In May of this year, for the first time in history, exactly half of investors in the U.S. had given up on stock pickers. That was the month that index funds finally caught actively managed funds in total assets under management. By August, index fund and ETF assets, led by Vanguard Group and BlackRock’s iShares, surpassed active stock funds. If you missed the investing milestone, that might be because, from all the coverage of index funds in recent years, you were convinced it had already happened. It was no surprise, and a long time coming.

Even the greatest mutual fund managers in history have capitulated to the index fund.

“We have so many funds beat the market 10 years, 20 years, but we’re not going to second-guess the customer,” said Peter Lynch, Fidelity Investments vice chairman and one of the original “star” mutual fund managers from the 1980s, who doubled the S&P 500 Index return over more than a decade on the Fidelity Magellan fund. In an interview with Bloomberg Lynch said, “We’re not going to say, ‘You fool! You idiot!’ If you want to buy an index fund, here it is.”

In fact, in the past year, Fidelity has rolled out four index mutual funds that are free to investors.

How bad is situation for active managers? Consider this: even though analysts who cover fund companies say history shows that a recession would crush stocks of asset managers as investors flee the market, they also say an economic downturn may be the last chance stock pickers ever get to prove that they can outperform when it counts.

The fee war

“Most of them are screwed,” said Greggory Warren, analyst at Morningstar, a financial information and research firm that first rose to prominence in previous decades through its “star” ratings of mutual funds. But his negativity does not rule out a situation in which it takes as long for the active managers to die out as it did for index funds to pass active funds in total assets.

“If I’m an active manager, it does not make sense to cut fees 50%. They have vehicles still throwing off cash even though they have been in net outflow mode for the past decade. The biggest problem is the slow bleed.”

“We are heading down an ongoing path where more money flows into ETFs than in the past,” said Todd Rosenbluth, director of mutual fund and ETF at CFRA.

CNBC Evolve will return, this time to Los Angeles, on Nov. 19. Visit cnbcevents.com/evolve to register.

Rosenbluth said there are degrees of insulation in the asset management industry, and many of the biggest firms are still healthy, but it depends on where revenue has come from historically.

It helps to have a strong presence in a 401(k) market like T. Rowe Price Group, which trades at the industry’s second-highest multiple after BlackRock among publicly traded asset managers and also has strong long-term performance relative to many other active shops.

Having broad target-date retirement fund products or having a brand like Capital Research & Management’s American Funds, which has a strong presence in the retirement market and a generation of advisors who are big fans of its active stock selection, are critical but increasingly being seen as exceptions to the current situation for most mutual fund managers.

More from Evolve:

Activists thought BlackRock, Vanguard found religion on climate change. Not anymore

Who won the zero-fee ETF war? It looks like no one

Caterpillar’s autonomous vehicles may be used by NASA to mine the moon and build a base

While concerns about index funds and ETFs are causing some kind of market implosion — or at least exacerbating one — and continuing to attract headlines without much evidence to support the argument, Warren sees little threat to growing ETF dominance.

“I don’t think ETFs will go away even if we have a big market shakeup. Look at the history of index funds: high single-digit organic growth over the long term, 7% to 8% over the past 30 years. A steady flow of capital keeps going to index funds and ETFs.”

Fidelity vice chairman Peter Lynch (pictured here in 1986), was the star mutual fund manager of Fidelity Magellan and doubled the S&P 500 return over more than a decade. He recently said plenty of managers still beat the index but, “We’re not going to say, ‘You fool! You idiot!’ If you want to buy an index fund, here it is.” (1986 photo by Ted Thai/The LIFE Picture Collection via Getty Images)

Ted Thai | The LIFE Picture Collection | Getty Images

The reason for this continued growth references Peter Lynch’s capitulation: Investors have decided they are getting more value for what index funds and ETFs deliver. Lynch’s successor on Fidelity Magellan, Jeff Vinik — who went on to a long career as a billionaire stock picker — announced on Wednesday he was closing down his hedge fund because investors were no longer giving money to long/short stock pickers as even the most-sophisticated investors lean more on quantitative investing disciplines.

“You can get good returns for what you are paying, even after fees, on some active funds and have an advantage from a diversification standpoint since they should do better in downturns, but the thing is that you can hold your breath until you are blue in the face saying that. The current environment is not conducive to it,” Warren said.

Patrick Davitt, analyst at Autonomous, a financial services and fintech-focused institutional research firm owned by asset management giant AllianceBernstein, said as the older demographic of retirement savers leaves their retirement plans and younger investors gravitate to passive target-date funds because they are cheaper, asset managers need to continue to outperform.

There is a wealth transfer between generations expected to reach as high as $68 trillion in the coming decades as baby boomers pass their wealth to heirs.

“As long as they outperform, there will be a place for them among the inflows, but just not many of them,” Davitt said.

“There are challenges for all asset managers because the business is mature, even those with inflows have been on the cusp of outflows for years. Investing in non-U.S. distribution, smaller retirement plans and model portfolios can help, but good performance is critical,” he said.

