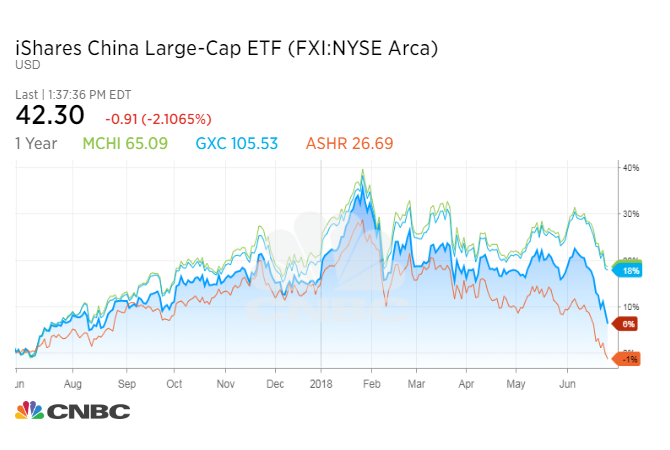

Mainland-listed stocks in particular, known as A-shares, are at multi-month lows and still struggling to find a bottom. Some of the largest China ETFs are in the red — especially those invested in mainland stocks — or are barely in the black this year:

- iShares China Large-Cap ETF (FXI): $4.2 billion in assets

- iShares MSCI China ETF (MCHI): $3.7 billion

- SPDR S&P China ETF (GXC): $1.2 billion

- Xtrackers Harvest CSI 300 China A-Shares ETF (ASHR): $664 million

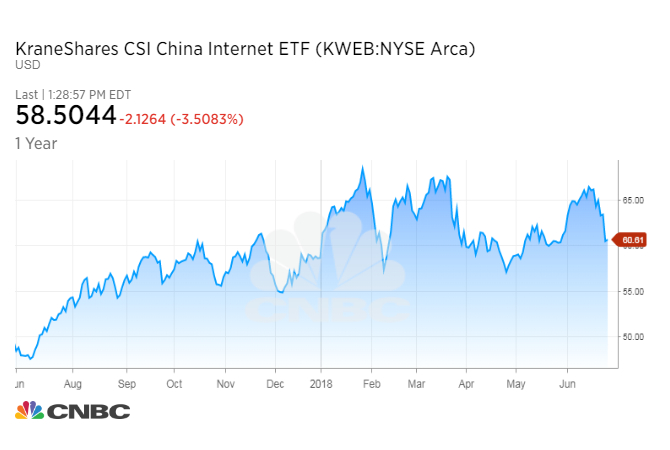

Contrast that to KWEB’s relatively bumpy-but-solid run this year, tallying gains of more than 7 percent, outperforming not only other major China equity ETFs but also the MSCI China IMI Information Tech Index — the benchmark we use for reference in this particular segment — by more than 6 percentage points, according to FactSet data.

Contrast that to KWEB’s relatively bumpy-but-solid run this year, tallying gains of more than 7 percent, outperforming not only other major China equity ETFs but also the MSCI China IMI Information Tech Index — the benchmark we use for reference in this particular segment — by more than 6 percentage points, according to FactSet data.

KWEB is an index-tracking China equity ETF, but one focused exclusive on internet stocks. Internet as a segment has been hot globally this year, and KWEB’s focus on some of the fastest-growing names in this industry is paying off. There’s also the train of thought that Chinese internet stocks are more shielded from U.S. tariffs than other sectors of the economy.

KWEB is an index-tracking China equity ETF, but one focused exclusive on internet stocks. Internet as a segment has been hot globally this year, and KWEB’s focus on some of the fastest-growing names in this industry is paying off. There’s also the train of thought that Chinese internet stocks are more shielded from U.S. tariffs than other sectors of the economy.

Notable here is that driving KWEB’s performance isn’t necessarily its big bet on the mightiest China internet names —companies like Alibaba, Baidu and Tencent. These companies are KWEB’s top holdings, and they have delivered a stellar run, but these three leading names in China’s tech segment have not been among KWEB’s top five best-performing stocks for the past three years.

Powering the fund is allocation to companies like online video streaming iQiyi, which are making a difference. Since listing its N-shares in the United States in March, iQiyi has seen its share price triple, FactSet data show. Compared with giants like Alibaba, which has a market cap of about $516 billion, iQiyi is small potatoes, with market cap today of about $25 billion.

“All of the outperformance can be attributed to stock selection in the software and IT services industry,” FactSet’s ETF analyst Scott Burley said — software and IT represent more than 70 percent of the portfolio.

“KWEB avoids hardware and semiconductors, which have done really poorly this year,” Burley said. “It also expands outside the tech sector and into other industries like online retailing and media for about 30 percent of the portfolio, but these have a been a mixed bag this year, creating only a slight drag on performance overall.”

EU News Digest Latest News & Updates

EU News Digest Latest News & Updates