s Goulden.

Subscribe to CNBC on YouTube.

EU News Digest Latest News & Updates

EU News Digest Latest News & Updates