Fund flows

Over the past three-year period through the end of September, open-end mutual funds managed by Federated Investors, Franklin Resources, Invesco and T. Rowe Price all have had negative net flows. Vanguard had positive net flows of over $700 billion.

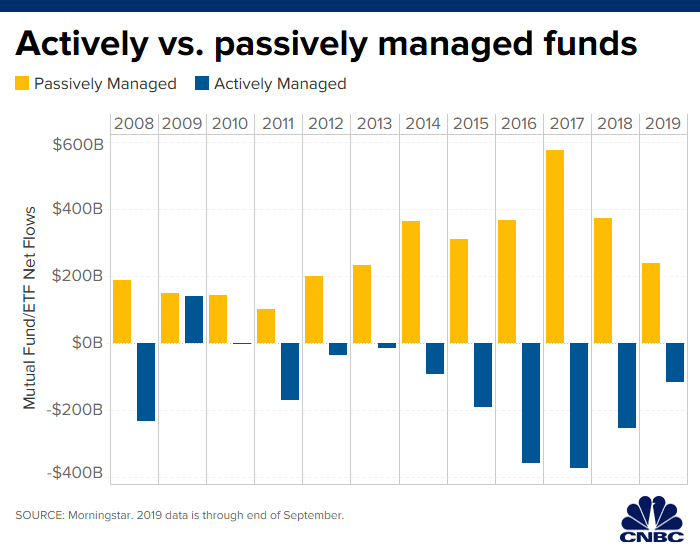

Morningstar measures mutual fund and ETF net flows based on beginning and ending calendar year total net assets and the percentage of asset growth due to a fund’s market return.

In the past 10 years, Vanguard has had positive net flows of more than $1.8 trillion; T. Rowe is closest to that among the handful of active managers, but not really close at all, with $21 billion in positive net flows. T. Rowe Price had positive net flows from 2008 through 2015 but has been in a negative net flow position in the past three years, according to Morningstar.

“There is more blood that has to come out of the active side of the business,” Warren said. “We need consolidation. Some of them clinging to their shops and closet indexing, they need to go away because they are not helping the cause.”

Consolidation may continue, but investors are not convinced it will help. Invesco trades at the lowest multiple among the publicly traded asset managers and analysts say that is a direct rebuke from the market over its recent acquisition strategy, which included buying OppenheimerFunds.

“They lost the street when they announced the deal, so it has been in more of a ‘show me’ penalty box where they need to prove that they can both get cost synergies from the deal and drive organic growth and margin expansion,” Warren said.

Rosenbluth said some of the portfolio products that Invesco has acquired are interesting from an investment standpoint, but the problem is, “Investors who only own a handful of cheap asset allocation products from the big three providers are not being harmed” by not bothering to consider them. “Over the longer-term we will see far fewer funds and firms offering mutual funds.”

The Janus Henderson 2016 tie-up is another major asset management transaction that shows what the markets thinks of deals in this space, with the hundreds of billions of dollars in assets under management combined failing to lift the stock.

“The history of asset management deals is not good,” Davitt said. “Any asset managers thinking about doing a large deal will think twice.”

But the situation is so difficult that more deals can’t be ruled out. “There are expense synergies that are needed and the ‘melting ice cube theory’ could come into play and so they might do a deal even if the market is skeptical,” Davitt added.

Asset management companies do not have their heads in the sand when it comes to ETFs. Franklin Resources and Oppenheimer Funds have recently entered the ETF market, and Franklin had one of the biggest winners of 2019 among new ETF launches with the Franklin Liberty U.S. Core Bond ETF (FLCB). Invesco already is among the biggest ETF companies with heavy-hitters like the Nasdaq QQQ and Biotechnology ETF, and in addition to the OppenheimerFunds deal it bought Guggenheim Investments’ ETF business in 2018.

T. Rowe Price has filed with regulators for a series of ETFs — though it has not launched any yet — and this week it hired a top State Street Global Advisors’ ETF executive, Tim Coyne.

But the battle is uphill.

“You have to be extremely scaled up with plain vanilla ETFs like Vanguard and BlackRock. I still think that there will be some business they steal away, but there is something to be said for a trusted brand. BlackRock and Vanguard won’t be pushed out of the market,” Warren said.

Bigger is better, for now

Getting into ETFs will not solve another growing problem: the balance of power has shifted “pretty dramatically” Warren says, to distributors.

Fidelity Investments offering zero fee index funds and the recent spate of moves by all the major discount brokers including Fidelity and Schwab to free trading of stocks and ETFs may not break these business yet, “but it still feels like a long, painful trudge,” Warren said.

The only thing he is sure of is a reason why investors have been reluctant to chase these asset management stocks even at depressed levels compared to the broader market: “The industry will be less profitable five years from now.”

That will mean bigger firms are in a better position when it comes to getting shelf space, and the smaller players hurt first, but the pressure will “work its way up,” said the Morningstar analyst. “There is no guarantee for the bigger asset managers.”

If you’re a long-only manager, why would you buy asset manager in year 10 of a bull market? We know about the secular issues and just given late-cycle concerns, why bother?

Patrick Davitt

analyst at Autonomous

Warren said conversations with investors about these stocks trading a depressed values don’t go far. He said at some point, Invesco and Affiliated Managers Group — trading at price-to-earnings ratios of roughly 6x and 5x earnings, respectively — are just too cheap to ignore, but not in front of an expected market correction in the near to medium term.

“The market has given up on them. I tell investors they are really cheap, but I don’t know what the catalyst is for the stocks to move higher. If there was a price at which there was optionality in these stocks I would have thought we would be there by now, but we are not. The word on the Street is ‘throw in the towel.’ People won’t pay up.”

P/E ratios for at least some in the group are close to the broader financial services sector P/E of 12x earnings, which is depressed compared to many other sectors of the U.S. stock market.

And there have been some signs of life in these stocks year-to-date, with rallies off lows in names like Federated Investors and Legg Mason. But Warren said the stock gains are far from a show of faith from the market in the future of the asset management business.

“And most of these guys were really down on the mat at the start of the year, so not too surprising to see some double-digit price gains,” the Morningstar analyst said.

Activist investor Nelson Peltz rejoined the Legg Mason board, and the prospect of a return to a more aggressive share repurchase program under pressure could deliver better performance for investors than the stock has been generating.

Federated Investors, which has a money market funds and fixed-income heavy business, rallied on the rise in interest rates earlier this year, but the shares have sold off steadily since the Fed started lowering rates.

The sector is in the midst of third quarter earnings, with Invesco, which was among the most heavily shorted financials, rallying on Wednesday after its latest earnings. T. Rowe shares were higher after its Thursday earnings, and Franklin Resources reports on Friday.

But analysts say the problems go deeper than any one quarter — good or bad — can reveal. Warren said the Invesco report showed organic growth that “wasn’t as bad” as the preliminary figures had indicated, but investment performance was worse, and he still thinks there are diminishing returns to consolidation. “At the end of the day, even the laggards have to rally from time to time,” he said.

“The business is in secular decline, but it also is late in the cycle, so the market is putting lower multiples on these firms, because when we have a real correction earnings estimates will come down,” Davitt said. “If you’re a long-only manager, why would you buy asset manager in year 10 of a bull market? We know about the secular issues and just given late cycle concerns, why bother?”

When a recession hits

“BlackRock and T. Rowe are names you can invest in and sleep at night, but recommending an Invesco at 6x earnings in this market? The market could be down 20% tomorrow and these guys are going down 30%,” Warren said.

That may be the most painful point of all about the asset management industry threat. The best chance, and maybe last chance left, to prove that active management works will be in the next downturn.

According to Morningstar data, 2009 and 2010 were the only years in the past decade when actively managed mutual funds posted positive net flows, and the situation has worsened in more recent years with a negative net flow peak of $373 billion in active funds in 2017, the same year index funds and ETFs posted positive net flows of $577 billion. Through the end of September, active funds had negative net flows of $115 billion compared to positive net flows of $238 billion for index funds and ETFs in 2019.

Coming out of the next bear market things could go one of two ways: If there is a significant correction and active managers significantly outperform index funds that will give them the marketing pitch they have been needing as to why investors should not use passive.

“And they should outperform in a real selloff if they are doing their work right,” Davitt said. “If they prove themselves that could be a tailwind. Clients ask me, ‘What swings the pendulum back?’ and that’s it.”

The alternative narrative, though, is a big selloff and they don’t prove themselves and then the decline continues and maybe accelerates. “You always seen an acceleration when the selloff happens, but when market comes back next time, if they underperform, even more investors will go to passive,” he said.

Morningstar’s Warren says the asset management case study is one of an industry that became too comfortable with a method of success that was always vulnerable to disruption.

“They have to be something different than product providers. It’s getting back in touch with what end clients need. Asset managers fell out of that mindset and for years it was easy to plug into wirehouse and broker/dealer channels and do all the marketing, and the flows would come with the performance there, but that model is broken,” Warren said.

He thinks the idea that the investor flows to passive could accelerate after the next downturn is a nice way of talking about what will really happen: “If they don’t perform better in the next recession, then it’s game over.”

Asset manager price-to-earnings ratios

| Asset Manager | P/E |

|---|---|

| BlackRock | 15 |

| T. Rowe Price | 13.3 |

| Federated Investors | 12 |

| Franklin Resources | 11 |

| AllianceBernstein | 10.2 |

| Legg Mason | 10.1 |

| Janus Henderson | 9 |

| Invesco | 5.9 |

| S&P 500 Financials | 12.2 |

| S&P 500 | 17 |

EU News Digest Latest News & Updates

EU News Digest Latest News & Updates